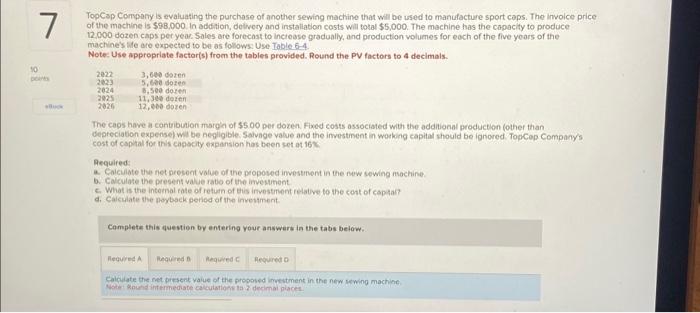

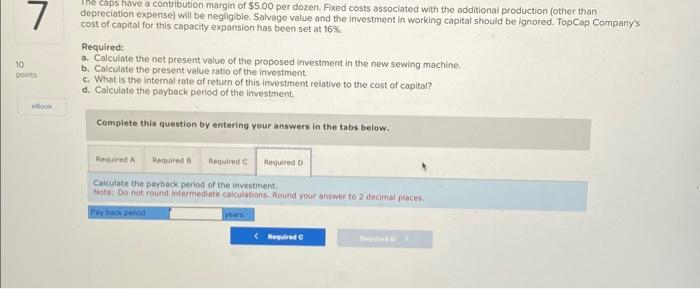

TopCsp Company is evaluating the purchase of another sewing machine that will be used to manufacture sport cops. The imvolce price of the machine is $98.000 in addation, debvery and installation costs will total $5000. The machine has the capacity to prodice 12,000 dozen caps per year. Sales are forecast to inctease gradually, and production volumes for each of the five yoars of the machine's life are expected to be as follows: Use Table 6-4. Note: Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals. The caps have a contribution margin of $500 per dozen. Fixed costs associated with the additional producton (other than depreciation expense) wir be negligible. Salvage value and the investment in wotking capital should be ignored. TopCop Companys cost of caplal for this capacity extansion has been tot at ise. Required: a. Calculate the net present value of the proposed imvestment in the rew sewing machine. b. Calculate the present value ratio of the imvestront. c. What is the internal fate of retuin of tis ifwestruent relative to the cont of capsar? d. Calculate the poyback peried of the investment. Complete this question by entering your answers in the tabs below. Calculate the ret present vaiue of the proposed imvestment in the new rewing machine: Wode : Round intermediate calculatione ta z decimal places. Required: a. Caiculate the net present value of the proposed investment in the new sewing machine. b. Calculate the present value ratio of the investment. c. What is the internal rate of return of this investment relative to the cost of capital? d. Calculate the payback period of the investment. Complete this question by entering your answers in the tabs below. Calculate the net present value of the proposed investment in the new sewing machine. Note: Round intermediate calculations to 2 decimal places. The caps have a contribution margin of $5.00 per dozen. Fixed costs associated with the additional production (other than depreciation expense) will be negligible. Salvage value and the imvestment in working capital should be ignored. TopCop Companys cost of capital for this capocity expansion has been set at 16%. Required: a. Calculate the net present value of the proposed investment in the new sowing machine. b. Calculate the present value ratio of the investment. c. What is the internat rate of refurn of this investment relative to the cost of capital? d. Calcutate the payback period of the investment. Complete this question by entering your answers in the tabs below. Calculate the present value ratio of the investment Notel Do not round intermediate calculstions. Roubd vour answer to 2 decimal places. The caps have a contribution margin of $5.00 per dozen. Fixed costs associated with the additional production (other than depreciation expense) will be negligible. Salvage vatue and the investment in working capital should be lgnored, Top Cap Company's cost of capital for this capacity expansion has been set at 16%. Required: a. Colculate the net present value of the proposed investment in the new sewing machine. b. Calculate the present value ratio of the investment. c. What is the internal rote of retum of this investment relative to the cost of capital? d. Calculate the payback period of the investment. Complete this question by entering your answers in the tabs below. What is the internal rate of retum of this investment relative to the cost of capital? nave a contribution margin of $5.00 per dozen. Fixed costs associated with the additional production (other than depreciation expense) will be negligible. Salvage value and the investment in working capltal shoutd be lgniored. TopCop Company's cost of capital for this capacity expansion has been set at 16%. Required: a. Calculate the net present value of the proposed investment in the new sewing machine. b. Calculate the present value ratio of the investment. c. What is the internal rate of return of this investment relative to the cost of capital? d. Calculate the payback period of the investment. Complete this question by entering your answers in the tabs below. Calculate the parback period of the investment. Notet Do not round intermediate calculations. Round your answer to 2 decimal places