Question

Using the information below please calculate the cash flow values at the end 1.The capital cost of the new building is expected to be $2.1

Using the information below please calculate the cash flow values at the end

1.The capital cost of the new building is expected to be $2.1 million today, including infrastructure such as new power and water supply. Business U has $22.3 million cash and it plans to use $1.6 million of this amount to pay for the building which will reduce the cost to just $500,000.

2.Business U proposes to construct the new store on property they currently own. The property is leased to a car yard for $140,000 each year. If the new store proceeds, then Business U must terminate the lease agreement and spend $8,000 to disconnect the existing power supply as it is inadequate for the new store. The power supply equipment can be sold for $40,000 today, is being depreciated to zero at an annual depreciation expense of $15,000, and has a current carrying value of $45,000. Business U will continue to own and lease the land to the car yard if the new store is not constructed. The Taxation Office confirms that disconnection of services such as power and water are a business expense.

3.According to the Announcement Business U has invested substantial amounts of capital implementing a "click & collect" service. The service is now fully operational and there is debate among management about whether the $900,000 investment in this service should be classified as a tax-deductible expense in 2021.

4.The annual sales for a new store are difficult to predict. However, Business U is confident that the new store can achieve sales in the first year of operation that are like an 'average' store. A full-year sales estimate for 2021= 3.6308mil/store

5.Since Business U plan to build the new store in the year 2021, for capital budgeting purposes the first year of cash sales is expected in 2022. However, the retail environment has rapidly improved according to figures in the Announcement. Therefore, you forecast that mew store's sales is 4.2154 mil. Sales are forecast to increase by 3% p.a. beyond 2022.

6.The Announcement discloses the "Gross profit %" for 1H FY21. You search the definition of gross profit margin to understand that the cost of goods sold margin (COGS %) plus gross profit margin equals one hundred percent. You calculate the COGS % figure for Business U and assume the figure 42.4% is applicable to the new store's sales. Fixed costs at the new store in 2022 are $190,000. Management is confident that with tight cost control they will be able to restrict the annual increase in fixed costs to $5,000 for each subsequent year. If the new store is built, Business U anticipates that total cash operating expenses will equal 30% of sales in 2022 to 2025 (inclusive). After 2025 cash operating expenses are expected to decrease by 2% to 28% of annual sales.

7.Starting in 2022, employees at the new store will receive annual training. Business U performs all training in-house using a dedicated facility that was established in 2020. The facility has an annual budget of $655,000 and inducts new employees in all aspects of the retail industry. Ordinarily, Business U would charge an arms-length amount of $75,000 per annum for staff training. However, the training division has sufficient spare capacity to train the new store's employees without the facility incurring any additional costs. The accounts department recommends internally invoicing the $75,000 training expense to the new store each year.

8.For taxation purposes the new building has a twenty-five-year life. However, Business U will perform the financial analysis of the new store over a ten-year period. The new store requires $300,000 of fixture and fittings (F&F). The Tax Office states that F&F have a six-year effective life. In Business U experience, F&F can be operated effectively for a full ten years before they need replacing. Business U management accountants depreciate all assets over an operational five-year life.

9.Business U will borrow $400,000 today to finance the new store. The ten-year interest-only loan has annual interest repayments of $16,000 (assuming a 4% p.a. rate). Business U accountant confirms that interest payments are classified as a business expense and are therefore tax deductible.

10.Business U assumes that the new building can be sold for $1,500,000 in the year 2031. At any point in time the resale value of the F&F is $22,000. Tax office regulations state that all non-current assets are depreciated to zero.

11.If Business U directors approve the new store it will require $200,000 of inventory, taking Business U total inventory figure to $5.9 million. The accounts receivable balance will increase from the current level of $4.1 million to $4.7 million. Accounts payable will remain at $6.2 million whether the new store proceeds or not.

12.Business U has a required rate of return of 8%. Assume the company tax rate will remain at 30%

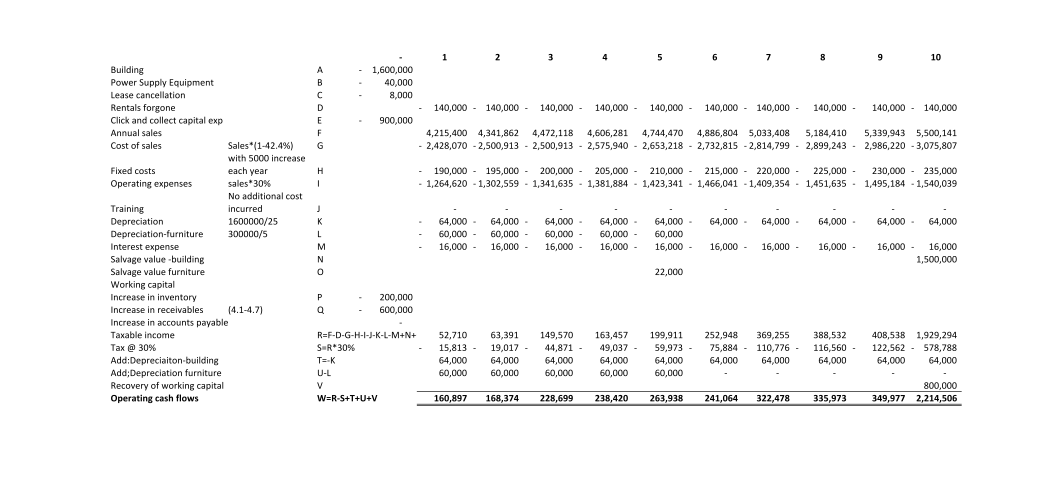

Below is an example of the cash flow value at year indicated by the (-) to year 10. I need help with calculating the cash flow values at the end using the information above and below

2 m 5 in 6 7 0 9 10 19 Building Power Supply Equipment Lease cancellation Rentals forgone A B 1,600,000 40,000 8,000 D 140,000 - 140,000 - 140,000 - 140,000 - 140,000 - 140,000 140,000 140,000 140,000 140,000 Click and collect capital exp Annual sales E 900,000 F 4,215,400 4,341,862 Cost of sales Sales*(1-42.4%) G - 2,428,070 -2,500,913 4,472,118 2,500,913 4,606,281 4,744,470 4,886,804 5,033,408 2,575,940 2,653,218 2,732,815 -2,814,799 5,184,410 2,899,243 5,339,943 5,500,141 2,986,220 -3,075,807 with 5000 increase Fixed costs each year H - - Operating expenses sales*30% 1 190,000 195,000 200,000 - 205,000 - 210,000 - 215,000 220,000 - 225,000 - 230,000 235,000 - 1,264,620 -1,302,559 1,341,635 1,381,884 1,423,341 1,466,041 -1,409,354 1,451,635 1,495,184 -1,540,039 No additional cost Training incurred J Depreciation Depreciation-furniture Interest expense Salvage value -building Salvage value furniture Working capital 300000/5 1600000/25 K L M N 64,000 - 64,000 - 60,000 - 60,000 - 16,000 - 16,000 - 64,000 - 60,000 - 16,000 - 64,000 - 60,000 - 16,000 - 64,000 - 60,000 16,000 - 64,000 - 64,000 - 64,000 - 64,000 - 64,000 16,000 - 16,000 - 16,000 - 16,000 - 16,000 1,500,000 22,000 Increase in inventory P 200,000 Increase in receivables (4.1-4.7) 600,000 Increase in accounts payable Taxable income R=F-D-G-H-I-J-K-L-M+N+ 52,710 63,391 149,570 163,457 199,911 Tax @ 30% S-R*30% 15,813 - 19,017- 44,871 - Add:Depreciaiton-building Add;Depreciation furniture Recovery of working capital Operating cash flows T=-K U-L 64,000 60,000 64,000 60,000 64,000 49,037 - 64,000 59,973 - 64,000 252,948 75,884 64,000 369,255 388,532 110,776 - 116,560 64,000 64,000 408,538 1,929,294 122,562 578,788 64,000 64,000 60,000 60,000 60,000 V 800,000 W=R-S+T+U+V 160,897 168,374 228,699 238,420 263,938 241,064 322,478 335,973 349,977 2,214,506

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started