Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waiting For Question B answer From a Legend.Thank you sir Problem 5 (20 marks) Consider the following options, which have the same two-year maturity and

Waiting For Question B answer From a Legend.Thank you sir

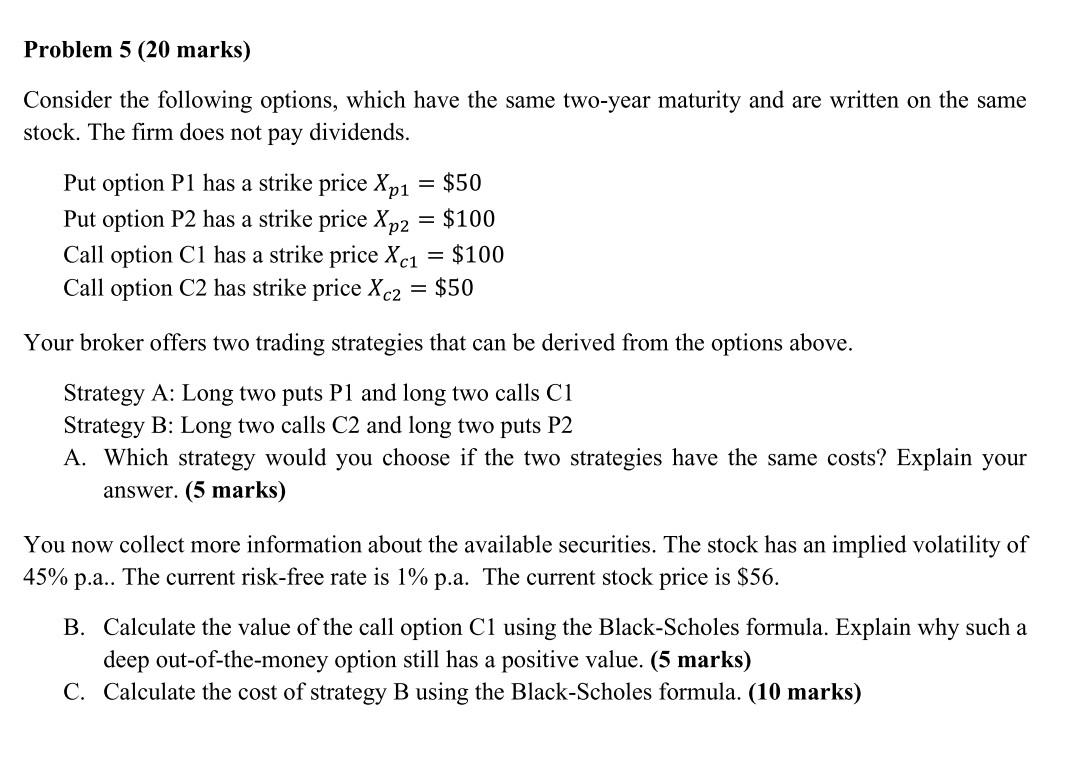

Problem 5 (20 marks) Consider the following options, which have the same two-year maturity and are written on the same stock. The firm does not pay dividends. Put option P1 has a strike price Xp1 = $50 Put option P2 has a strike price Xp2 = $100 Call option C1 has a strike price Xc1 = $100 Call option C2 has strike price Xc2 = $50 Your broker offers two trading strategies that can be derived from the options above. Strategy A: Long two puts P1 and long two calls C1 Strategy B: Long two calls C2 and long two puts P2 A. Which strategy would you choose if the two strategies have the same costs? Explain your answer. (5 marks) You now collect more information about the available securities. The stock has an implied volatility of 45% p.a.. The current risk-free rate is 1% p.a. The current stock price is $56. B. Calculate the value of the call option C1 using the Black-Scholes formula. Explain why such a deep out-of-the-money option still has a positive value. (5 marks) C. Calculate the cost of strategy B using the Black-Scholes formula. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started