Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wall Corporation has 20, 000 ordinary shares of Paper Corporation purchased in 2014 for P180, 000. At the time of acquisition, Wall designated the

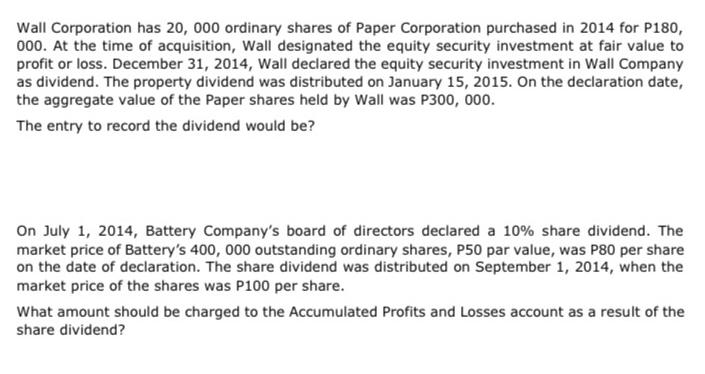

Wall Corporation has 20, 000 ordinary shares of Paper Corporation purchased in 2014 for P180, 000. At the time of acquisition, Wall designated the equity security investment at fair value to profit or loss. December 31, 2014, Wall declared the equity security investment in Wall Company as dividend. The property dividend was distributed on January 15, 2015. On the declaration date, the aggregate value of the Paper shares held by Wall was P300, 000. The entry to record the dividend would be? On July 1, 2014, Battery Company's board of directors declared a 10% share dividend. The market price of Battery's 400, 000 outstanding ordinary shares, P50 par value, was P80 per share on the date of declaration. The share dividend was distributed on September 1, 2014, when the market price of the shares was P100 per share. What amount should be charged to the Accumulated Profits and Losses account as a result of the share dividend?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution a The entry to record the dividend for Wall Corporation would be Date of declaration December 31 2014 Debit Equity Security Investment at fair value P300000 Credit Dividend Declared P300000 D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started