Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What does this mean Delicious Deserts, Incorporated Income Statement For The Year Ending December 3 1 , 2 0 1 2 Revenues Gross Sales. q

What does this mean

Delicious Deserts, Incorporated

Income Statement For The Year Ending December

Revenues

Gross Sales.

Less: Sales Discounts

Less: Returns Cancelled Weddings $

Net Sales. $

Cost of Goods Sold

Beginning Inventory January

Cost Of Ingredients To Bake Cakes.

Total Cost of Goods For Sale

Less: Ending Inventory December $

Cost of Goods Sold. $

Gross Profit. $

Operating Expenses

Selling Expenses $ $

$

$

$

Sales Commissions.

Advertising. $

Other Selling Expenses Internet

$

$

Total Selling Expenses. $

General and Administrative Expenses

Professional & Office Salaries. $

Utilities. $

Office Supplies. $

Bank Interest Paid on Loans.

Insurance $

Rent Fixed Cost $

Total General & Administrative Expense. $

Total Operating Expenses. $

Net Profit Before Taxes.

Less: FederalStateLocal Taxes. $

NET PROFIT. S

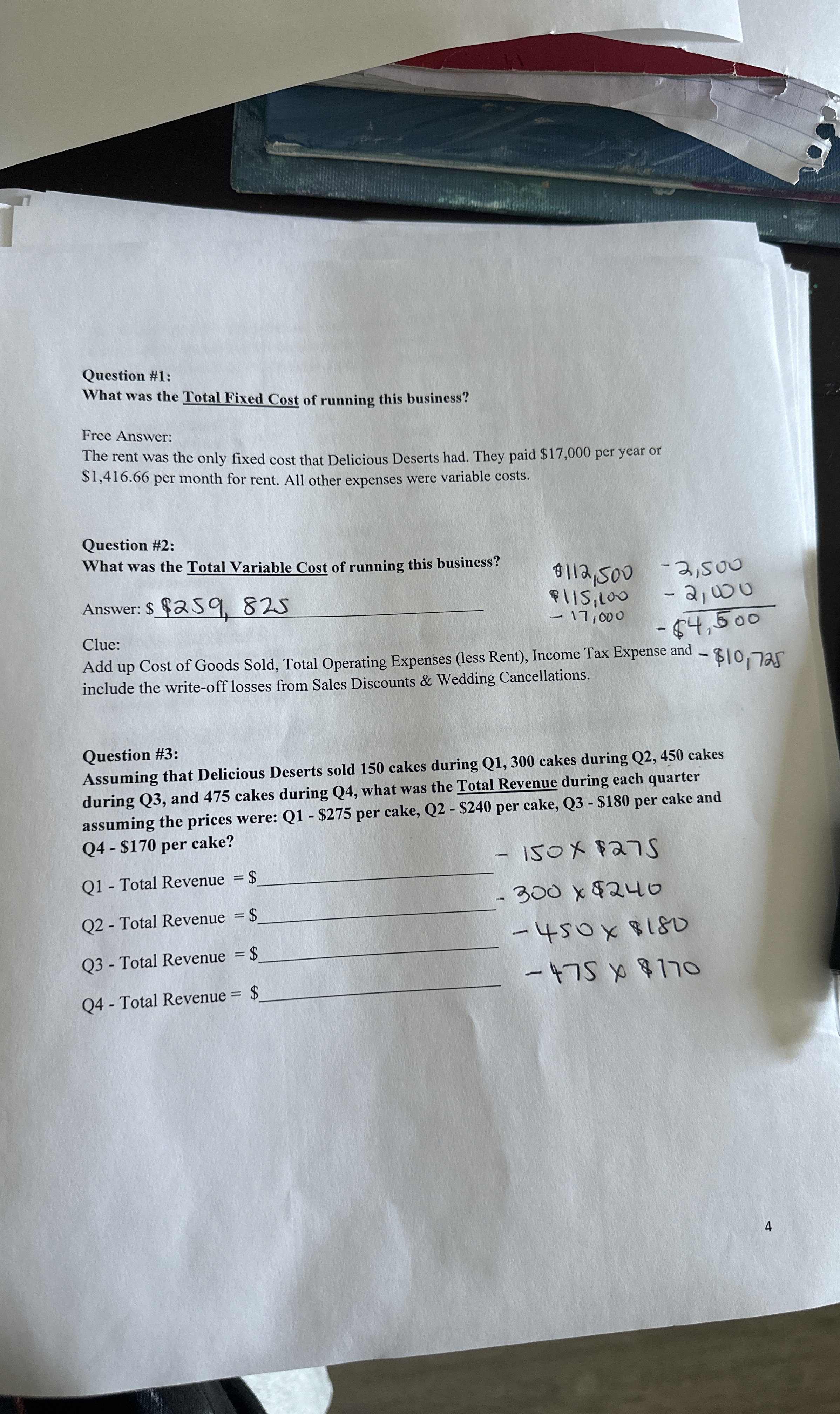

Question #:

What was the Total Fixed Cost of running this business?

Free Answer:

The rent was the only fixed cost that Delicious Deserts had. They paid $ per year or $ per month for rent. All other expenses were variable costs.

Question #:

What was the Total Variable Cost of running this business?

Answer: $ $

$

$

$

Clue:

Add up Cost of Goods Sold, Total Operating Expenses less Rent Income Tax Expense and $ include the writeoff losses from Sales Discounts & Wedding Cancellations.

Question #:

Assuming that Delicious Deserts sold cakes during Q cakes during cakes during Q and cakes during Q what was the Total Revenue during each quarter assuming the prices were: $ per cake, $ per cake, $ per cake and Q $ per cake?

Q Total Revenue $ $

Total Revenue $ $

Q Total Revenue $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started