Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is XYZ company's cost of common stock (r s ) using the Discounted Cash Flow (Constant Dividend Growth Model) approach? XYZ Co. is estimating

What is XYZ company's cost of common stock (rs) using the Discounted Cash Flow (Constant Dividend Growth Model) approach?

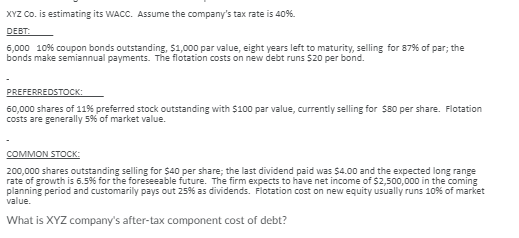

XYZ Co. is estimating its WACC. Assume the company's tax rate is 40%. DEBT 6,000 10% coupon bonds outstanding, $1,000 par value, eight years left to maturity, selling for 37% of par; the bonds make semiannual payments. The flotation costs on new debt runs $20 per bond. PREFERREDSTOCK: 50,000 shares of 11% preferred stock outstanding with $100 par value, currently selling for $80 per share. Flotation costs are generally 5% of market value. COMMON STOCK: 200,000 shares outstanding selling for $40 per share the last dividend paid was $4.00 and the expected long range rate of growth is 5.5% for the foreseeable future. The firm expects to have net income of $2,500,000 in the coming planning period and customarily pays out 25% as dividends. Flotation cost on new equity usually runs 10% of market value. What is XYZ company's after-tax component cost of debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started