When Bob is made redundant, he decides to run a business selling e-bikes. In order. to do this, he sets up a limited company,

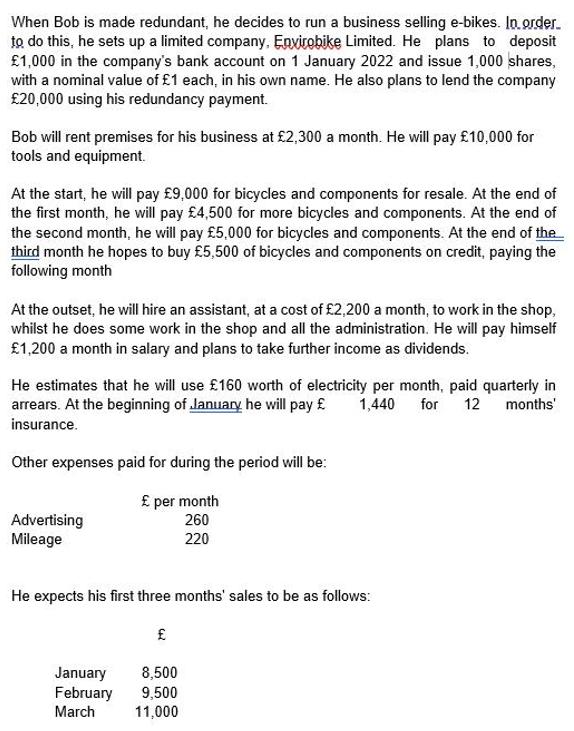

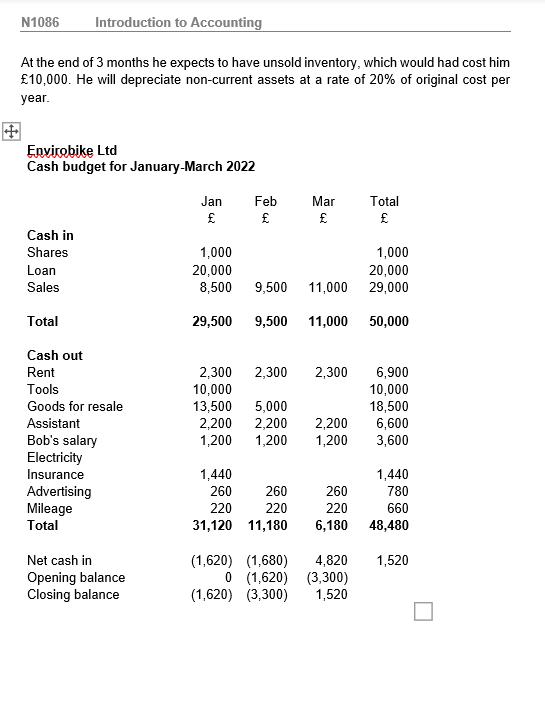

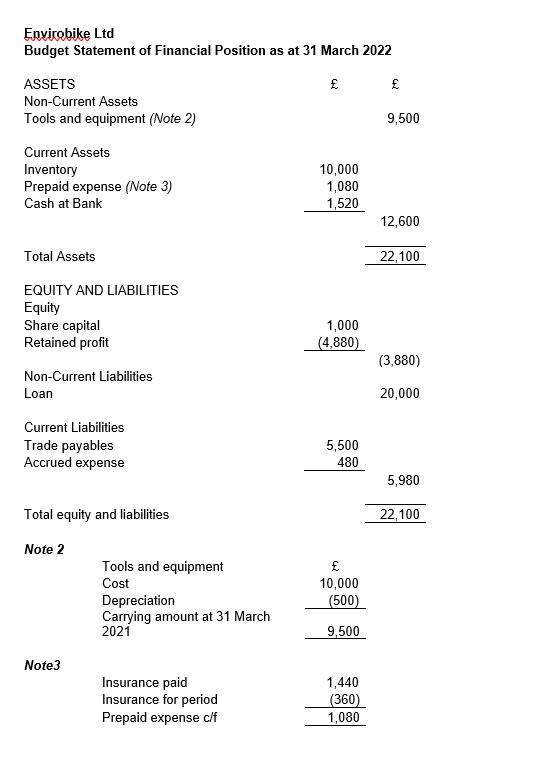

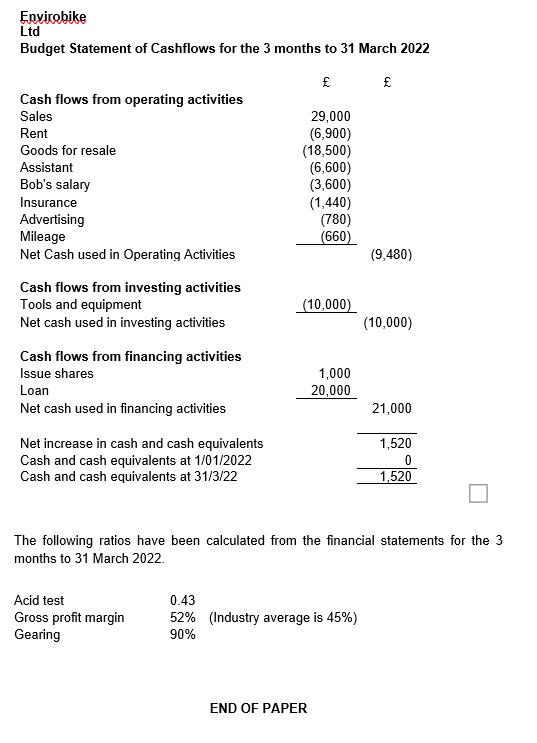

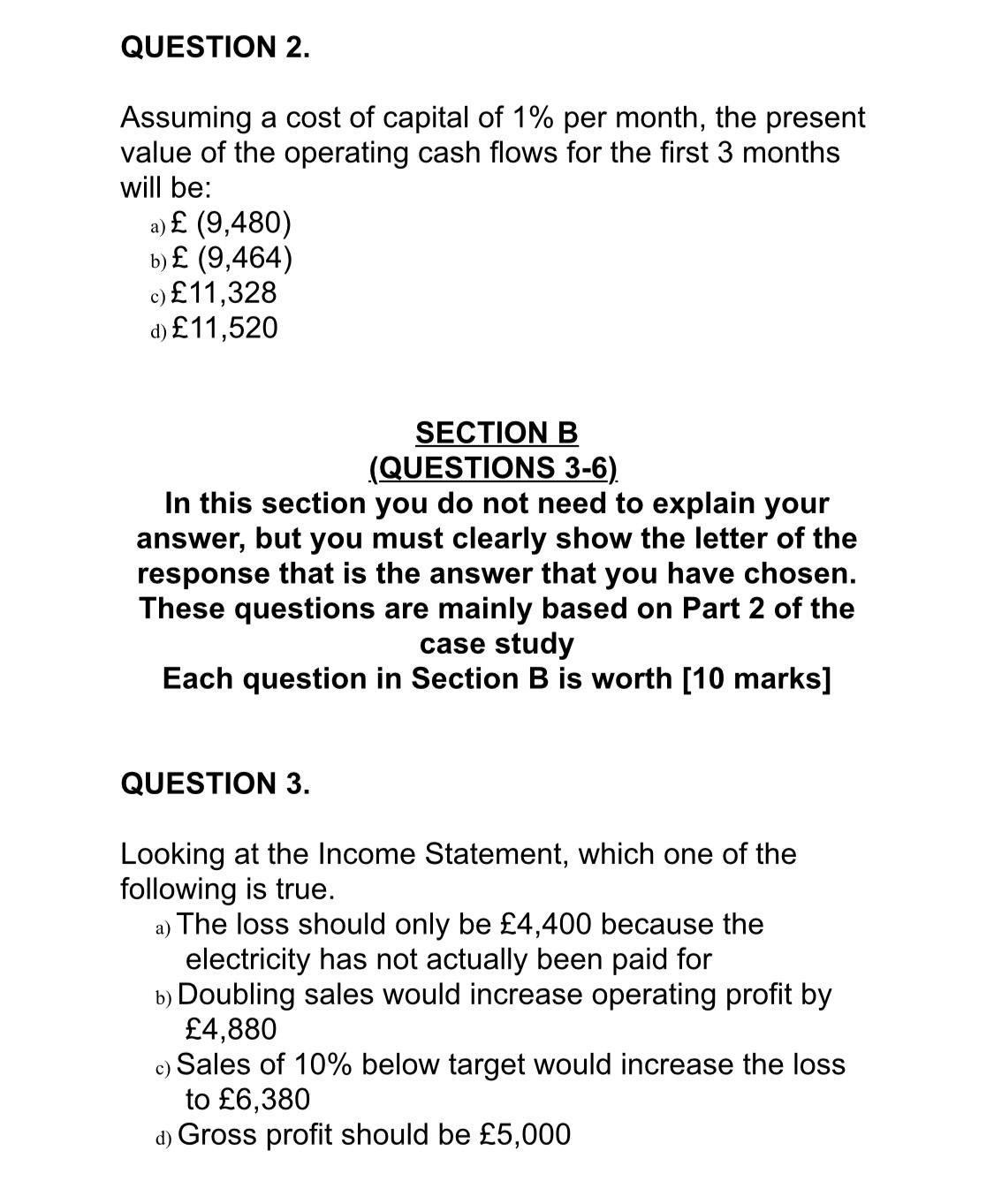

When Bob is made redundant, he decides to run a business selling e-bikes. In order. to do this, he sets up a limited company, Envirobike Limited. He plans to deposit 1,000 in the company's bank account on 1 January 2022 and issue 1,000 shares, with a nominal value of 1 each, in his own name. He also plans to lend the company 20,000 using his redundancy payment. Bob will rent premises for his business at 2,300 a month. He will pay 10,000 for tools and equipment. At the start, he will pay 9,000 for bicycles and components for resale. At the end of the first month, he will pay 4,500 for more bicycles and components. At the end of the second month, he will pay 5,000 for bicycles and components. At the end of the third month he hopes to buy 5,500 of bicycles and components on credit, paying the following month At the outset, he will hire an assistant, at a cost of 2,200 a month, to work in the shop, whilst he does some work in the shop and all the administration. He will pay himself 1,200 a month in salary and plans to take further income as dividends. He estimates that he will use 160 worth of electricity per month, paid quarterly in arrears. At the beginning of lanuary he will pay 1,440 for 12 months' insurance. Other expenses paid for during the period will be: per month 260 Advertising Mileage 220 He expects his first three months' sales to be as follows: January February March 8,500 9,500 11,000 N1086 Introduction to Accounting At the end of 3 months he expects to have unsold inventory, which would had cost him 10,000. He will depreciate non-current assets at a rate of 20% of original cost per year. Envirobike Ltd Cash budget for January-March 2022 Jan Feb Mar Total Cash in Shares 1,000 20,000 8,500 1,000 20,000 11,000 29,000 Loan Sales 9,500 Total 29,500 9,500 11,000 50,000 Cash out Rent 2,300 10,000 13,500 2,200 1,200 2,300 2,300 6,900 10,000 18,500 6,600 3,600 Tools Goods for resale 5,000 Assistant 2,200 2,200 1,200 Bob's salary Electricity 1,200 Insurance 1,440 1,440 Advertising Mileage 260 260 260 780 220 220 220 660 Total 31,120 11,180 6,180 48,480 Net cash in (1,620) (1,680) 1,520 Opening balance Closing balance 4,820 0 (1,620) (3,300) 1,520 (1,620) (3,300) PART 2 Envirobike Ltd Budget Income Statement for the 3 months to 31 March 2022 Sales Revenue 29,000 (14,000) 15,000 less Cost of Sales (Note 1) Gross Profit less Operating expenses: Rent Assistant's 6,900 salary Bob's salary Electricity 6,600 3,600 480 Insurance 360 Advertising Mileage Depreciation 780 660 500 19,880 Operating profit (4,880) Note 1 Opening inventory Purchases Closing inventory Cost of Sales 24,000 (10,000) 14,000 Envirobike Ltd Budget Statement of Financial Position as at 31 March 2022 ASSETS Non-Current Assets Tools and equipment (Note 2) 9,500 Current Assets Inventory Prepaid expense (Note 3) 10,000 1,080 1,520 Cash at Bank 12,600 Total Assets 22,100 EQUITY AND LIABILITIES Equity Share capital Retained profit 1,000 (4,880) (3,880) Non-Current Liabilities Loan 20,000 Current Liabilities Trade payables Accrued expense 5,500 480 5,980 Total equity and liabilities 22,100 Note 2 Tools and equipment Cost 10,000 Depreciation Carrying amount at 31 March 2021 (500) 9,500 Note3 Insurance paid Insurance for period Prepaid expense c/f 1,440 (360) 1,080 Envirobike Ltd Budget Statement of Cashflows for the 3 months to 31 March 2022 Cash flows from operating activities Sales 29,000 (6,900) (18,500) (6,600) (3,600) (1,440) (780) (660) Rent Goods for resale Assistant Bob's salary Insurance Advertising Mileage Net Cash used in Operating Activities (9,480) Cash flows from investing activities Tools and equipment Net cash used in investing activities (10,000) (10,000) Cash flows from financing activities Issue shares 1,000 20,000 Loan Net cash used in financing activities 21,000 Net increase in cash and cash equivalents Cash and cash equivalents at 1/01/2022 Cash and cash equivalents at 31/3/22 1,520 1,520 The following ratios have been calculated from the financial statements for the 3 months to 31 March 2022. Acid test 0.43 Gross profit margin Gearing 52% (Industry average is 45%) 90% END OF PAPER QUESTION 2. Assuming a cost of capital of 1% per month, the present value of the operating cash flows for the first 3 months will be: a) (9,480) b) (9,464) c) 11,328 d) 11,520 SECTION B (QUESTIONS 3-6) In this section you do not need to explain your answer, but you must clearly show the letter of the response that is the answer that you have chosen. These questions are mainly based on Part 2 of the case study Each question in Section B is worth [10 marks] QUESTION 3. Looking at the Income Statement, which one of the following is true. a) The loss should only be 4,400 because the electricity has not actually been paid for b) Doubling sales would increase operating profit by 4,880 Sales of 10% below target would increase the loss to 6,380 d) Gross profit should be 5,000 c)

Step by Step Solution

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

2 Jan Feb Mar Net Cash 1620 1680 4820 Cash in shares ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started