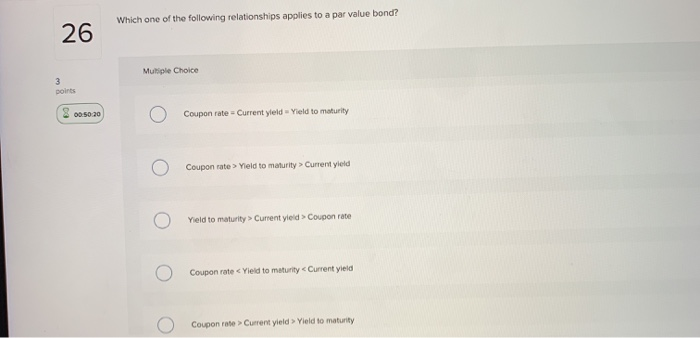

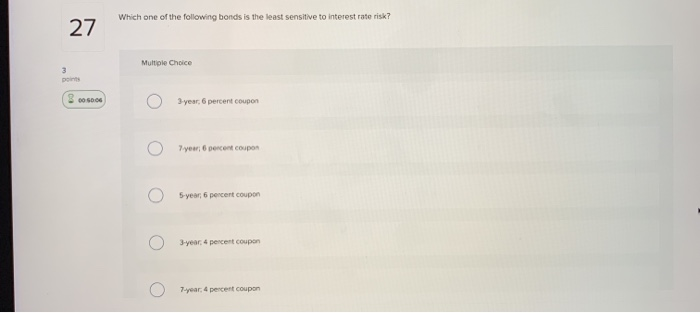

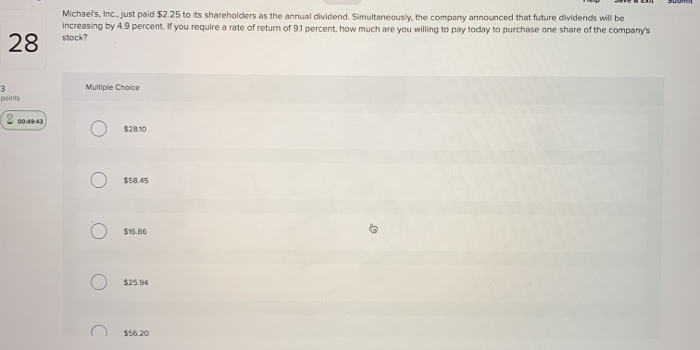

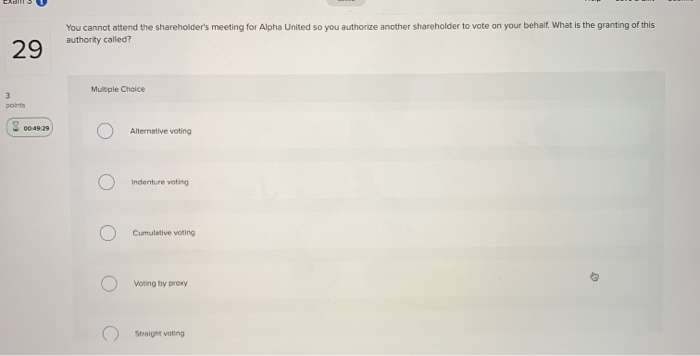

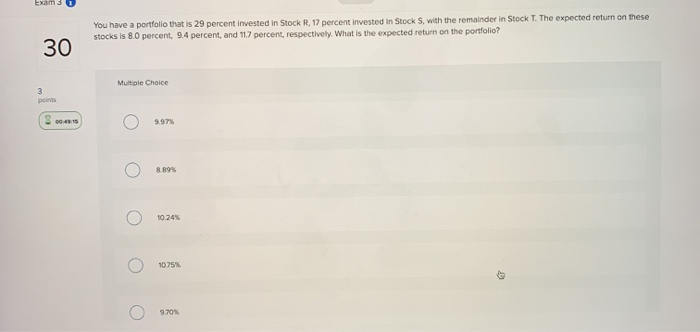

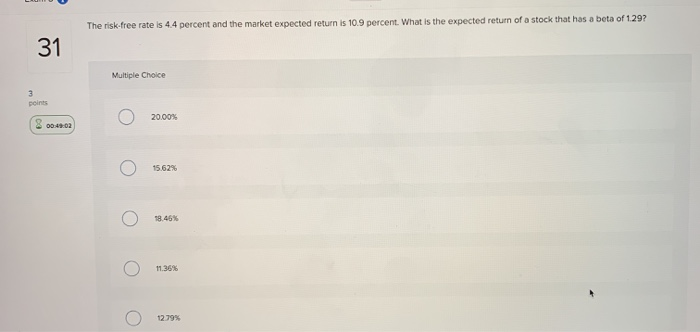

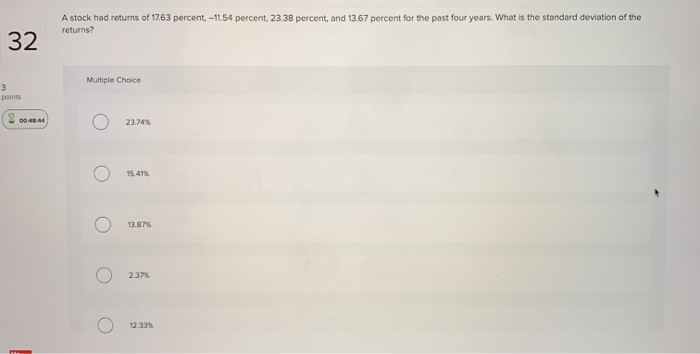

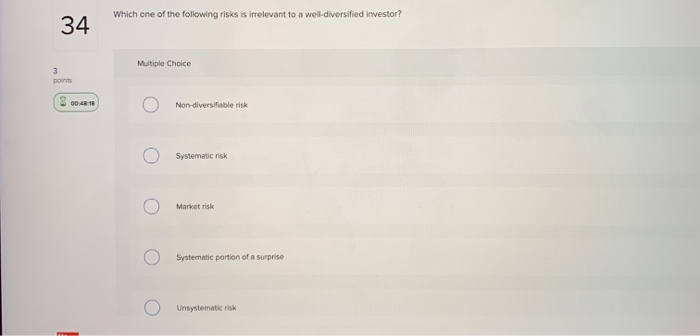

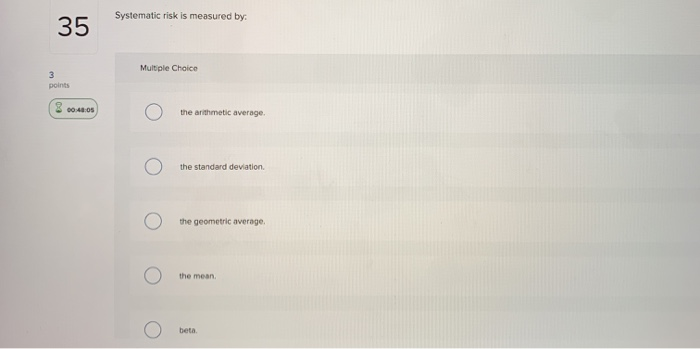

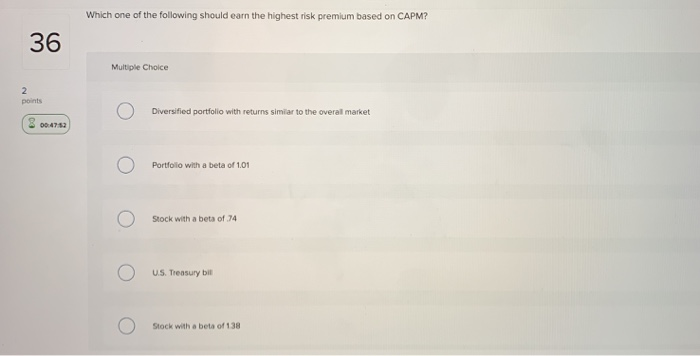

Which one of the following relationships applies to a par value bond? Coupon rate - Current yield Yield to maturity Coupon rate > Yield to maturity > Current yield Yield to maturity > Current yield > Coupon rate Coupon rate Current yield > Yield to maturity Which one of the following bonds is the least sensitive to interest rate risk? Multiple Choice 3 year, 6 percent coupon , O 5-year, 6 percent coupon 3.year. 4 percent coupon 7year, 4 percent coupon Michael's, Inc., just paid $2 25 to its shareholders as the annual dividend. Simultaneously, the company announced that future dividends will be increasing by 4.9 percent. If you require a rate of return of 9.1 percent, how much are you willing to pay today to purchase one share of the company's stock? 28 points g goes 43 o o 558, 45 o 516.06 o c You cannot attend the shareholder's meeting for Alpha United so you authorize another shareholder to vote on your behalf. What is the granting of this authority called? O Alternative voting C) inderture voting O Cumulative voting O Voting by prowy O Straight voting You have a portfolio that is 29 percent invested in Stock R. 17 percent invested in Stock S, with the remainder in Stock T. The expected return on these stocks is 8.0 percent, 9.4 percent, and 117 percent, respectively. What is the expected return on the portfolio? The risk-free rate is 4.4 percent and the market expected return is 10.9 percent. What is the expected return of a stock that has a beta of 1.29? 18.46% A stock had returns of 17.63 percent. -11.54 percent, 23.38 percent, and 13.67 percent for the past four years. What is the standard deviation of the returns? 32 points 0042 15.41% Which one of the following is a risk that applies to most securities? o Diversifiable o O Unsystematic o O Asset-specific o o Which one of the following risks is irrelevant to a well-diversified investor? Non-diversifiable risk Systematic risk Market risk Systematic portion of a surprise Unsystematic risk Systematic risk is measured by: 35 Multiple Choice the arithmetic average. the standard deviation the geometric average. the mean Which one of the following should earn the highest risk premium based on CAPM? 36 points O Diversified portfolio with returns similar to the overal market 3 00:47:52 Portfolio with a beta of 1.01 O Stock with a beta of 74 O US Treasury bit Stock with a beta of 138