Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is it that a firm's capital investments can be positive NPV investments? Choose all that apply. Firms may enjoy a monopoly advantage in their

Why is it that a firm's capital investments can be positive NPV investments? Choose all that apply.

Firms may enjoy a monopoly advantage in their geographical area.

Firms can earn cash flows on capital investments whose present value exactly covers their ini

tial investment.

Firms can exploit patents or exclusive technology to create a competitive advantage.

Firms can build customer recognition and loyalty for

their products to generate repeat sales.

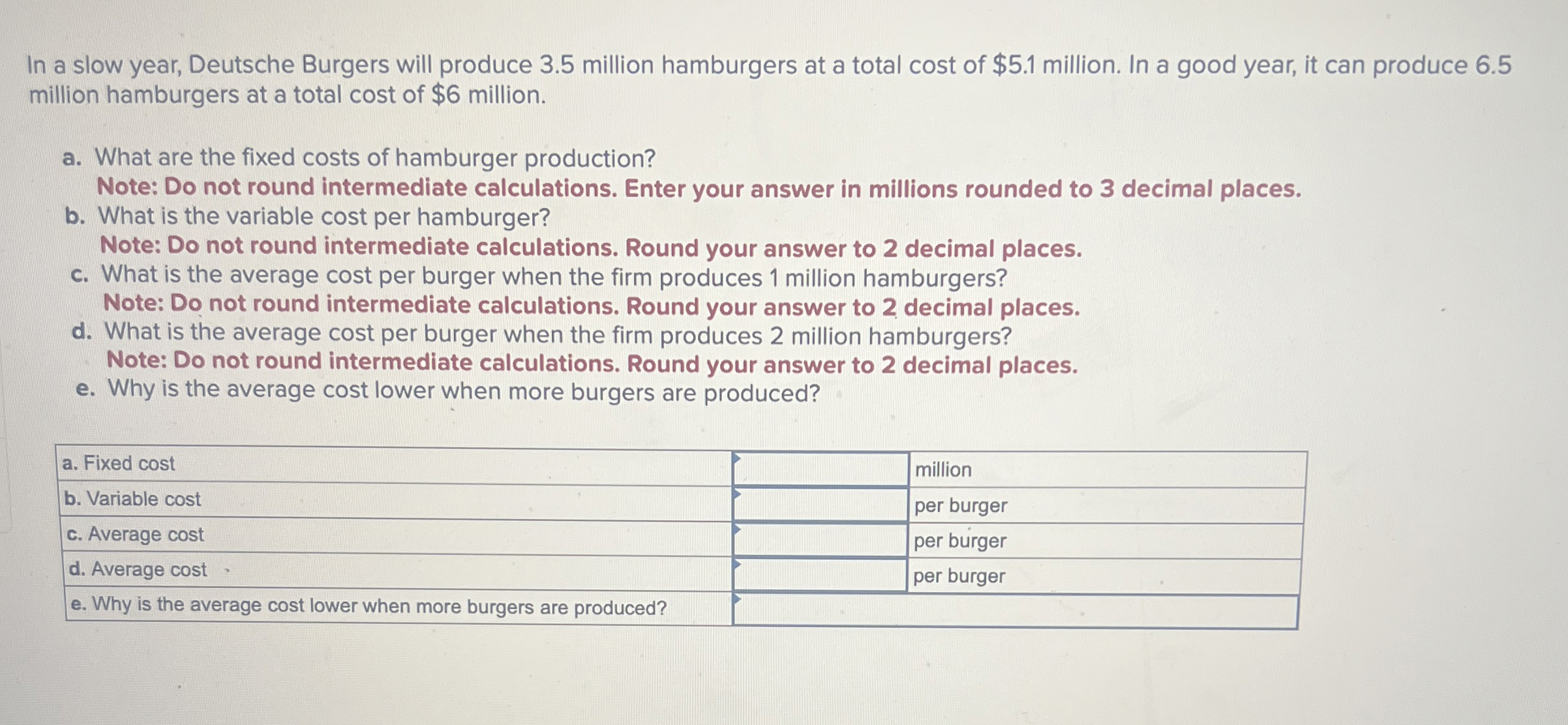

In a slow year, Deutsche Burgers will produce million hamburgers at a total cost of $ million. In a good year, it can produce

million hamburgers at a total cost of $ million.

a What are the fixed costs of hamburger production?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

b What is the variable cost per hamburger?

Note: Do not round intermediate calculations. Round your answer to decimal places.

c What is the average cost per burger when the firm produces million hamburgers?

Note: Do not round intermediate calculations. Round your answer to decimal places.

d What is the average cost per burger when the firm produces million hamburgers?

Note: Do not round intermediate calculations. Round your answer to decimal places.

e Why is the average cost lower when more burgers are produced?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started