Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Company is considering purchasing an asset for $100,000 that has a 5-year useful life and a $20,000 salvage value. Double declining balance depreciation

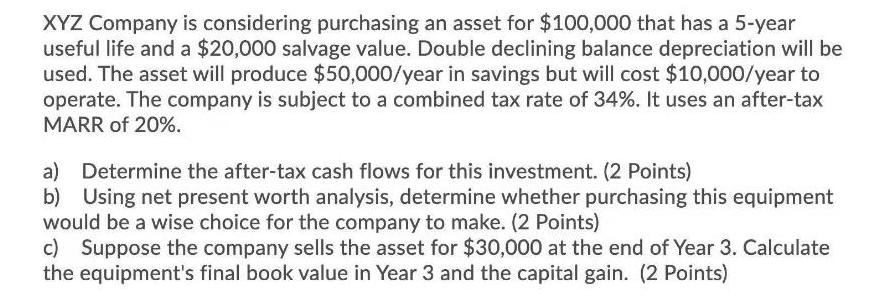

XYZ Company is considering purchasing an asset for $100,000 that has a 5-year useful life and a $20,000 salvage value. Double declining balance depreciation will be used. The asset will produce $50,000/year in savings but will cost $10,000/year to operate. The company is subject to a combined tax rate of 34%. It uses an after-tax MARR of 20%. a) Determine the after-tax cash flows for this investment. (2 Points) b) Using net present worth analysis, determine whether purchasing this equipment would be a wise choice for the company to make. (2 Points) c) Suppose the company sells the asset for $30,000 at the end of Year 3. Calculate the equipment's final book value in Year 3 and the capital gain. (2 Points)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The aftertax cash flows for this investment are as follows Year 1 50000 10000 3400 36600 Year 2 5000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started