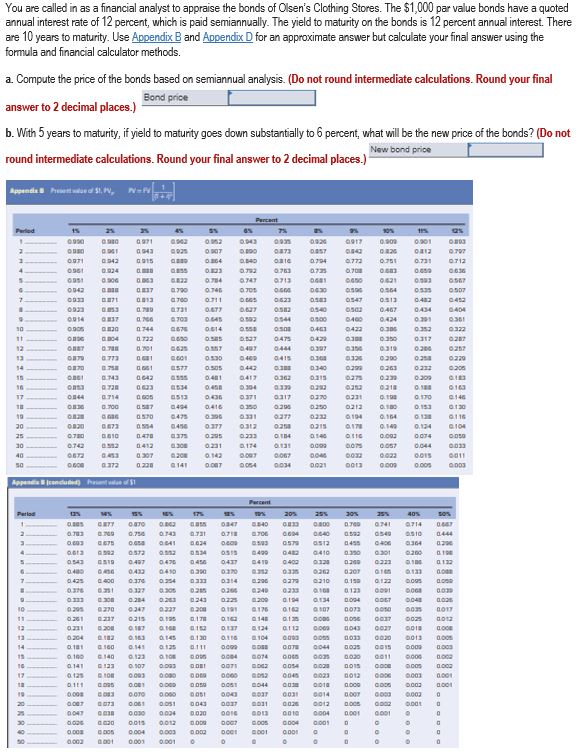

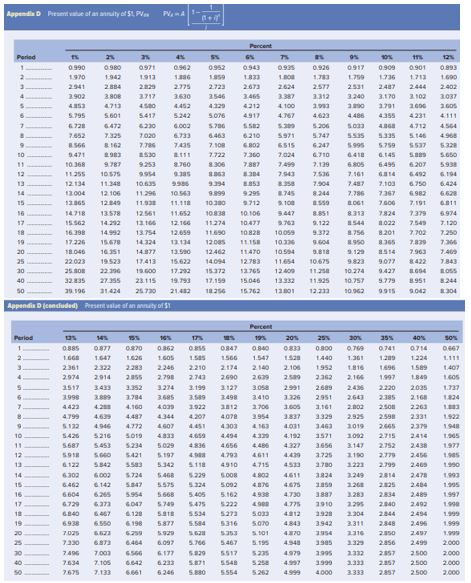

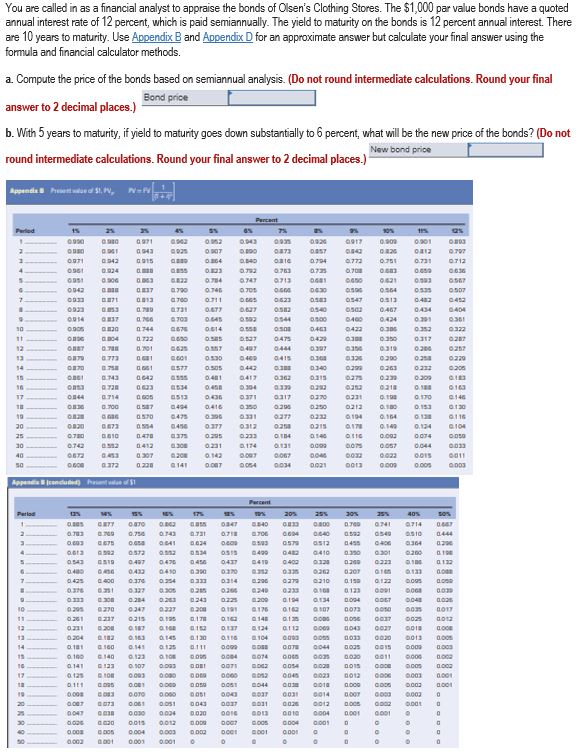

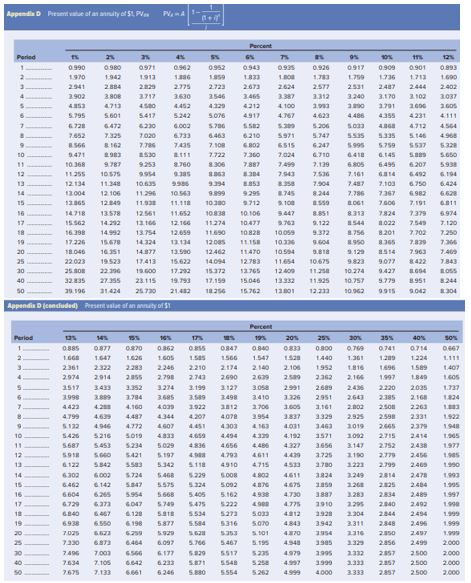

You are called in as a financial analyst to appraise the bonds of Olsen's Clothing Stores. The $1,000 par value bonds have a quoted annual interest rate of 12 percent, which is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest. There are 10 years to maturity. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the price of the bonds based on semiannual analysis. (Do not round intermediate calculations. Round your final Bond price answer to 2 decimal places.) b. With 5 years to maturity, if yield to maturity goes down substantially to 6 percent, what will be the new price of the bonds? (Do not New bond price round intermediate calculations. Round your final answer to 2 decimal places.) Percent 0.93 0.02 00 0.003 00 43 23 226 0.51 0.6 0.021 22702 0.731 0.65 OG 0.93 0.024 900 SS 222 0.03 073 0. 2 072 0951 0.963 0713 0681 0 0.905 0 4 31 OYO 703 0. 65 0. 2 06 0.67 0.614 553 0.650 O S 6.12 0625 ST 407 05020540 0.544 0900 Os 461 0.473 0.429 444 097 0414 0.4240301 0.0 033 0.17 319 300 200 0404 036 0322 0.22 6252 0220 OBAT 0701 0218 10.30 201 7 05 OS 513 6.494 6 0500475 0.456 06100 0373 2 0412 300 453 0307 2 0172 0.22 0141 36 0.416 076 037 0295 0 231 0.142 0. 00 0.417 0362 034 033 37 317 0.250 0.20 3 277 0312 25 0.233 134 0.174 .131 DOT 0.067 0 540034 21 Q 0.250 0.213 0212 0194 Q.17 1 QC ODS DOTS 46 DO 00210013 180 0164 149 0.093 0.057 0:022 0000 0202 01 16 OTO0146 0.133 130 .17 .116 0.14 0.104 0074 0050 0.044 GOLS 0011 0.00 0.00 QE2 OBCE Apple $1 .es ET TO 30 50 00 BS10 04 06 0.6 . 034 0.410 0900301 020 019 0.400 0.00 0.433 40 2000 20 02 0335 0207 10 13 000 0.425 0.400 0.375 0.25403 0 314 0279 0210113301220900 1 2730 25 30 240 Qot DOO 1209140934024 DCT 0410 0270 037 32720191 0175 GOTO 003 0017 2 0215 17 OG 148 DOZS 2012 021120000 DE D OT 124 112 0204 0.163 014 01300116 0104 0033 00200013 0:00 0.11 160 0.141 0.125 0111 000 000 001500 000 190 140 0.121 05 C04001400 0.020 00110.000000 014101230107 0. 0.125 010 0003 000 000 0012 COO 0.003 000 0.111 0000 0.00 0.00 0.00 0.0610044 Coor00.000000 000 370 051 0510 041 0 10020012003 ODER 300 00 000 0004 00 OOIE DE 0010 0004 0000001 0.00 0.00 0.0130012 DS DOO DOOS 000 000 0 0 0.003 005 004 003 002 Dec 000100 0 0 0.0001000100010 SPAR 38 A hely SPP- 0 36 13 10 2.54 0 271 2006 2005 672 SS S S 206 7,325 7620 6.733 .463 6210 5971 5.747 316 8025515527 361 530 100 6.710 10368 9.77 9253 2760 8.306 1055 999 735 7.50 7536 2134 131015 2106 11296109.999 84 1365 12.04 113 11.8 1030 9712 100 55 141 13528 1295111652 10828 0106 155621221316612166 11274 107 3.763 9.122 16.38 14.992 13.754 12.659 160 10.828 10.059 9.372 17226 18.046 16351 14.877 13.50 12462 1490 10.5 9.818 22.023 19.523 17.413 15.622 1409 1 2.783 11.054 10675 35.0 32396 1.600 17.212 1532 2765 12.109 11.20 32335 27355 28.115 19.793 17.159 15046 13332 11.525 30106 31424 25 730 21.452 125615762 12301 122 0 47124 SSS S S .16 S995 759 537 5320 6.18 6.15 S 5600 505 6495 620759 7.161 1 692 19 747 703 70 64 776 367 3 6620 OG 7000 7.1916.011 813 732 737 6974 544 1022 7.543 120 568.201 702 7.250 365 78296 9.129 514 796.3 7.4 2 077 788) 10 274 427 604 05 10.757 3.779 951 244 10.062 0915 304 304 Appendia concluded) se le of an y of 40% 0714 1224 29 50% 0.667 1111 1 7 123 20% 20% 30 % 0885 08770870 0362 085 084 09400833 0:00 0.7690741 1901 129 261 222 223 2245 22102172121051952915 195 2014 2014 2055 2.798 2 2690 261 2 212 21 19 1517 343 3352324 3199 3127 3.05 291 2.689246 2220 1998 399 34 355 359 2498 240 1206 442 4 4 .160 &0933.522 3812 2706 16S 11612003 2.500 160 73 2025 2.263 0 0 594 234 653 5687 S 3 5341495 48364656 1793 099 192 75 1027341 3556 31 212 24 2725110 2111 2456 S 1 611 3 04 5 5 56 5518 2 75 2910 2210 22 34 7330 33 740670 76347105 662