Answered step by step

Verified Expert Solution

Question

1 Approved Answer

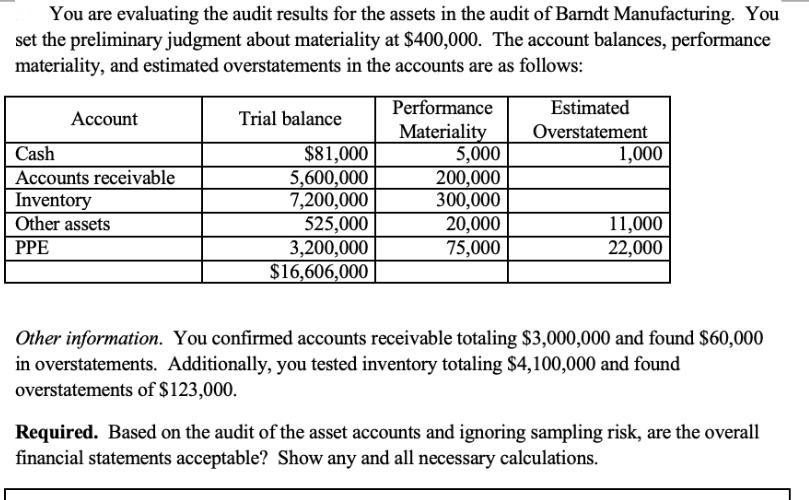

You are evaluating the audit results for the assets in the audit of Barndt Manufacturing. You set the preliminary judgment about materiality at $400,000.

You are evaluating the audit results for the assets in the audit of Barndt Manufacturing. You set the preliminary judgment about materiality at $400,000. The account balances, performance materiality, and estimated overstatements in the accounts are as follows: Account Cash Accounts receivable Inventory Other assets PPE Trial balance $81,000 5,600,000 7,200,000 525,000 3,200,000 $16,606,000 Performance Materiality 5,000 200,000 300,000 20,000 75,000 Estimated Overstatement 1,000 11,000 22,000 Other information. You confirmed accounts receivable totaling $3,000,000 and found $60,000 in overstatements. Additionally, you tested inventory totaling $4,100,000 and found overstatements of $123,000. Required. Based on the audit of the asset accounts and ignoring sampling risk, are the overall financial statements acceptable? Show any and all necessary calculations.

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

In 3000000 of accounts receivable the overstatement amount is 60000 The direct projection of error i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started