Answered step by step

Verified Expert Solution

Question

1 Approved Answer

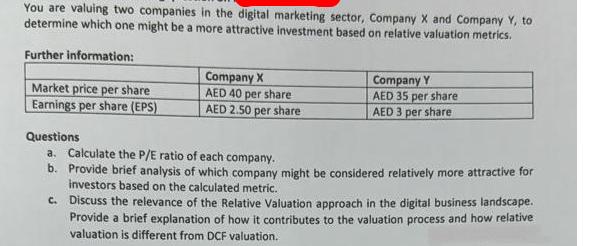

You are valuing two companies in the digital marketing sector, Company X and Company Y, to determine which one might be a more attractive

You are valuing two companies in the digital marketing sector, Company X and Company Y, to determine which one might be a more attractive investment based on relative valuation metrics. Further information: Market price per share Earnings per share (EPS) Company X AED 40 per share AED 2.50 per share Company Y AED 35 per share AED 3 per share Questions a. Calculate the P/E ratio of each company. b. Provide brief analysis of which company might be considered relatively more attractive for investors based on the calculated metric. c. Discuss the relevance of the Relative Valuation approach in the digital business landscape. Provide a brief explanation of how it contributes to the valuation process and how relative valuation is different from DCF valuation.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The PE ratio PricetoEarnings ratio is calculated by dividing the market price per share by the earnings per share For Company X PE ratio Market pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started