Answered step by step

Verified Expert Solution

Question

1 Approved Answer

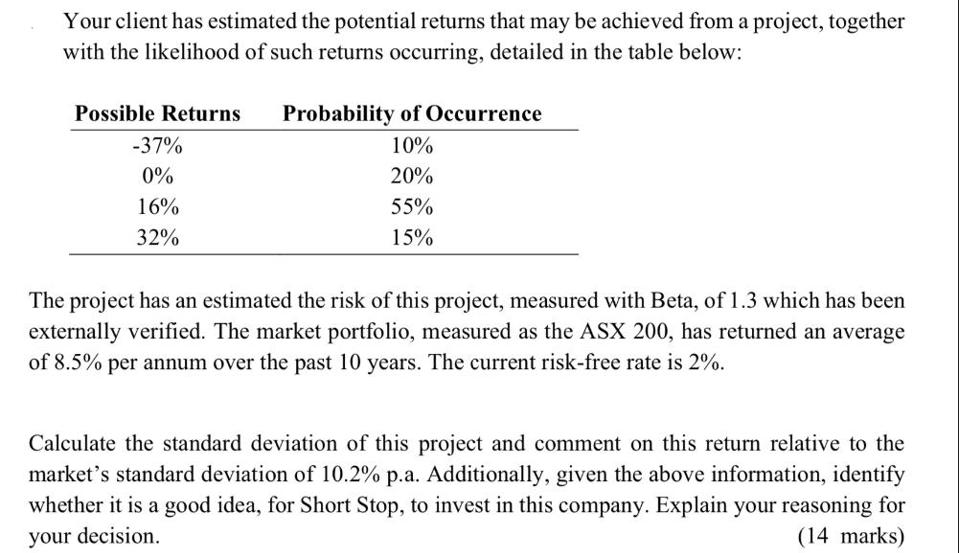

Your client has estimated the potential returns that may be achieved from a project, together with the likelihood of such returns occurring, detailed in

Your client has estimated the potential returns that may be achieved from a project, together with the likelihood of such returns occurring, detailed in the table below: Possible Returns Probability of Occurrence 10% 20% -37% 0% 16% 32% 55% 15% The project has an estimated the risk of this project, measured with Beta, of 1.3 which has been externally verified. The market portfolio, measured as the ASX 200, has returned an average of 8.5% per annum over the past 10 years. The current risk-free rate is 2%. Calculate the standard deviation of this project and comment on this return relative to the market's standard deviation of 10.2% p.a. Additionally, given the above information, identify whether it is a good idea, for Short Stop, to invest in this company. Explain your reasoning for your decision. (14 marks)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the standard deviation of the project we need to use the formula for the weighted standard deviation The formula is as follows Pi Ri Ravg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started