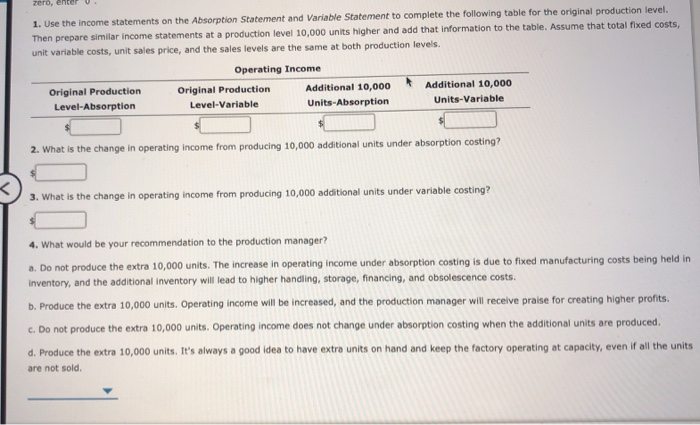

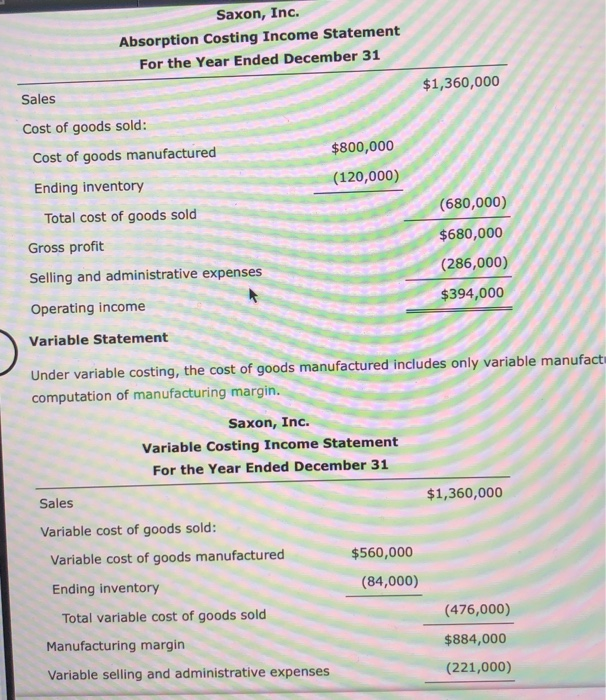

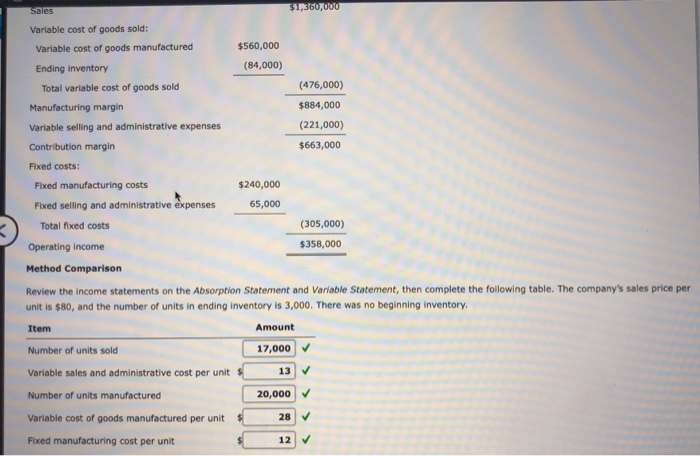

zero, entei 1. Use the income statements on the Absorption Statement and Variable Statement to complete the following table for the original production level. Then prepare similar income statements at a production level 10,000 units higher and add that information to the table. Assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same at both production levels. Operating Income Original Production Original Production Additional 10,000 Additional 10,000 Level-Absorption Level-Variable Units-Absorption Units-Variable 2. What is the change in operating income from producing 10,000 additional units under absorption costing? 3. What is the change in operating income from producing 10,000 additional units under variable costing? 4. What would be your recommendation to the production manager? a. Do not produce the extra 10,000 units. The increase in operating income under absorption costing is due to fixed manufacturing costs being held in Inventory, and the additional inventory will lead to higher handling, storage, financing, and obsolescence costs. b. Produce the extra 10,000 units. Operating income will be increased, and the production manager will receive praise for creating higher profits. c. Do not produce the extra 10,000 units. Operating income does not change under absorption costing when the additional units are produced. d. Produce the extra 10,000 units. It's always a good idea to have extra units on hand and keep the factory operating at capacity, even if all the units are not sold Saxon, Inc. Absorption Costing Income Statement For the Year Ended December 31 $1,360,000 Sales $800,000 (120,000) (680,000) Cost of goods sold: Cost of goods manufactured Ending inventory Total cost of goods sold Gross profit Selling and administrative expenses Operating income Variable Statement $680,000 (286,000) $394,000 Under variable costing, the cost of goods manufactured includes only variable manufact computation of manufacturing margin. Saxon, Inc. Variable Costing Income Statement For the Year Ended December 31 $1,360,000 $560,000 (84,000) Sales Variable cost of goods sold: Variable cost of goods manufactured Ending inventory Total variable cost of goods sold Manufacturing margin Variable selling and administrative expenses (476,000) $884,000 (221,000) sales $1,360,000 Variable cost of goods sold: Variable cost of goods manufactured $560,000 Ending inventory (84,000) Total variable cost of goods sold (476,000) Manufacturing margin $884,000 Variable selling and administrative expenses (221,000) Contribution margin $663,000 Fixed costs: Fixed manufacturing costs $240,000 Fixed selling and administrative expenses 65,000 Total fixed costs (305,000) Operating income $358,000 Method Comparison Review the income statements on the Absorption Statement and Variable Statement, then complete the following table. The company's sales price per unit is $80, and the number of units in ending inventory is 3,000. There was no beginning inventory Item Amount Number of units sold 17,000 Variable sales and administrative cost per unit 13 Number of units manufactured 20,000 Variable cost of goods manufactured per unit 28 Fixed manufacturing cost per unit 12