Review Examples 50 and 52 in the text. In both examples, the taxpayers AGI is $129,400 even

Question:

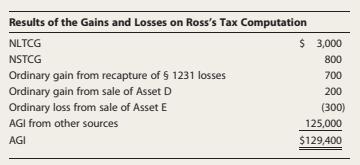

Review Examples 50 and 52 in the text. In both examples, the taxpayer’s AGI is $129,400 even though in Example 52 there is $700 of nonrecaptured § 1231 loss from 2015. Explain why the two AGI amounts are the same.

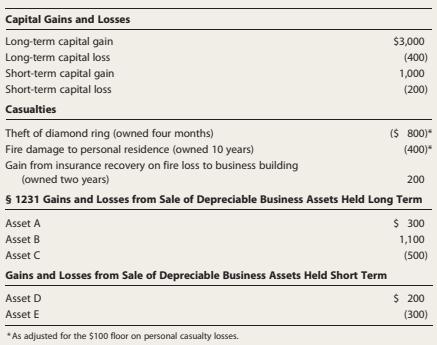

Example 50:

During 2016, Ross had $125,000 of AGI before considering the following recognized gains and losses:

Ross had no net § 1231 losses in tax years before 2016.

Example 52:

Assume the same facts as in Example 50, except that Ross has a $700 nonrecaptured net § 1231 loss from 2015.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted: