Chaz Corporation has taxable income in 2022 of $312,000 for purposes of computing the 179 expense and

Question:

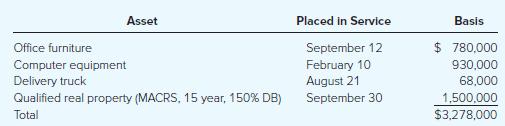

Chaz Corporation has taxable income in 2022 of $312,000 for purposes of computing the §179 expense and acquired the following assets during the year:

What is the maximum total depreciation deduction that Chaz may deduct in 2022?

Transcribed Image Text:

Asset Office furniture Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Total Placed in Service September 12 February 10 August 21 September 30 Basis $ 780,000 930,000 68,000 1,500,000 $3,278,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

The maximum amount of depreciation expense that can be dedu...View the full answer

Answered By

BillClinton Muguai

I have been a tutor for the past 5 years. I have experience working with students in a variety of subject areas, including computer science, math, science, English, and history. I have also worked with students of all ages, from elementary school to college. In addition to my tutoring experience, I have a degree in education from a top university. This has given me a strong foundation in child development and learning theories, which I use to inform my tutoring practices.

I am patient and adaptable, and I work to create a positive and supportive learning environment for my students. I believe that all students have the ability to succeed, and it is my job to help them find and develop their strengths. I am confident in my ability to tutor students and help them achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Question Posted:

Students also viewed these Business questions

-

Chaz Corporation has taxable income in 2015 of $312,000 before the §179 expense and acquired the following assets during the year: What is the maximum total depreciation expense that Chaz may...

-

Chaz Corporation has taxable income in 2014of $312,000 before the 179 expense and acquired the following assets during the year: Asset ............................ Placed in Service ......... Basis...

-

Chaz Corporation has taxable income in 2017 of $312,000 for purposes of computing the 179 expense and acquired the following assets during the year: What is the maximum total depreciation expense...

-

1. Conduct a SWOT analysis for HHI's proposed electronic commerce Web site. You can use the information in the case narrative, your personal knowledge of the retail hardware industry, and information...

-

The number of nonconformities found on final inspection of a tape deck is shown in Table 7E.14. Can you conclude that the process is in statistical control? What center line and control limits would...

-

Identify the graph(s) of any lines with slope zero. Problem refer to graphs (A)(D). -5 (A) (B) -5 -5 (C) (D)

-

(Horizontal and Vertical Analysis) Presented below are comparative balance sheets for the Eola Yevette Company. Instructions (a) Prepare a comparative balance sheet of Yevette Company showing the...

-

Listed below are amounts of strontium-90 (in millibecquerels, or mBq, per gram of calcium) in a simple random sample of baby teeth obtained from Pennsylvania residents and New York residents born...

-

The balance sheet and income statement for Vespa Company are presented below. Vespa Company Balance Sheet As at December 31 2018 2017 Assets Current Assets Cash $118,900 $75,500 Accounts Receivable...

-

Three points X1, X2, X3 are selected at random on a line L. What is the prob- ability X2 lies between X1 and X3?

-

Woolard Supplies (a sole proprietorship) has taxable income in 2022 of $240,000 before any depreciation deductions (179, bonus, or MACRS) and placed some office furniture into service during the...

-

Assume that ACW Corporation has 2022 taxable income of $1,500,000 for purposes of computing the 179 expense. The company acquired the following assets during 2022 (assume no bonus depreciation): a)...

-

What congruence theorem is illustrated in Figure 10.54? Figure 10.54

-

The table below shows the population of Mozambique between 1960 and 2010. This data can be modelled using an exponential function of the form P = ab t , where t is the time in years since 1960 and a...

-

Southco is a medium-sized American-owned global manufacturer of access hardware solutions, such as latches and hinges, used for applications in the aircraft, railway, computer and automotive...

-

To what extent do staffing processes at the Dionysos reflect the strategic approach to recruitment and selection encapsulated by the conceptual framework and model depicted in Key Concepts 8.4 and...

-

Im an accounting major, not an operations expert, yelled just-promoted Bob Barthrow, the executive vice president of the Midwest Frequent Flyer Call Center, during a senior-level management meeting....

-

The Hudson Jewelers case study can be found in Appendix C. Chapter 14 Case Question for Discussion: 1.Customer demand (weekly visits) at Hudson Jewelers is highly seasonal, as shown in the worksheet...

-

Verify that the function has the following properties, where t is measured in days and D is the number of hours between sunrise and sunset. a. It has a period of 365 days. b. Its maximum and minimum...

-

Sundial Technologies produces and sells customized network systems in New Brunswick. The company offers a 60-day, all software and labor-and an extra 90-day, parts-only- warranty on all of its...

-

Explain the pay-as-you-go system.

-

For each of the following tax treatments, determine the concept, construct, or doctrine that provides the rationale for the treatment: a. Lester purchases some stock for a total cost of $2,500. On...

-

Postum Partnership purchases a building in 2014 for $250,000. It deducts $5,600 in depreciation on the building in 2014, $6,400 in 2015, $6,400 in 2016, and $3,200 in 2017. It sells the building in...

-

Selected comparative financial statement data for DAS inc. Balance Sheet (En milliers de dollars) 2017 2018 Assets Assets CT - Cash 41.63 47.5 - Accounts Receivable 64.2 72.6 - inventories 969.7...

-

please help!! One chance at turning in!!! 16 rows! I'd highly appreicate it I am unsure what information you need... I provided all Current Attempt in Progress Mike Greenberg opened Grouper Window...

-

Blue Ridge Marketing Inc. manufactures two products, A and B . Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is...

Study smarter with the SolutionInn App