John dies on 3 March 2018 . Between 6 April 2017 and 3 March 2018, he has

Question:

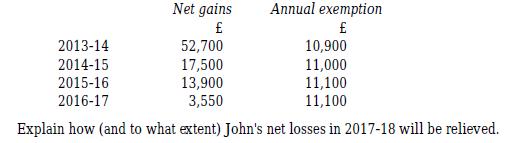

John dies on 3 March 2018 . Between 6 April 2017 and 3 March 2018, he has capital gains of £1,200 and capital losses of £15,400. His net gains in recent tax years (and the annual exemption for each year) have been as follows:

Transcribed Image Text:

2013-14 2014-15 2015-16 2016-17 Net gains Annual exemption 52,700 17,500 13,900 3,550 Explain how (and to what extent) John's net losses in 2017-18 will be relieved. 10,900 11,000 11,100. 11,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

The image provided includes financial information about the net gains and annual exemptions for an individual named John from the tax years 201314 thr...View the full answer

Answered By

Hillary Waliaulah

As a tutor, I am that experienced with over 5 years. With this, I am capable of handling a variety of subjects.

5.00+

17+ Reviews

30+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

John dies on 3 March 2022. Between 6 April 2021 and 3 March 2022, he has capital gains of 1,200 and capital losses of 15,400. His net gains in recent tax years (and the annual exemption for each...

-

Sarah dies on 16 December 2017 , having made net capital losses of 7,300 between 6 April 2017 and the date of her death. Her net gains in the previous three years (and the annual exemption for each...

-

A bakery with a December 31 st year end purchased new equipment on October 31 st 2000 for $10,000. This was their first equipment purchase. Required: What are the tax consequences if the equipment is...

-

Use the following information to answer the questions that follow.... The Big Cheese Company * 2019 2020 Interest Expense 200 1950 Cash 180 30 Property, Plant, and Equipment 16000 39550 Inventories...

-

Assume the number of errors along a magnetic recording surface is a Poisson random variable with a mean of one error every 105 bits. A sector of data consists of 4096 eight-bit bytes. (a) What is the...

-

Typical interview strategies are frank and friendly, problem solving and biographical. L01

-

Using the same row and column headings as the tables above, create a combined table for Congress.

-

Norm purchases a new sports utility vehicle (SUV) on October 12, 2010, for $50,000. The SUV has a gross vehicle weight of 6,200 lbs. It is used 100% of the time for business and it is the only...

-

21. Finding the Dividend [LO1] Secolo Corporation stock currently sells for $68 per share. The market requires a return of 11 percent on the firms stock. If the company maintains a constant 3.75...

-

An individual has capital losses brought forward from previous years amounting to 4,800. Compute the individual's taxable gains for 2017-18 if total gains and losses for the year are as follows:...

-

In 2017-18, an individual has capital gains of 263,000 and allowable losses of 12,000. He has no unrelieved capital losses brought forward from previous ye ars. His taxable income for 2017-18 (after...

-

The following are three decision factors related to the assessed level of control risk: effectiveness of internal controls, cost-effectiveness of a reduced assessed level of control risk, and results...

-

Follows is a list of outstanding invoices at 12/31/09. List is by customer. Company: Winter Invoice: 101 Date: Amount: 4/15 300.00 155 7/1 500.00 162 10/14 600.00 197 12/16 250.00 Bradley 126 6/25...

-

Question 3. The acceleration of a robot as it moves along a straight line in the horizontal x-axis is given by -kt a = e (2 cos wt +3 sin wt), k = 0, w % 0, where k and w are positive constants and...

-

(1 pt) To find the length of the curve defined by from the point (0,0) to the point (1,9), you'd have to compute where a b= and f(x)= y=5x+4x / f(x)dx

-

screen. In Exercises 21 through 32, find the instantaneous rates of change of the given functions at the indicated points. 21. f(x) = 2x + 3, c = 2 22.) f(x) = -3x+4, c = 3 23. f(x) = x - 1, c = 1...

-

Solve . f(x)= cos(x) 2+ sin(x)

-

(a) Identify Singapore Telecommunication Ltd's sources of revenue. (b) Describe the revenue recognition criteria applied by Singapore Telecommunication Ltd in relation to: (i) Phone cards and prepaid...

-

The registrar of a college with a population of N = 4,000 full-time students is asked by the president to conduct a survey to measure satisfaction with the quality of life on campus. The following...

-

Suzanne acquired the following ordinary shares in Quarine plc: She made no further acquisitions and the shares were valued at 3.20 each on 31 March 1982. On 24 July 2020, Suzanne sold 1,200 shares...

-

In June 2019, Walter bought 10,000 shares in Ovod plc at a cost of 7 per share. In September 2020, Rundico plc made a takeover bid for Ovod plc, offering the Ovod shareholders eight Rundico shares...

-

(a) In November 2009, Yorick bought 6,000 ordinary shares in Togon plc for 30,000. In March 2021, the company went into liquidation and Yorick received a first distribution of 1 per share. The market...

-

This short exercise demonstrates the similarity and the difference between two ways to acquire plant assets. (Click the icon to view the cases.) Compare the balances in all the accounts after making...

-

Balance sheet and income statement data for two affiliated companies for the current year appear below: BALANCE SHEET As at December 31, Year 6 Albeniz Bach Cash $ 40,000 $ 21,000 Receivables 92,000...

-

please reference excel cells Caroll Manufacturing company manufactures a single product. During the past three weeks, Caroll's cost accountant observed that output costs varied considerably. The...

Study smarter with the SolutionInn App