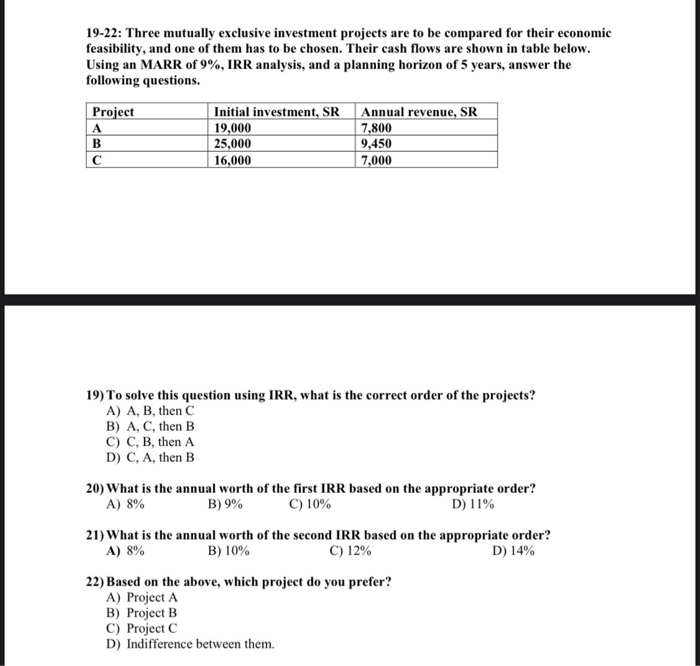

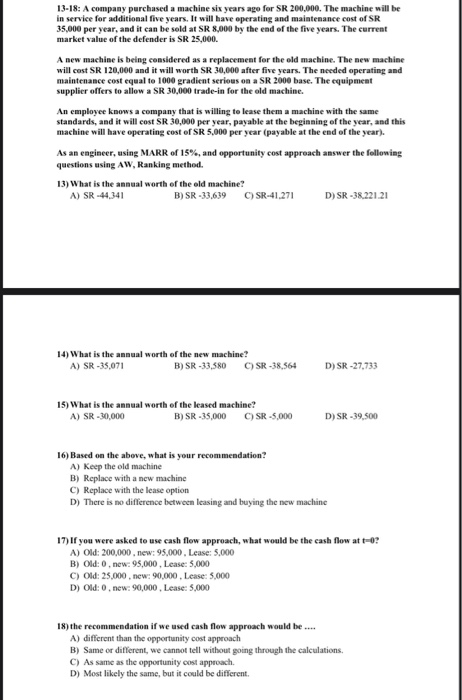

19-22: Three mutually exclusive investment projects are to be compared for their economic feasibility, and one of them has to be chosen. Their cash flows are shown in table below. Using an MARR of 9%, IRR analysis, and a planning horizon of 5 years, answer the following questions. Project A B Initial investment, SR 19,000 25,000 16,000 Annual revenue, SR 7,800 9,450 7,000 19) To solve this question using IRR, what is the correct order of the projects? A) A, B, then B) A, C, then B C) C, B, then A D) C, A, then B 20) What is the annual worth of the first IRR based on the appropriate order? A) 8% B) 9% C) 10% D) 11% 21) What is the annual worth of the second IRR based on the appropriate order? A) 8% B) 10% C) 12% D) 14% 22) Based on the above, which project do you prefer? A) Project A B) Project B C) Project C D) Indifference between them. 13-18: A company purchased a machine six years ago for SR 200.000. The machine will be in service for additional five years. It will have operating and maintenance cost of SR 35,000 per year, and it can be sold at SR 8,000 by the end of the five years. The current market value of the defender is SR 25,000. A new machine is being considered as a replacement for the old machine. The new machine will cost SR 120,000 and it will worth SR 30,000 after five years. The needed operating and maintenance cost equal to 1000 gradient serious on a SR 2000 base. The equipment supplier offers to allow a SR 30,000 trade-in for the old machine. An employee knows a company that is willing to lease them a machine with the same standards, and it will cost SR 30,000 per year, payable at the beginning of the year, and this machine will have operating cost of SR 5,000 per year (payable at the end of the year). As an engineer, using MARR of 15%, and opportunity cost approach answer the following questions using AW, Ranking method 13) What is the annual worth of the old machine? A) SR-44.341 B) SR-33.639 CSR-41.271 D) SR-38.221.21 14) What is the annual worth of the new machine? A) SR-35,071 B) SR-33,580 C) SR-38.564 D) SR-27.733 15) What is the annual worth of the leased machine A) SR-30,000 B) SR-35,000 C) SR-5,000 D) SR-39,500 16) Based on the above, what is your recommendation? A) Keep the old machine B) Replace with a new machine C) Replace with the lease option D) There is no difference between leasing and buying the new machine 17) If you were asked to use cash flow approach, what would be the cash flow at t-02 A) Old: 200,000, new: 95,000. Lease: 5.000 B) Old: 0, new: 95,000, Lease: 5,000 C) Old: 25.000, new: 90,000. Lease: 5,000 D) Old: 0, new: 90,000, Lease: 5,000 18) the recommendation if we used cash flow approach would be .... A) different than the opportunity cost approach B) Same or different, we cannot tell without going through the calculations C) Assame as the opportunity cost approach. D) Most likely the same, but it could be different