Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The efficient market hypothesis suggests that one investment is as good as any other because securities' prices are correct. This means that investors should

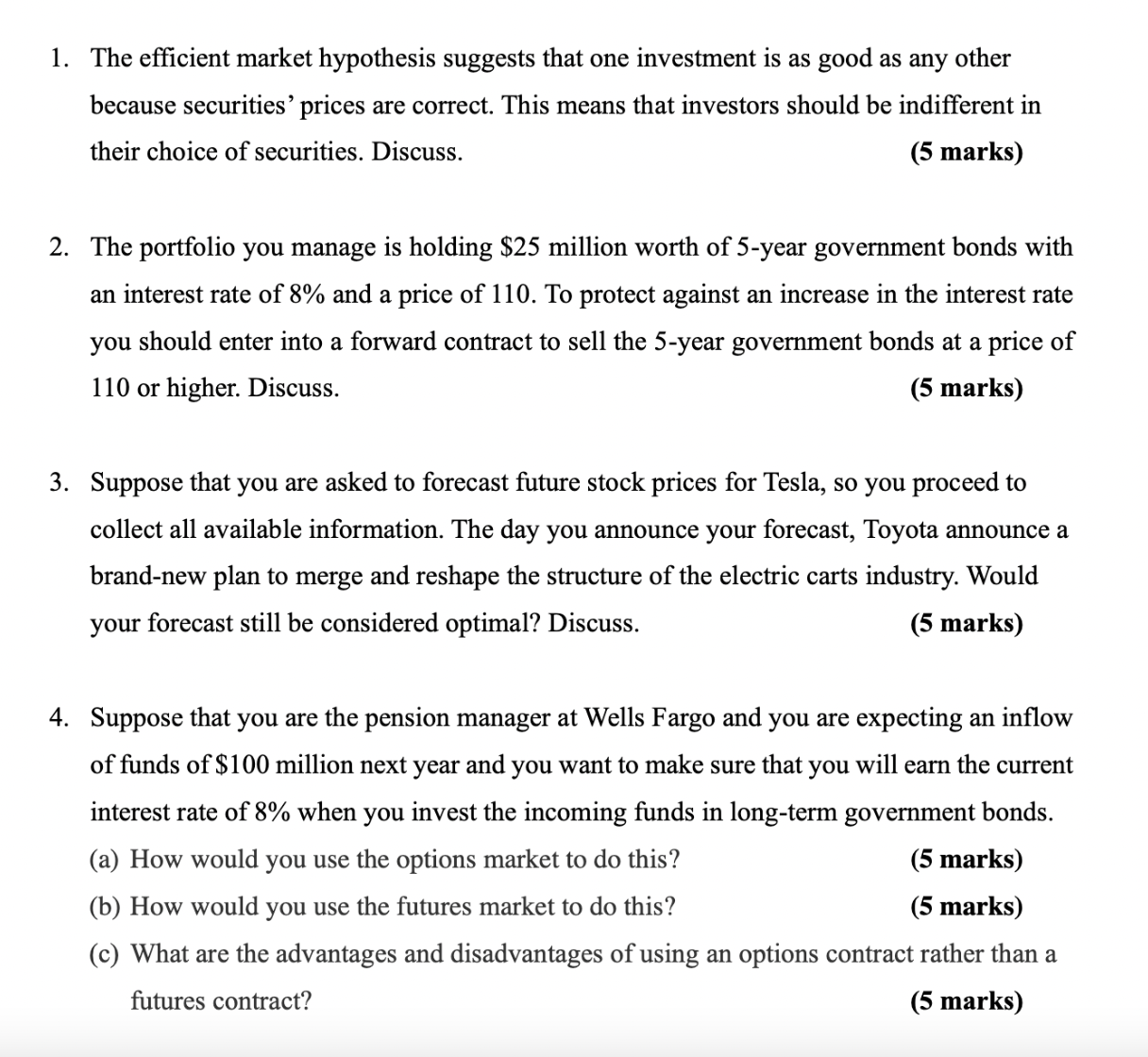

1. The efficient market hypothesis suggests that one investment is as good as any other because securities' prices are correct. This means that investors should be indifferent in their choice of securities. Discuss. (5 marks) 2. The portfolio you manage is holding $25 million worth of 5-year government bonds with an interest rate of 8% and a price of 110 . To protect against an increase in the interest rate you should enter into a forward contract to sell the 5 -year government bonds at a price of 110 or higher. Discuss. (5 marks) 3. Suppose that you are asked to forecast future stock prices for Tesla, so you proceed to collect all available information. The day you announce your forecast, Toyota announce a brand-new plan to merge and reshape the structure of the electric carts industry. Would your forecast still be considered optimal? Discuss. (5 marks) 4. Suppose that you are the pension manager at Wells Fargo and you are expecting an inflow of funds of $100 million next year and you want to make sure that you will earn the current interest rate of 8% when you invest the incoming funds in long-term government bonds. (a) How would you use the options market to do this? (5 marks) (b) How would you use the futures market to do this? (5 marks) (c) What are the advantages and disadvantages of using an options contract rather than a futures contract

1. The efficient market hypothesis suggests that one investment is as good as any other because securities' prices are correct. This means that investors should be indifferent in their choice of securities. Discuss. (5 marks) 2. The portfolio you manage is holding $25 million worth of 5-year government bonds with an interest rate of 8% and a price of 110 . To protect against an increase in the interest rate you should enter into a forward contract to sell the 5 -year government bonds at a price of 110 or higher. Discuss. (5 marks) 3. Suppose that you are asked to forecast future stock prices for Tesla, so you proceed to collect all available information. The day you announce your forecast, Toyota announce a brand-new plan to merge and reshape the structure of the electric carts industry. Would your forecast still be considered optimal? Discuss. (5 marks) 4. Suppose that you are the pension manager at Wells Fargo and you are expecting an inflow of funds of $100 million next year and you want to make sure that you will earn the current interest rate of 8% when you invest the incoming funds in long-term government bonds. (a) How would you use the options market to do this? (5 marks) (b) How would you use the futures market to do this? (5 marks) (c) What are the advantages and disadvantages of using an options contract rather than a futures contract Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started