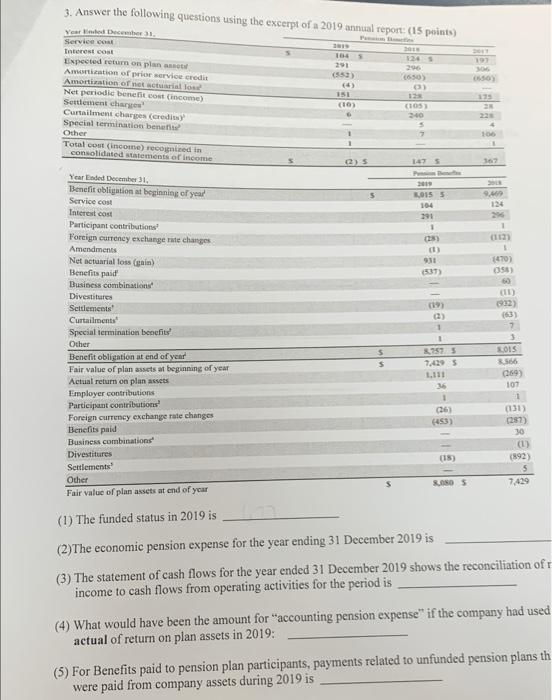

197 3. Answer the following questions using the excerpt of a 2019 annual report: (15 points) Year Wall December Service Interest 104 126 Expected return on plane 20 Amortization of prior service credit (550) Amortization of action (4) 151 Net periodic benefit cost income) Settlement charge (10) (105) 3,00 Curtaiment charges (credits 3 Special termination ben 7 Other Total cost (income) ed in consolidated statements of income 050) 175 100 (2) 5 16 5 2009 0155 104 191 1 . 134 1 (112 1 4470 055) 60 (11 902) 063) 7 Year Ended December 31 Benefit obligation at beginning of your Service cost Interest cost Participant contributions Foreign currency exchange rate changes Amendments Net actuarial loss (gain) Benefits paid Business combinations Divestitures Settlements Curtailments Special termination benefits! Other Benefit obligation at end of year Fair value of plan assets at beginning of year Actual return on plan assets Employer contributions Participant contributions Foreign currency exchange rate changes Benefits paid Business combinations Divestitures Settlements Other Fair value of plan assets at end of year 1 1 7575 7.4295 $ 1 (26) 4453) SOLS 566 069) 107 1 (131) (257) 30 ( (892) SUOSOS 7.429 (1) The funded status in 2019 is (2)The economic pension expense for the year ending 31 December 2019 is (3) The statement of cash flows for the year ended 31 December 2019 shows the reconciliation of income to cash flows from operating activities for the period is (4) What would have been the amount for "accounting pension expense" if the company had used actual of return on plan assets in 2019: (5) For Benefits paid to pension plan participants, payments related to unfunded pension plans th were paid from company assets during 2019 is 197 3. Answer the following questions using the excerpt of a 2019 annual report: (15 points) Year Wall December Service Interest 104 126 Expected return on plane 20 Amortization of prior service credit (550) Amortization of action (4) 151 Net periodic benefit cost income) Settlement charge (10) (105) 3,00 Curtaiment charges (credits 3 Special termination ben 7 Other Total cost (income) ed in consolidated statements of income 050) 175 100 (2) 5 16 5 2009 0155 104 191 1 . 134 1 (112 1 4470 055) 60 (11 902) 063) 7 Year Ended December 31 Benefit obligation at beginning of your Service cost Interest cost Participant contributions Foreign currency exchange rate changes Amendments Net actuarial loss (gain) Benefits paid Business combinations Divestitures Settlements Curtailments Special termination benefits! Other Benefit obligation at end of year Fair value of plan assets at beginning of year Actual return on plan assets Employer contributions Participant contributions Foreign currency exchange rate changes Benefits paid Business combinations Divestitures Settlements Other Fair value of plan assets at end of year 1 1 7575 7.4295 $ 1 (26) 4453) SOLS 566 069) 107 1 (131) (257) 30 ( (892) SUOSOS 7.429 (1) The funded status in 2019 is (2)The economic pension expense for the year ending 31 December 2019 is (3) The statement of cash flows for the year ended 31 December 2019 shows the reconciliation of income to cash flows from operating activities for the period is (4) What would have been the amount for "accounting pension expense" if the company had used actual of return on plan assets in 2019: (5) For Benefits paid to pension plan participants, payments related to unfunded pension plans th were paid from company assets during 2019 is