Question

a. Which method did the company use in arriving at net cash flows from operating activities? b. Did current assets other than cash increase or

a.

a.

Which method did the company use in arriving at net cash flows from operating activities?

b.

Did current assets other than cash increase or decrease during the year ended February 29, 2012?

c.

Did current liabilities increase or decrease during that year ended February 29, 2012?

d.

What were the main investing activities during this three-

year period?

e.

What was the main source of cash from financing activities during the three-

year period?

f.

Did the company pay any interest expense during the year ended February 19, 2012?

g.

Given the following data, calculate the cash flow per share of common stock ratio, the cash flow margin ratio, and the

cash flow liquidity ratio. How do these ratios compare with the ratios show

n for other companies in the chapter?

a. Cash flow per share of common stock ratio: ____________________________________

b. Cash flow margin ratio: ____________________________________

c. Cash flow liquidity ratio:

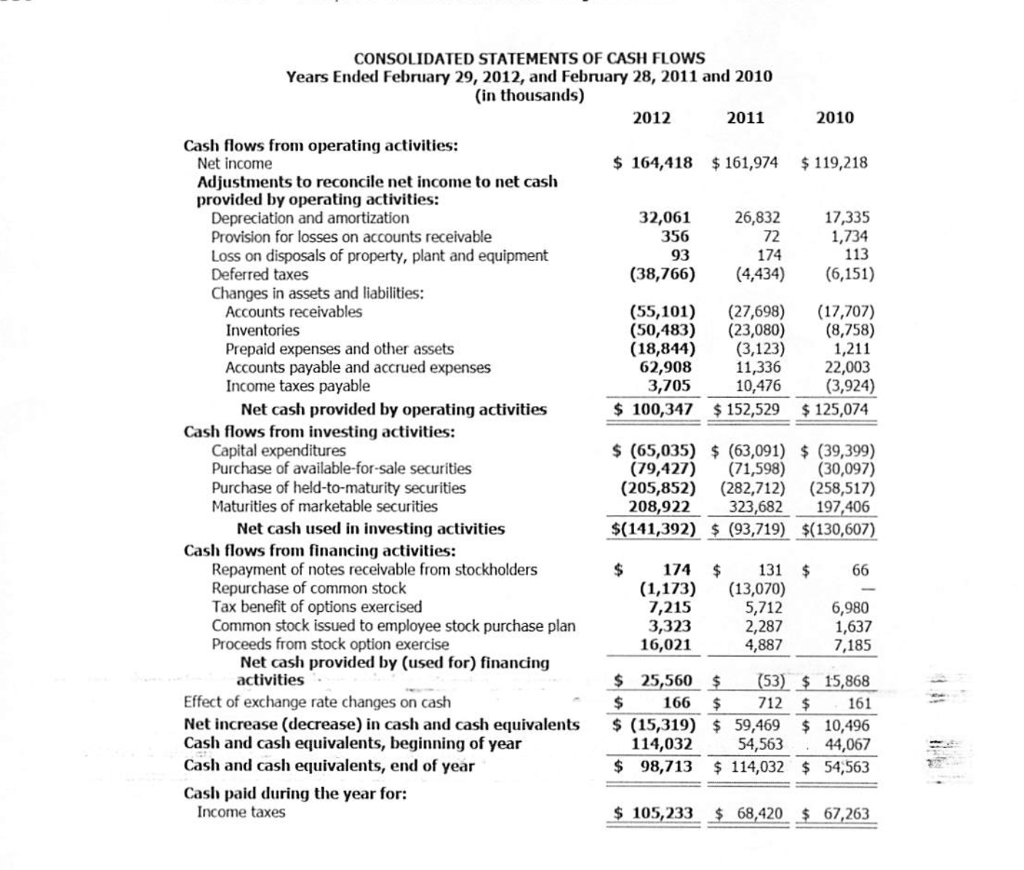

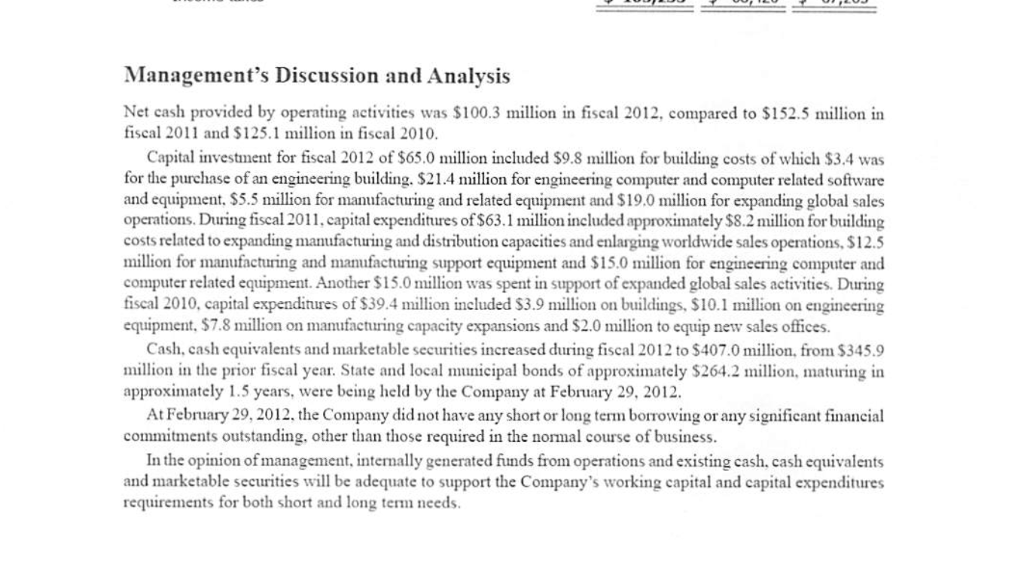

CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended February 29, 2012, and February 28, 2011 and 2010 (in thousands) 2012 2011 2010 Cash flows from operating activities: 164,418 $161,974 $119,218 Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Provision for losses on accounts receivable Loss on disposals of property, plant and equipment Deferred taxes Changes in assets and liabilities: 32,061 26,832 17,335 1,734 113 (38,766) (4,434)6,151) 356 93 72 174 Accounts receivables Inventories Prepaid expenses and other assets Accounts payable and accrued expenses Income taxes payable (55,101) (27,698) 17,707) (50,483) (23,080) (8,758) (18,844) (3,123) 1,211 22,003 10,476(3,924) 62,90811,336 Net cash provided by operating activities $100,347 152,529 $ 125,074 Cash flows from investing activities: Capital expenditures Purchase of available-for-sale securities (65,035) (63,091) (39,399) (79,427) (71,598) (30,097) (205,852) (282,712) (258,517) 208,922323,682197,406 $(141,392) (93,719) $(130,607) Purchase of held-to-maturity securities Maturities of marketable securities Net cash used in investing activities Cash flows from financing activities: Repayment of notes receivable from stockholders Repurchase of common stock Tax benefit of options exercised Common stock issued to employee stock purchase plan Proceeds from stock option exercise $174 131$66 (1,173)(13,070) 5,712 2,287 4,887 7,215 3,323 16,021 6,980 1,637 7,185 Net cash provided by (used for) financing activities 25,560 (53) 15,868 $166 712 $161 Net increase (decrease) in cash and cash equivalents (15,319) 59,469 10,496 44,067 $ 98,713 $114,032 $ 54,563 Effect of exchange rate changes on cash Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Cash paid during the year for: 114,032 54,563 105,233$ 68420 5 67263 Income taxes 67,263Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started