Question

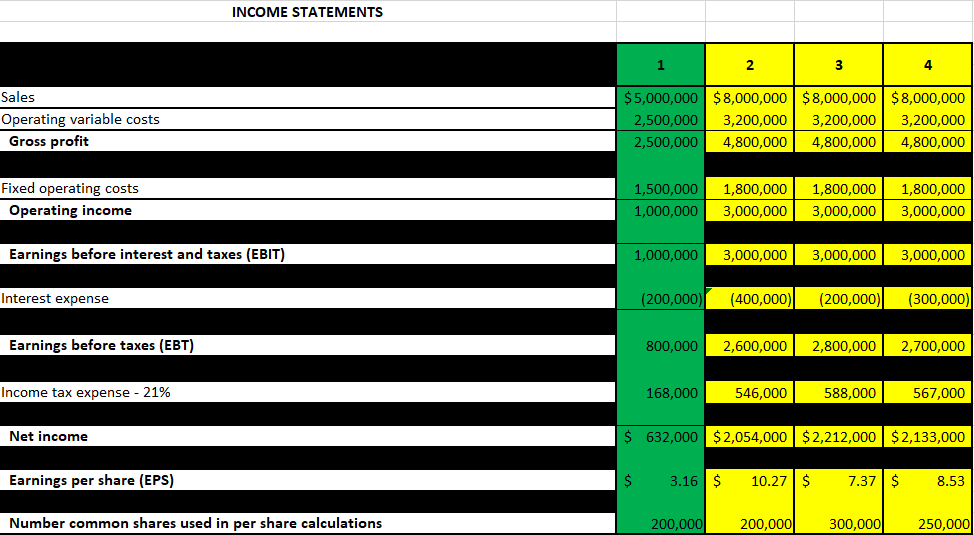

Actual (1 ) XYZ CORP sales are $5,000,000 (1 million units at $5 each). Its operating variable costs are 50% of its sales level and

Actual (1 ) XYZ CORP sales are $5,000,000 (1 million units at $5 each). Its operating variable costs are 50% of its sales level and its fixed operating costs are $1,500,000. Additionally, it has annual interest charges of 10% from a total Debt of $2,000,000. The firm also has 200,000 shares of common stock outstanding and is subject to a 21% tax rate. The firm is currently financed with 50% debt and 50% equity (common stock at par value of $10)

Now, XYZ corp is considering an expansion of its facilities. To do so, they need $2,000,000 in additional financing. The firm has 3 plans to consider:

Plan 2: Sell $2million of new debt at 10% interest. It is expected that variable operating costs will decrease to 40% of its sales, and fixed operating costs will increase to $1.8 million.

Plan 3: Sell $2million of new common stock at $20 per share. It is expected that variable operating costs will decrease to 40% of its sales, and fixed operating costs will increase to $1.8 million.

Plan 4: Sell $1 million of new debt at a 10% interest and $1 million of new common stock at $20 per share. Variable operating costs will decrease to 40% of itssales, and fixed operating costs will increase to $1.8 million.

****Using the data provided in this Income Statement, which will be the break-even point in units of Part 1,2,3, and 4. Explain.*****

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started