answer by searching up TESLA FORM 10-q 9/30/19

The 10-q is a pdf by tesla. search it up.

Answer A,B, and C

answer C using this.

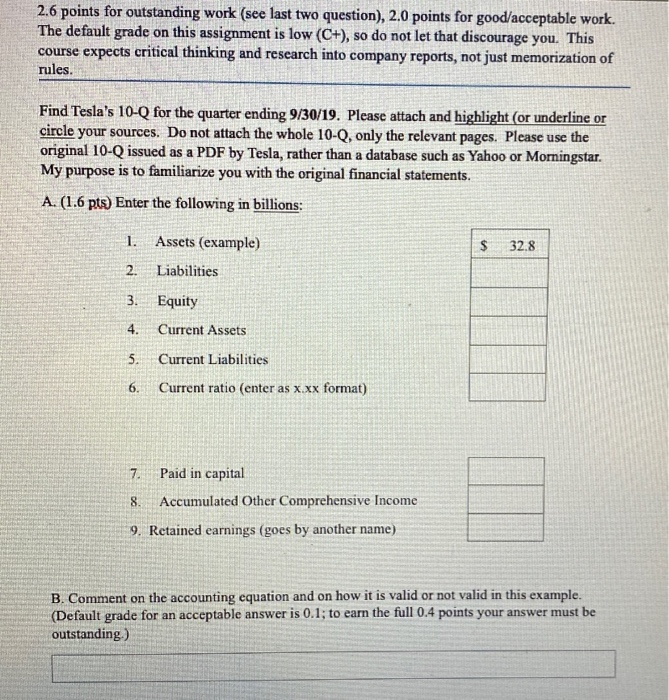

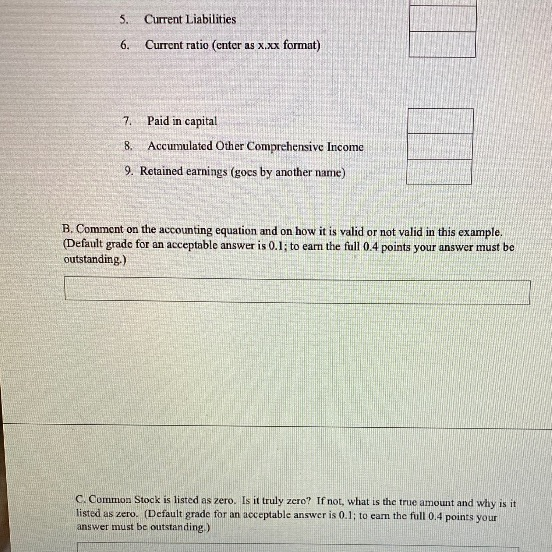

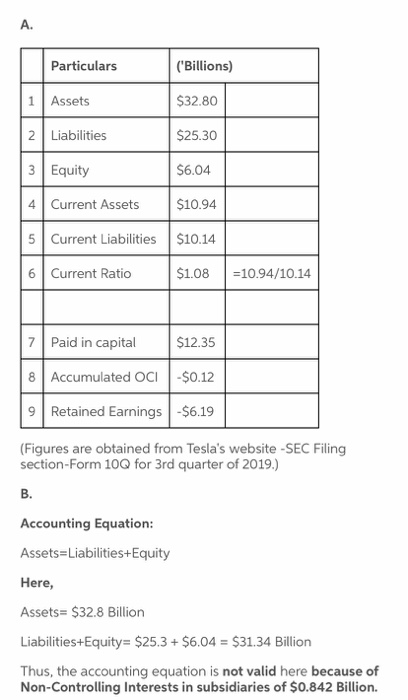

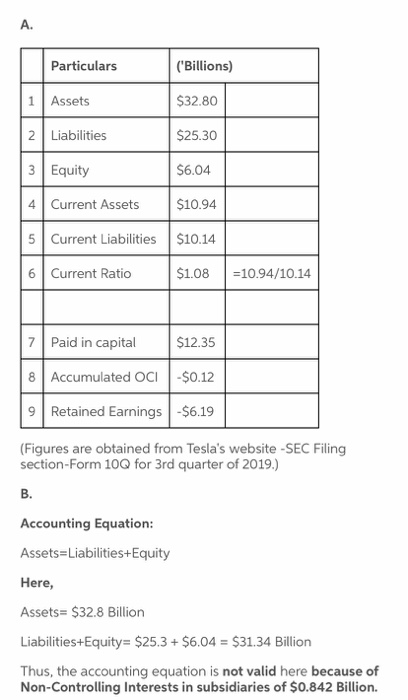

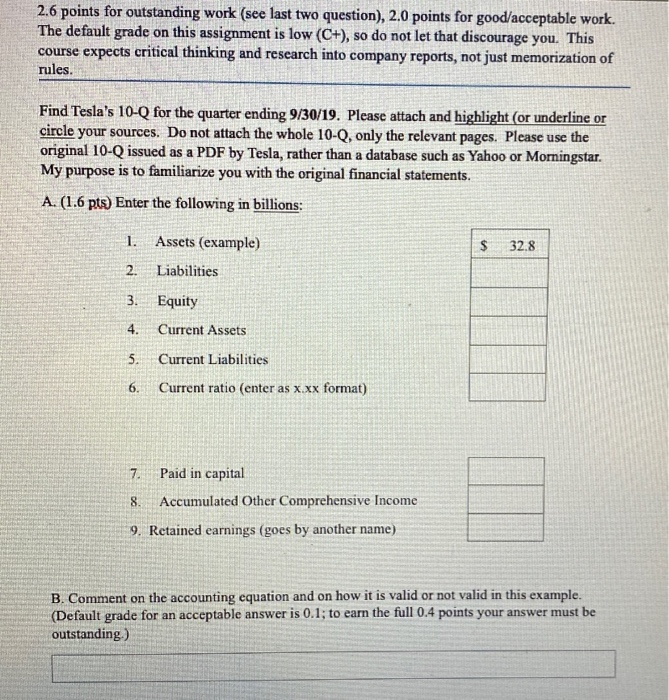

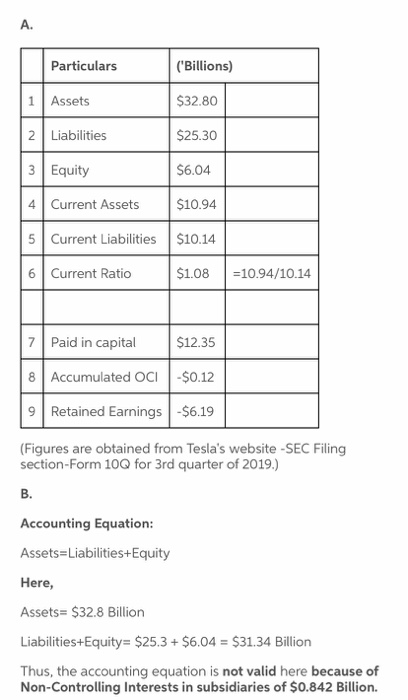

2.6 points for outstanding work (see last two question), 2.0 points for good/acceptable work. The default grade on this assignment is low (C+), so do not let that discourage you. This course expects critical thinking and research into company reports, not just memorization of rules. Find Tesla's 10-Q for the quarter ending 9/30/19. Please attach and highlight (or underline or circle your sources. Do not attach the whole 10-Q, only the relevant pages. Please use the original 10-Q issued as a PDF by Tesla, rather than a database such as Yahoo or Morningstar. My purpose is to familiarize you with the original financial statements. A. (1.6 pts) Enter the following in billions: 32.8 1. 2. 3. 4. Assets (example) Liabilities Equity Current Assets Current Liabilities Current ratio (enter as x.xx format) 5. 6. 7. Paid in capital 8. Accumulated Other Comprehensive Income 9. Retained earnings (goes by another name) B. Comment on the accounting equation and on how it is valid or not valid in this example, (Default grade for an acceptable answer is 0.1; to earn the full 0.4 points your answer must be outstanding.) 5. Current Liabilities 6. Current ratio (enter as xxx format) 7. Paid in capital 8. Accumulated Other Comprehensive Income 9. Retained earnings (gocs by another name) B. Comment on the accounting equation and on how it is valid or not valid in this example. (Default grade for an acceptable answer is 0.1; to earn the full 0.4 points your answer must be outstanding.) C. Common Stock is listed as zero. Is it truly zero? If not, what is the true amount and why is it listed as zero. (Default grade for an acceptable answer is 0.1. to earn the full 0.4 points your answer must be outstanding) Particulars ('Billions) Assets $32.80 2 Liabilities $25.30 3 Equity $6.04 4 Current Assets $10.94 5 Current Liabilities $10.14 6 Current Ratio $1.08 =10.94/10.14 Paid in capital $12.35 8 Accumulated OCI -$0.12 9 Retained Earnings $6.19 (Figures are obtained from Tesla's website -SEC Filing section-Form 100 for 3rd quarter of 2019.) Accounting Equation: Assets=Liabilities+Equity Here, Assets= $32.8 Billion Liabilities+Equity= $25.3 + $6.04 = $31.34 Billion Thus, the accounting equation is not valid here because of Non-Controlling Interests in subsidiaries of $0.842 Billion