Question

Ben is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very

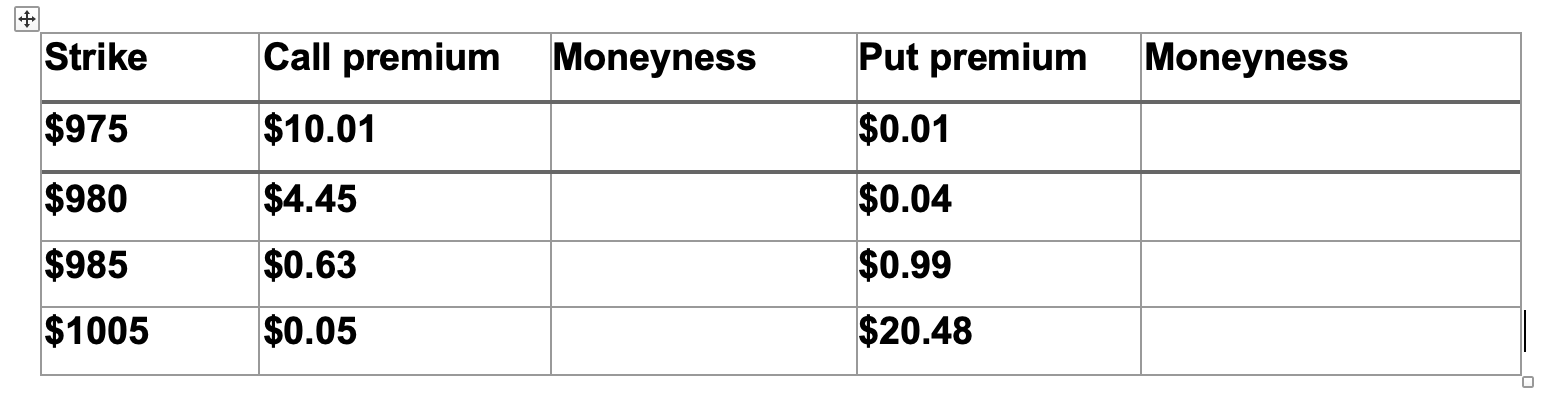

Ben is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Ben wishes to protect the value of his investments. He seeks your advice on using option contracts and presents a list of options for you to choose from. Assume the number of underlying shares per contract is 100 shares. Give reasons why.

(i) Please specify the moneyness of the above options. Are they in the money, at the money or out of the money?

(ii) Identify what kind of risk that Jaleel is facing and to hedge this risk, which option would you suggest that Jaleel should purchase? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started