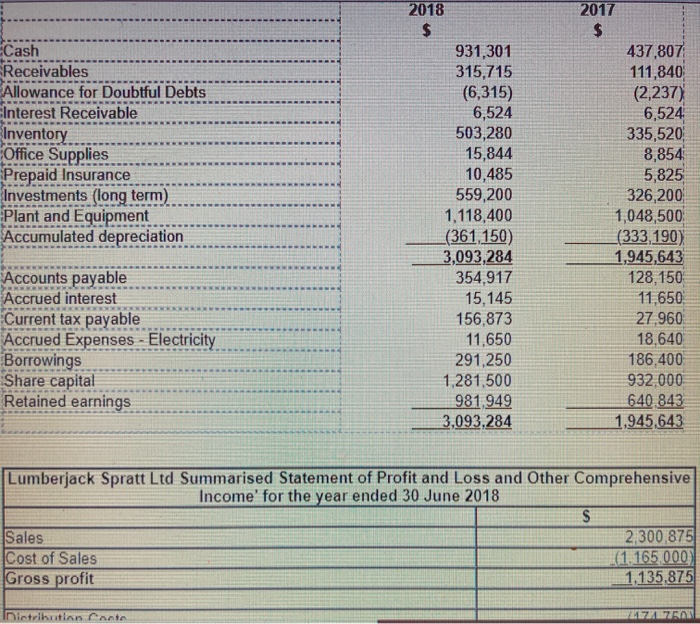

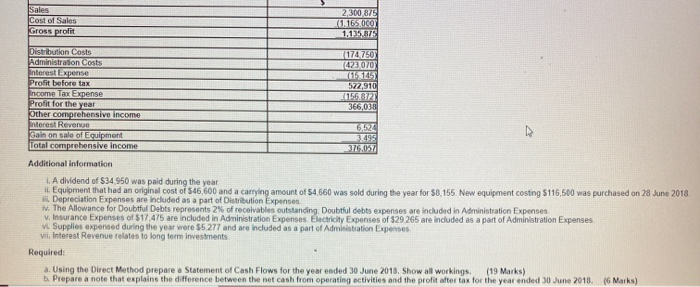

Cash Receivables Allowance for Doubtful Debts Interest Receivable Inventory Office Supplies Prepaid Insurance Investments (long term). Plant and Equipment Accumulated depreciation 2018 $ 931,301 315,715 (6,315) 6,524 503,280 15,844 10,485 559,200 1,118,400 (361,150) 3,093,284 354,917 15,145 156,873 11,650 291,250 1,281,500 981.949 3,093,284 2017 $ 437,807 111,840 (2,237) 6,524 335,520 8,854 5,825 326,200 1,048,500 (333,190) 1,945,643 128,150 11,650 27,960 18,640 186,400 932.000 640 843 1,945,643 Accounts payable Accrued interest Current tax payable Accrued Expenses - Electricity Borrowings Share capital Retained earnings Lumberjack Spratt Ltd Summarised Statement of Profit and Loss and Other Comprehensive Income' for the year ended 30 June 2018 $ Sales 2,300,875 Cost of Sales (1 165,000) Gross profit 1,135,875 Inictribution Conte 7.750 Sales Cost of Sales Gross profit 2,300 875 (1.165.000 1,135,87 (174 750 (423070 (11 125 572,910 Distribution Costs Administration Costs Interest Expense Profit before tax ncome Tax Expense Profit for the year Other comprehensive Income Interest Revenge Sain on sale of Equipment Total comprehensive income 366,038 6,527 3.499 376,057 Additional information I. A dividend of 534 950 was paid during the year ll. Equipment that had an original cost of $46,600 and a carrying amount of 54 560 was sold during the year for $8,155. New equipment costing 5116,500 was purchased on 28 June 2018 Depreciation Expenses are included as a part of Distribution Expenses i The Allowance for Doubtful Debts represents 2% of receivables outstanding Doubtful debts expenses are included in Administration Expenses v. Insurance Expenses of 17.475 are included in Administration Expenses Electricity Expenses of $29.265 are included as a part of Administration Expenses v Supplies exposed during the year were $5 277 and are included as a part of Administration Expenses vii. Interest Revenue relates to long term investments Required: 3. Using the Direct Method prepare a statement of Cash Flows for the year ended 30 June 2018. Show all workings. (19 Marks) b. Prepare a note that explains the difference between the net cash from operating activities and the profit after tax for the year ended 30 June 2018. (6 Marks) Cash Receivables Allowance for Doubtful Debts Interest Receivable Inventory Office Supplies Prepaid Insurance Investments (long term). Plant and Equipment Accumulated depreciation 2018 $ 931,301 315,715 (6,315) 6,524 503,280 15,844 10,485 559,200 1,118,400 (361,150) 3,093,284 354,917 15,145 156,873 11,650 291,250 1,281,500 981.949 3,093,284 2017 $ 437,807 111,840 (2,237) 6,524 335,520 8,854 5,825 326,200 1,048,500 (333,190) 1,945,643 128,150 11,650 27,960 18,640 186,400 932.000 640 843 1,945,643 Accounts payable Accrued interest Current tax payable Accrued Expenses - Electricity Borrowings Share capital Retained earnings Lumberjack Spratt Ltd Summarised Statement of Profit and Loss and Other Comprehensive Income' for the year ended 30 June 2018 $ Sales 2,300,875 Cost of Sales (1 165,000) Gross profit 1,135,875 Inictribution Conte 7.750 Sales Cost of Sales Gross profit 2,300 875 (1.165.000 1,135,87 (174 750 (423070 (11 125 572,910 Distribution Costs Administration Costs Interest Expense Profit before tax ncome Tax Expense Profit for the year Other comprehensive Income Interest Revenge Sain on sale of Equipment Total comprehensive income 366,038 6,527 3.499 376,057 Additional information I. A dividend of 534 950 was paid during the year ll. Equipment that had an original cost of $46,600 and a carrying amount of 54 560 was sold during the year for $8,155. New equipment costing 5116,500 was purchased on 28 June 2018 Depreciation Expenses are included as a part of Distribution Expenses i The Allowance for Doubtful Debts represents 2% of receivables outstanding Doubtful debts expenses are included in Administration Expenses v. Insurance Expenses of 17.475 are included in Administration Expenses Electricity Expenses of $29.265 are included as a part of Administration Expenses v Supplies exposed during the year were $5 277 and are included as a part of Administration Expenses vii. Interest Revenue relates to long term investments Required: 3. Using the Direct Method prepare a statement of Cash Flows for the year ended 30 June 2018. Show all workings. (19 Marks) b. Prepare a note that explains the difference between the net cash from operating activities and the profit after tax for the year ended 30 June 2018. (6 Marks)