Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial statements for ypur firm show that at the end of 2020, your firm had the following actual dollar cash flows: Revenues $100,000 Maintenance costs

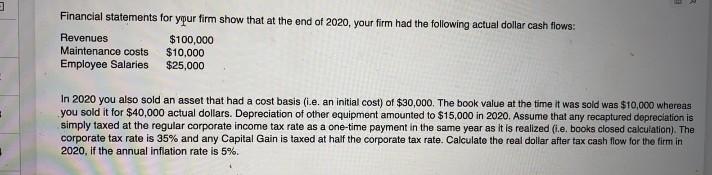

Financial statements for ypur firm show that at the end of 2020, your firm had the following actual dollar cash flows: Revenues $100,000 Maintenance costs $10,000 Employee Salaries $25,000 In 2020 you also sold an asset that had a cost basis (i.e. an initial cost of $30,000. The book value at the time it was sold was $10,000 whereas you sold it for $40,000 actual dollars. Depreciation of other equipment amounted to $15,000 in 2020. Assume that any recaptured depreciation is simply faxed at the regular corporate income tax rate as a one-time payment in the same year as it is realized (.e. books closed calculation). The corporate tax rate is 35% and any Capital Gain is taxed at half the corporate tax rate. Calculate the real dollar after tax cash flow for the firm in 2020. if the annual inflation rate is 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started