Answered step by step

Verified Expert Solution

Question

1 Approved Answer

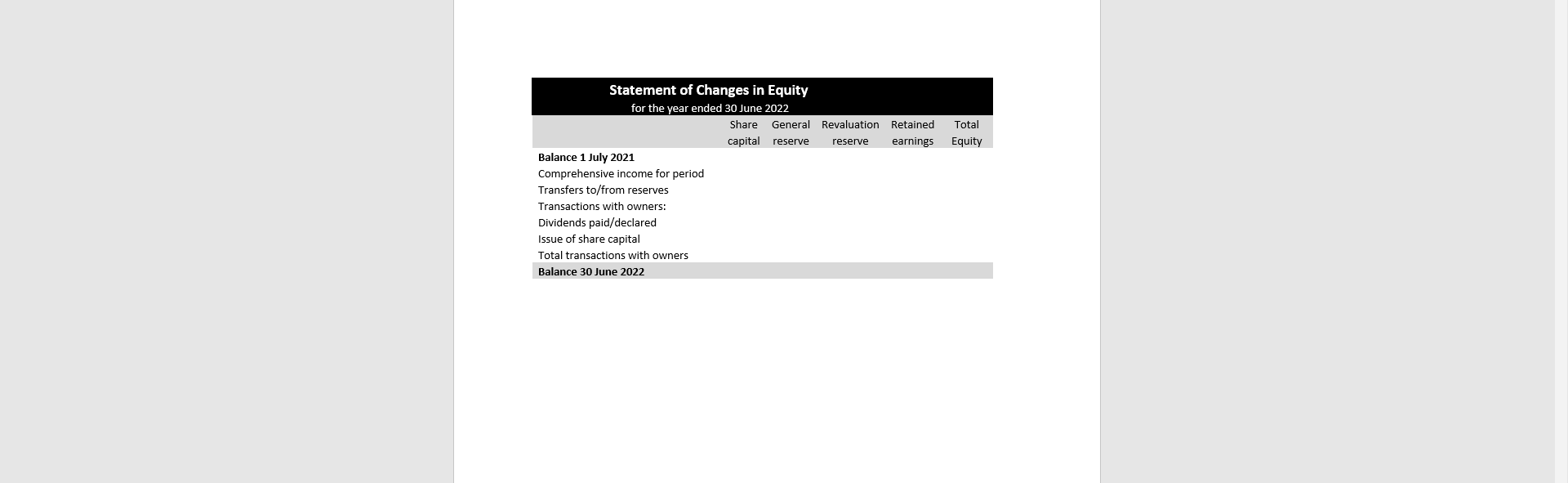

Hi Tutor, could you please help me with this question? I need help with a Statement of Financial Position, Statement of Changes in Equity and

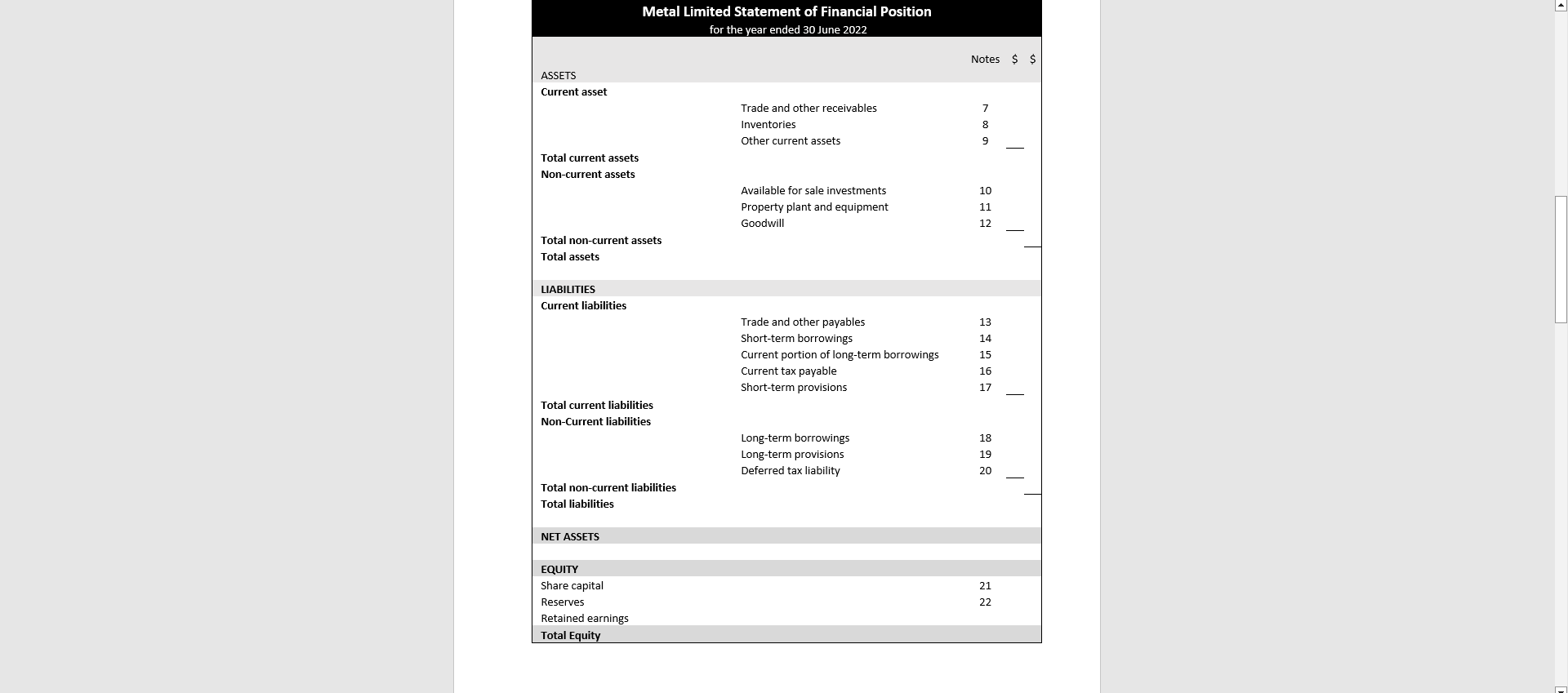

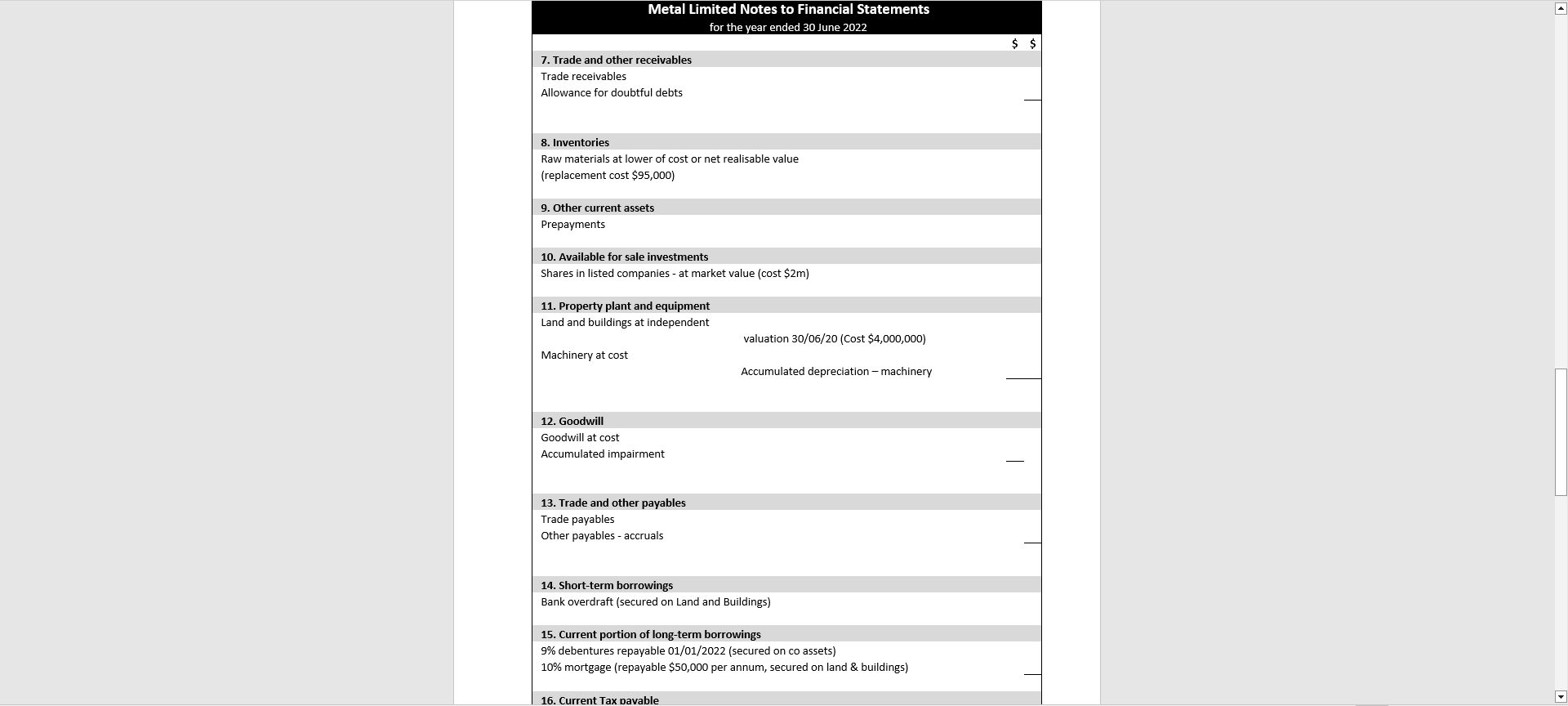

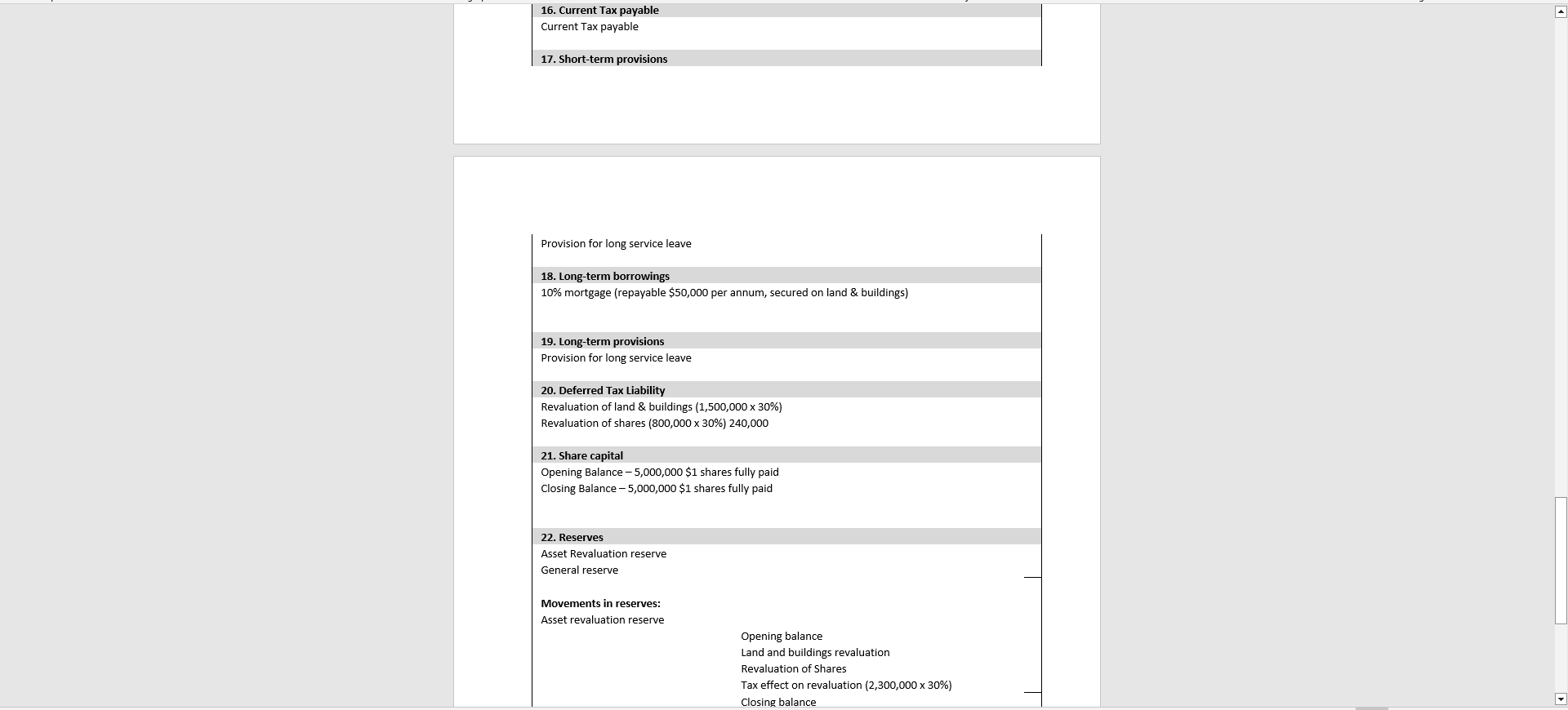

Hi Tutor, could you please help me with this question? I need help with a Statement of Financial Position, Statement of Changes in Equity and Appropriate notes to the financial statements as at 30 June 2022.

Thanks

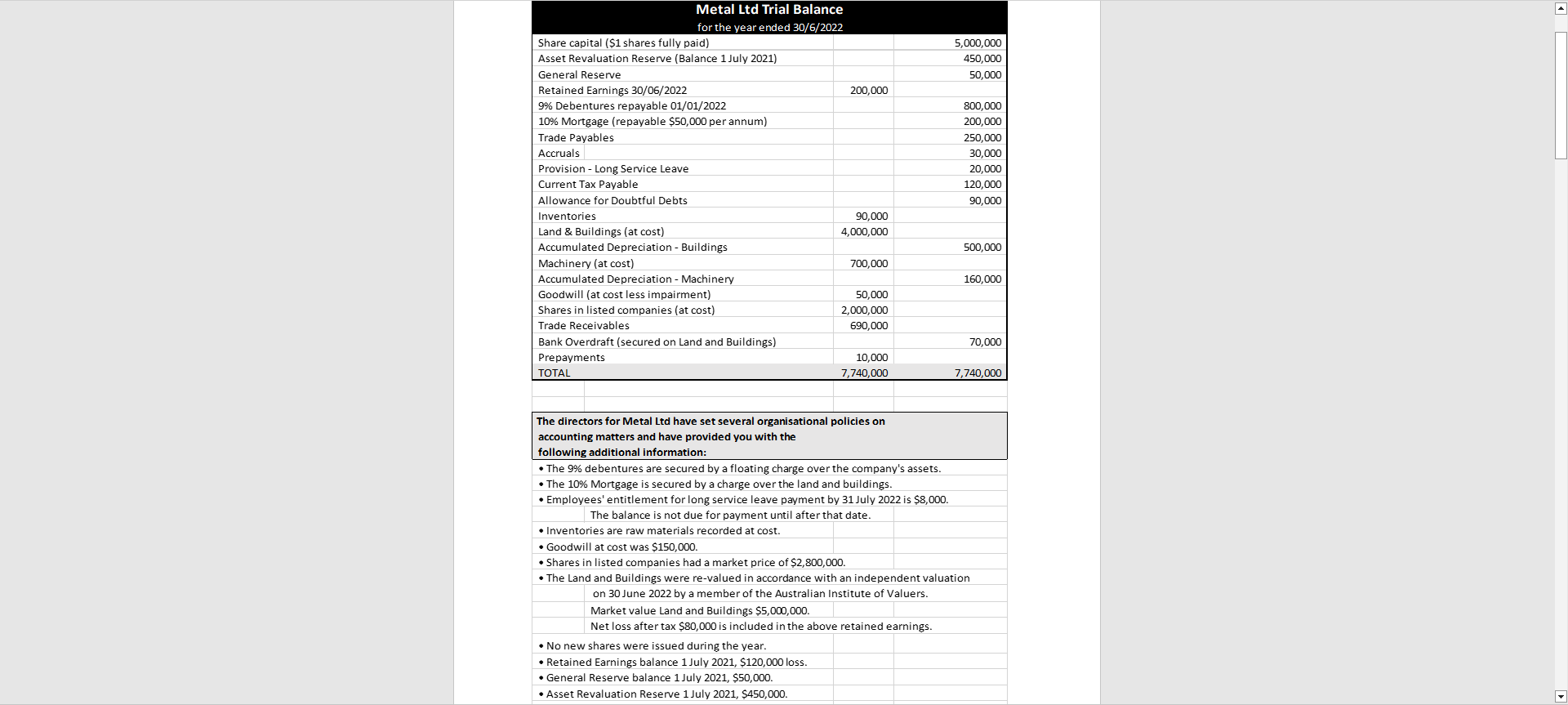

Metal Ltd Trial Balance for the year ended 30/6/2022 Share capital ($1 shares fully paid) 5,000,000 General Reserve Asset Revaluation Reserve (Balance 1 July 2021) Retained Earnings 30/06/2022 9% Debentures repayable 01/01/2022 10% Mortgage (repayable $50,000 per annum) 450,000 50,000 200,000 800,000 200,000 Trade Payables 250,000 Accruals 30,000 Provision - Long Service Leave 20,000 Current Tax Payable 120,000 Allowance for Doubtful Debts 90,000 Inventories 90,000 Land & Buildings (at cost) 4,000,000 Accumulated Depreciation - Buildings 500,000 Machinery (at cost) 700,000 Accumulated Depreciation - Machinery 160,000 Goodwill (at cost less impairment) 50,000 Shares in listed companies (at cost) 2,000,000 Trade Receivables 690,000 Bank Overdraft (secured on Land and Buildings) 70,000 Prepayments 10,000 TOTAL 7,740,000 7,740,000 The directors for Metal Ltd have set several organisational policies on accounting matters and have provided you with the following additional information: The 9% debentures are secured by a floating charge over the company's assets. The 10% Mortgage is secured by a charge over the land and buildings. Employees' entitlement for long service leave payment by 31 July 2022 is $8,000. The balance is not due for payment until after that date. Inventories are raw materials recorded at cost. Goodwill at cost was $150,000. Shares in listed companies had a market price of $2,800,000. The Land and Buildings were re-valued in accordance with an independent valuation on 30 June 2022 by a member of the Australian Institute of Valuers. Market value Land and Buildings $5,000,000. Net loss after tax $80,000 is included in the above retained earnings. No new shares were issued during the year. Retained Earnings balance 1 July 2021, $120,000 loss. General Reserve balance 1 July 2021, $50,000. Asset Revaluation Reserve 1 July 2021, $450,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started