Question

It is April 10th and you transmitted the last tax returns, so it is time to relax and plan the next vacation. Just as you

Required:

1) Your client is petrified of an IRS audit and asks how to handle this. What would you advise them?

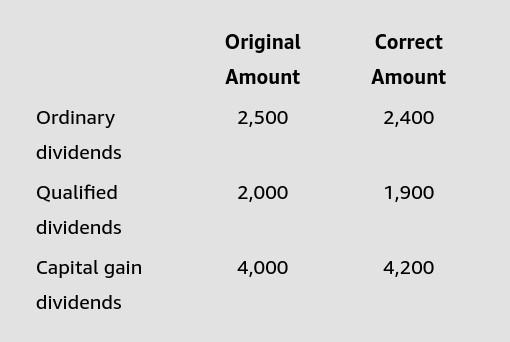

Ordinary dividends Qualified dividends Capital gain dividends Original Amount 2,500 2,000 4,000 Correct Amount 2,400 1,900 4,200

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

I would advise my client to report the proper income amounts on their tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting in Canada

Authors: Hilton Murray, Herauf Darrell

8th edition

1259087557, 1057317623, 978-1259087554

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App