Answered step by step

Verified Expert Solution

Question

1 Approved Answer

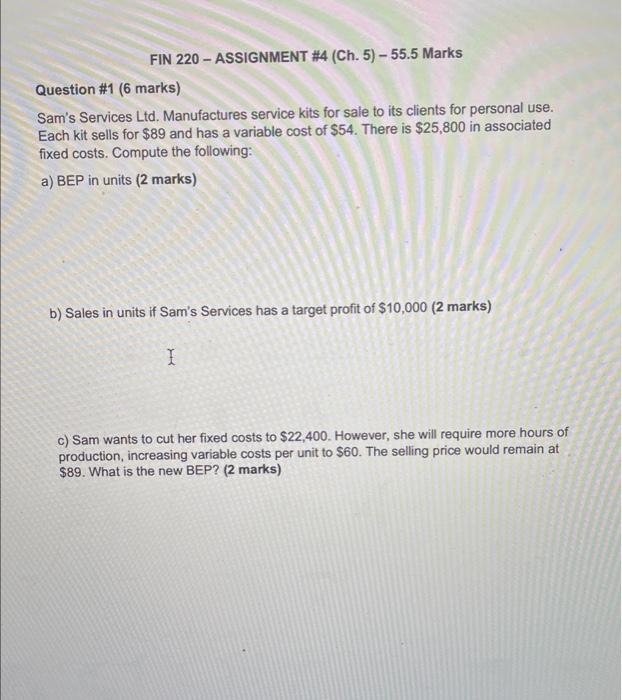

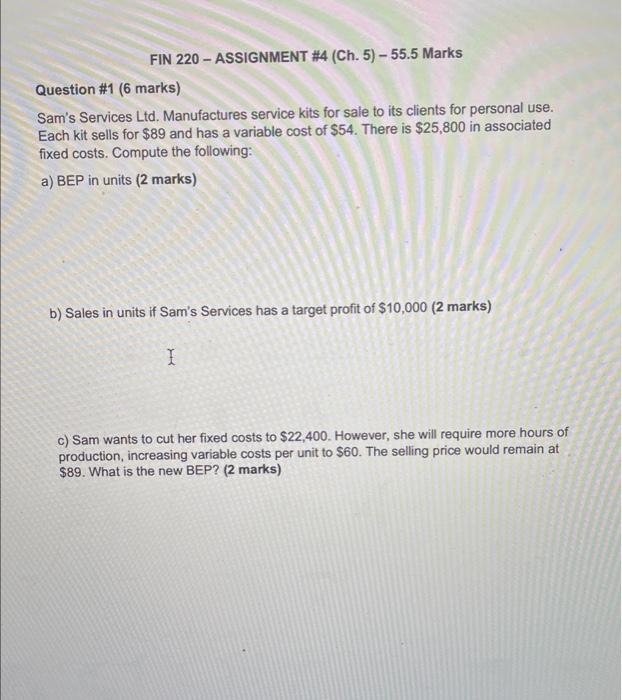

please help. im super stuck on how to start theses qustions. thank you!!! b) Sales in units if Sam's Services has a target profit of

please help. im super stuck on how to start theses qustions. thank you!!!

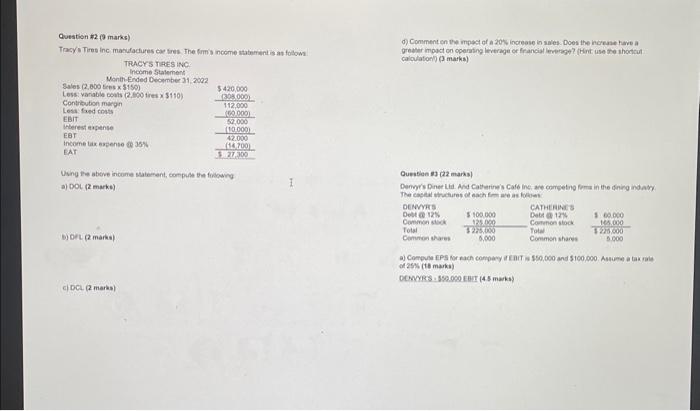

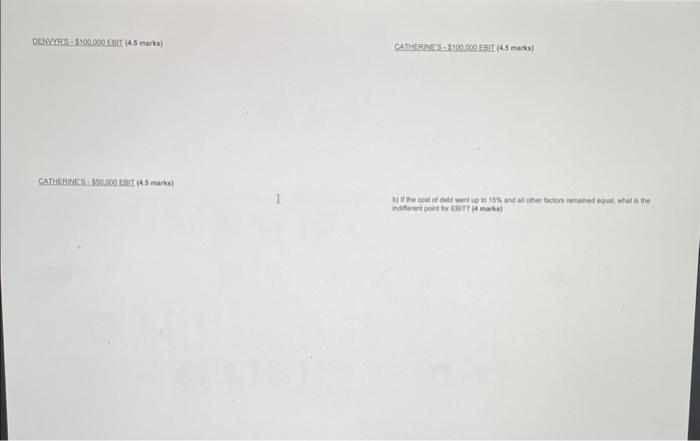

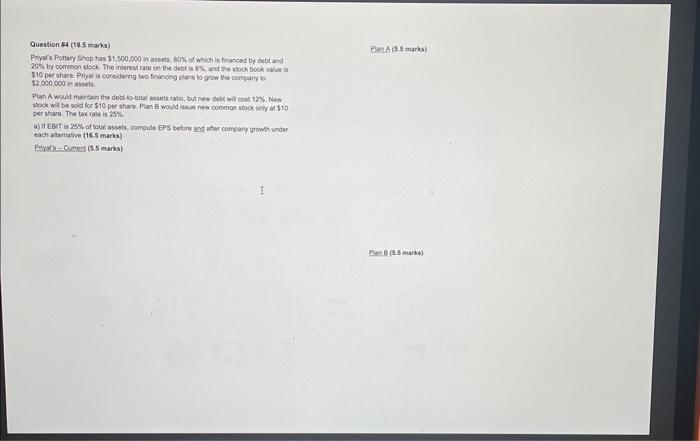

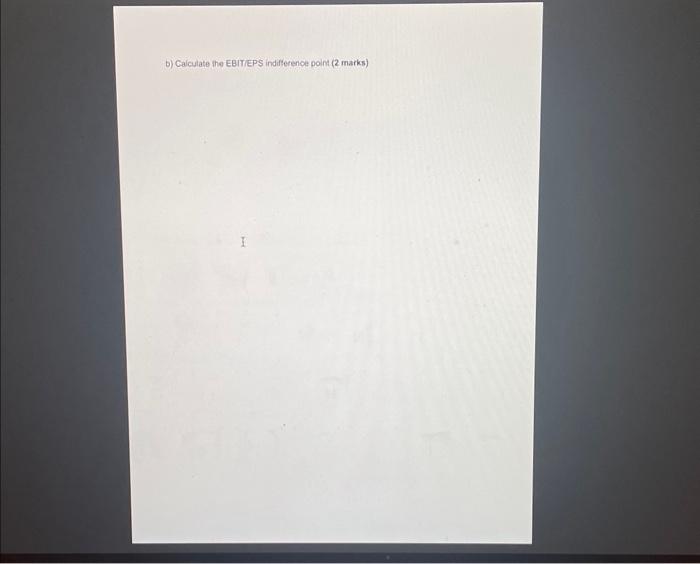

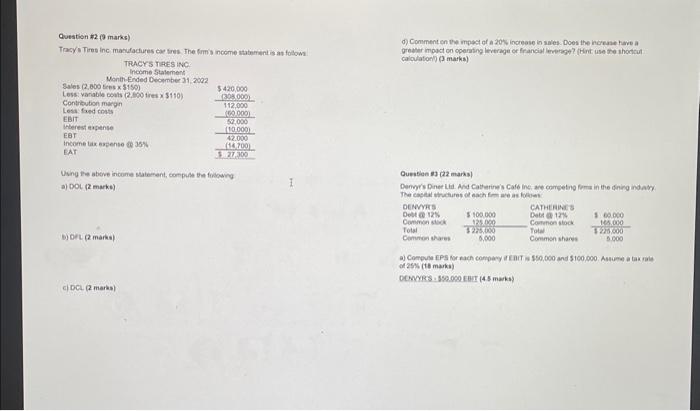

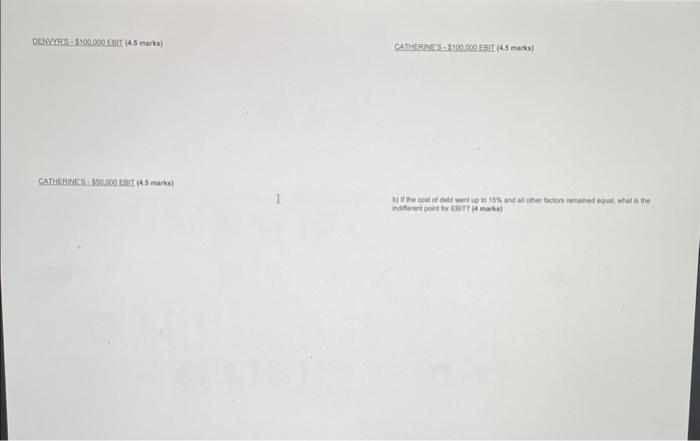

b) Sales in units if Sam's Services has a target profit of $10,000 (2 marks) z c) Sam wants to cut her fixed costs to $22,400. However, she will require more hours of production, increasing variable costs per unit to $60. The selling price would remain at \$89. What is the new BEP? ( 2 marks) Guestion 2 (9 marks) d) Comment on we mpest of a 20 th increase in saies. Does the norease have a Tracyls Tires inc macufactures cac tres the frimis nocme statherent is as folow. greater most on operiting leverage or francial evetagn? (Hint. use tre shodtion carovatonl (3 marks) Quesien 93(22 mans) a) DOL (2 marks) Dengris Diner Lla And Caterine's Cafe ine; are competno forme in the dinirg indayr. b) Bet (2 marks) of 25sis (t) marka) OCWCyRS : 359000 EBI (4 5 mank) DEAWDRE - 5100.000 FAII (4.5 marks) CATHEREVES-11000s0 ESIT ( 4.5 marts) CATHERENET - 180009 feIt (4.5 marss) miferent point for EBrT7 (4 marko) Question 44 ( 18.5 tiarks) 20% by comenon stock. The inierest rate on the debt is 8%, and 94 tock bock value ia $10 per share. Pripul is cotsiderng two fratcing plants to y ow the cempary st $2,000,000 an astets. stack will be wold for $10 per thare. Plon B would istuan new corrmon stock only at $10 per thare. Tha tax rale is 25% a) If EBIT is 25\%, of sclai assets, concule EPS belore and atier compary growh under each ateinate (18. 5 marks) Pryals - Cunets (5.5 marks) b) Caiculate the EBITiEPS indifference point (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started