Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide the answer in detail Back to Week 5 Financial analysis westion 4 answered o out of 5.00 ag question Brent is deciding between

Please provide the answer in detail

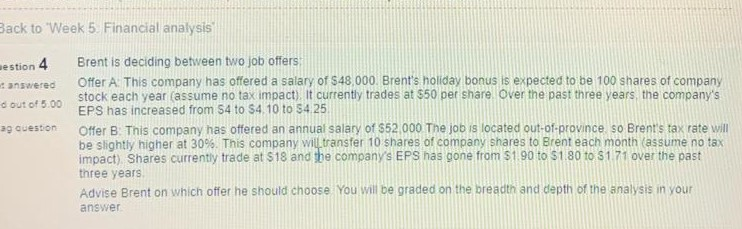

Back to "Week 5 Financial analysis westion 4 answered o out of 5.00 ag question Brent is deciding between two job offers Offer A. This company has offered a salary of $48,000. Brent's holiday bonus is expected to be 100 shares of company stock each year (assume no tax impact). It currently trades at $50 per share over the past three years the company's EPS has increased from 54 to 54 10 to 54 25 Offer B. This company has offered an annual salary of $52 000 The job is located out-of-province so Brent's tax rate will be slightly higher at 30%. This company will transfer 10 shares of company shares to Brent each month (assume no tax impact) Shares currently trade at $18 and the company's EPS has gone from $1.90 to $180 to $1 71 over the past three years Advise Brent on which offer he should choose You will be graded on the breadth and depth of the analysis in yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started