Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide the journal entry to record each of the independent transactions or events as shown. If no journal entry is needed, state the registry

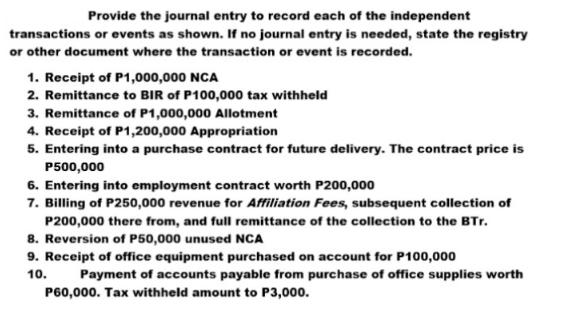

Provide the journal entry to record each of the independent transactions or events as shown. If no journal entry is needed, state the registry or other document where the transaction or event is recorded. 1. Receipt of P1,000,000 NCA 2. Remittance to BIR of P100,000 tax withheld 3. Remittance of P1,000,000 Allotment 4. Receipt of P1,200,000 Appropriation 5. Entering into a purchase contract for future delivery. The contract price is P500,000 6. Entering into employment contract worth P200,000 7. Billing of P250,000 revenue for Affiliation Fees, subsequent collection of P200,000 there from, and full remittance of the collection to the BTr. 8. Reversion of P50,000 unused NCA 9. Receipt of office equipment purchased on account for P100,000 10. Payment of accounts payable from purchase of office supplies worth P60,000. Tax withheld amount to P3,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Receipt of P1000000 NCA Debit NCA NonCurrent Assets P1000000 Credit CashBank CashBank Account P100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started