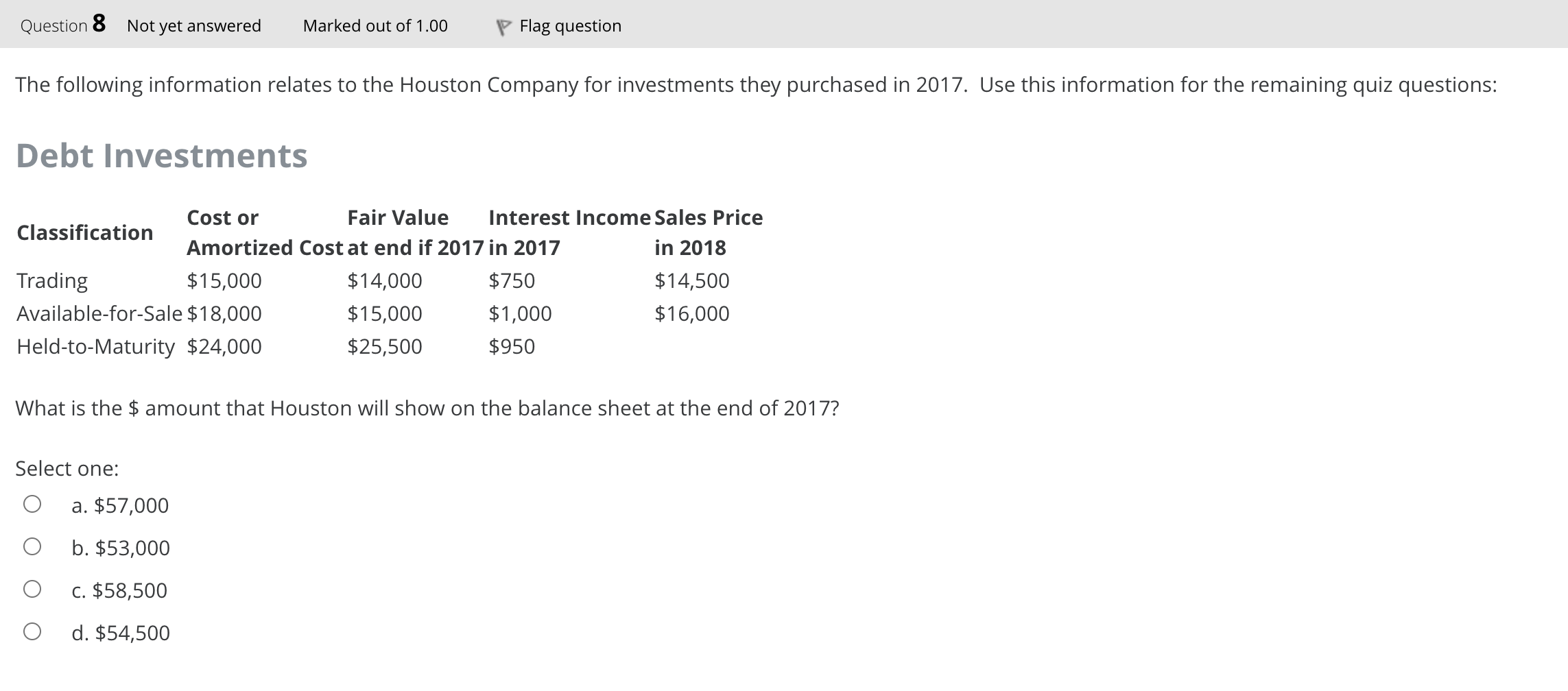

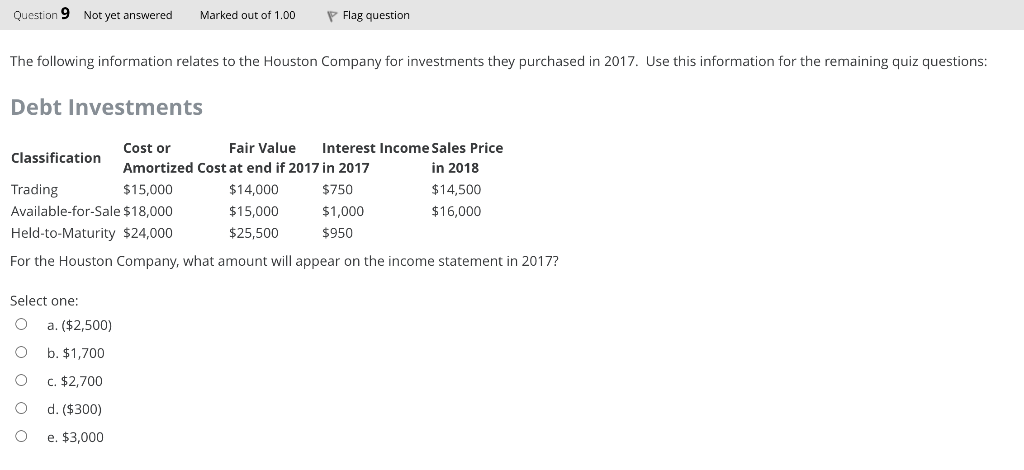

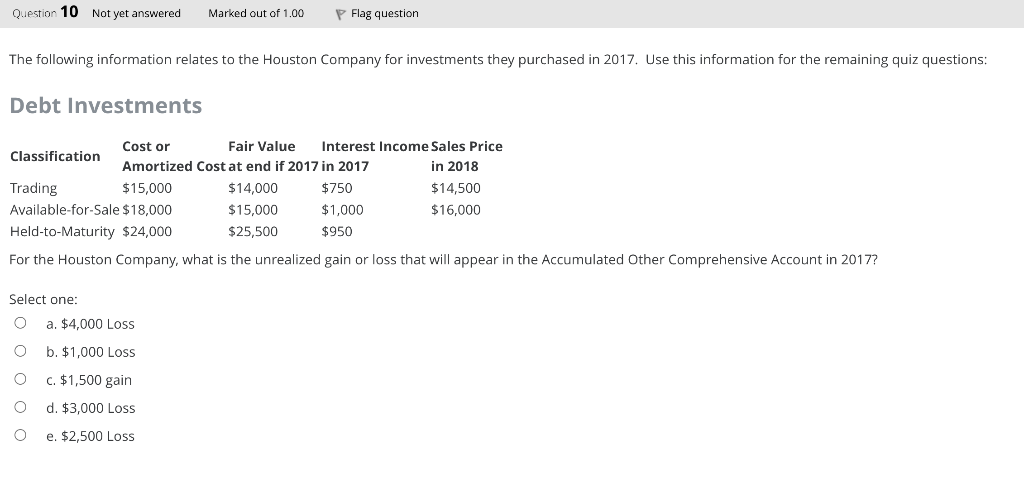

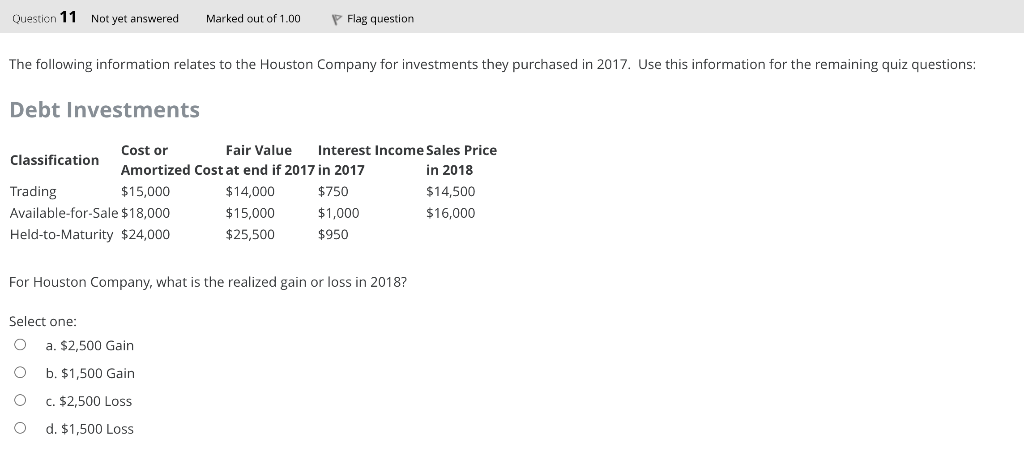

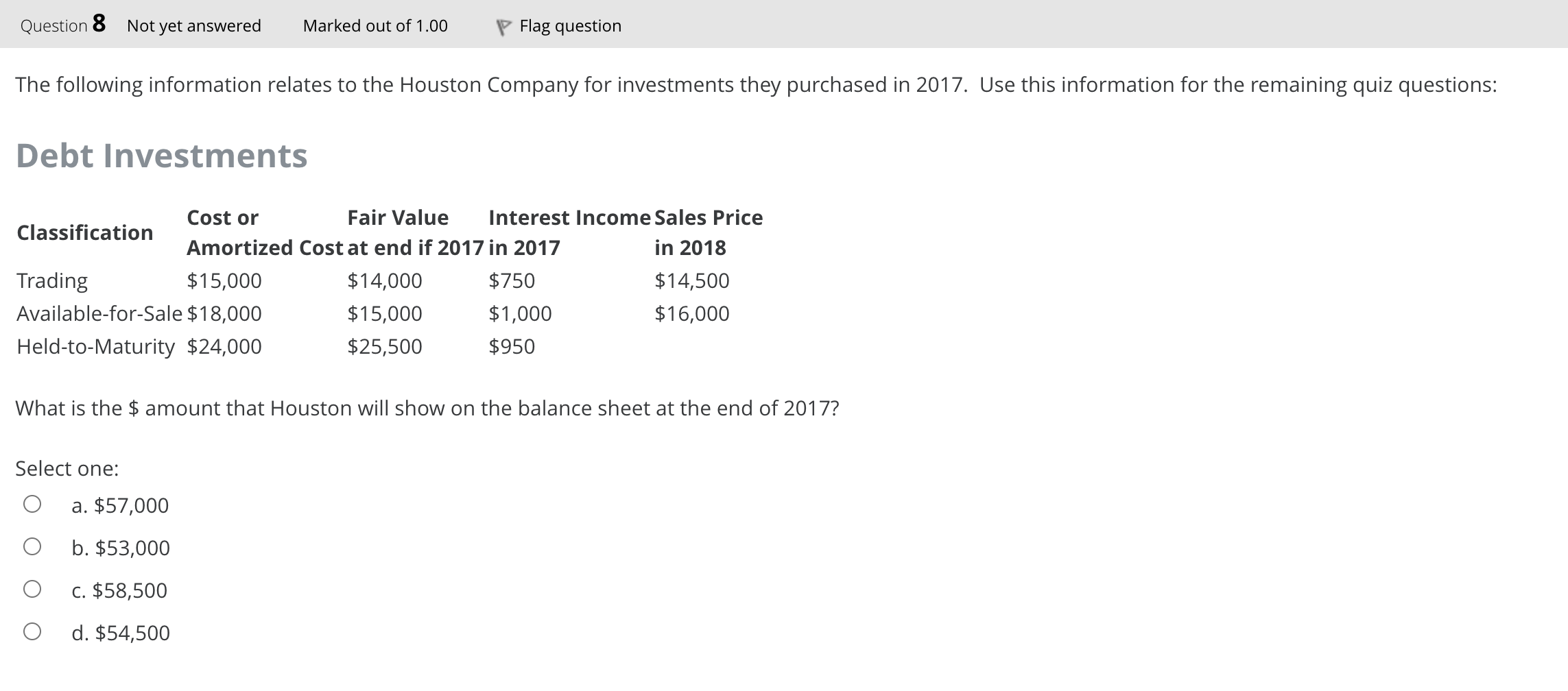

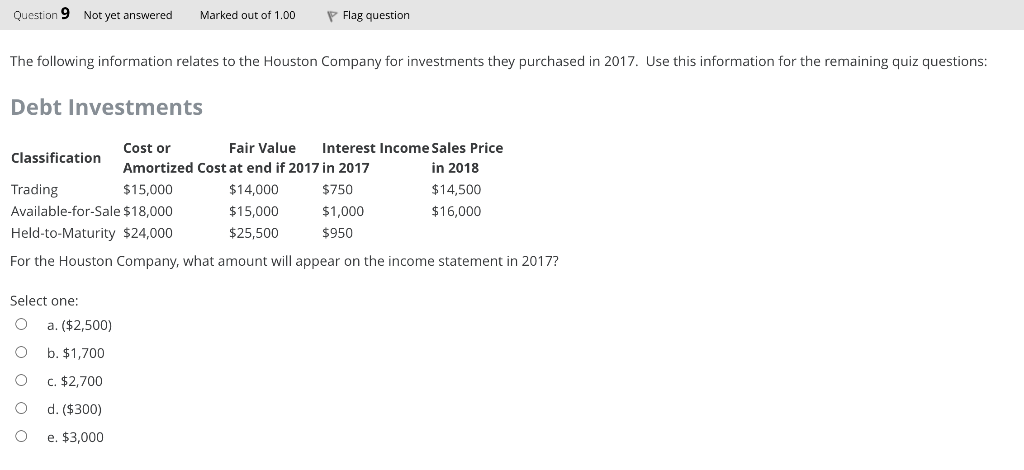

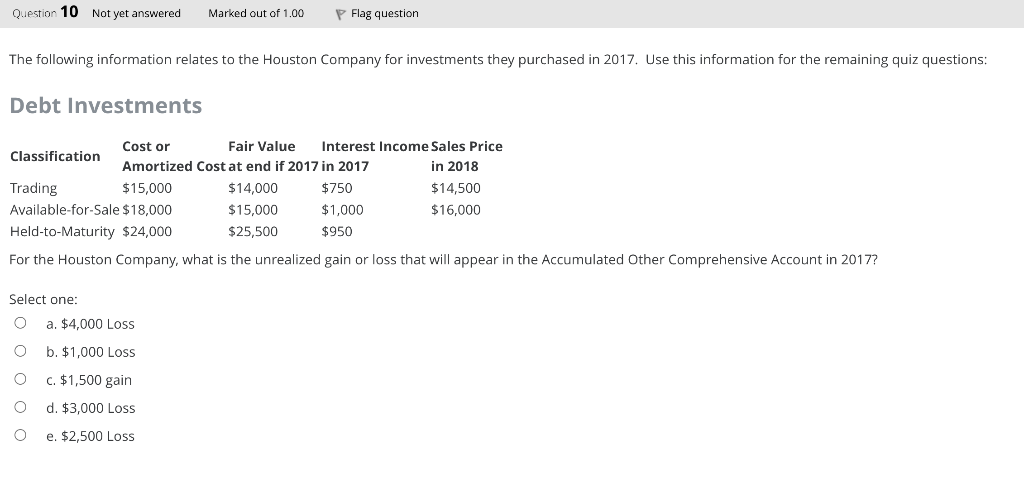

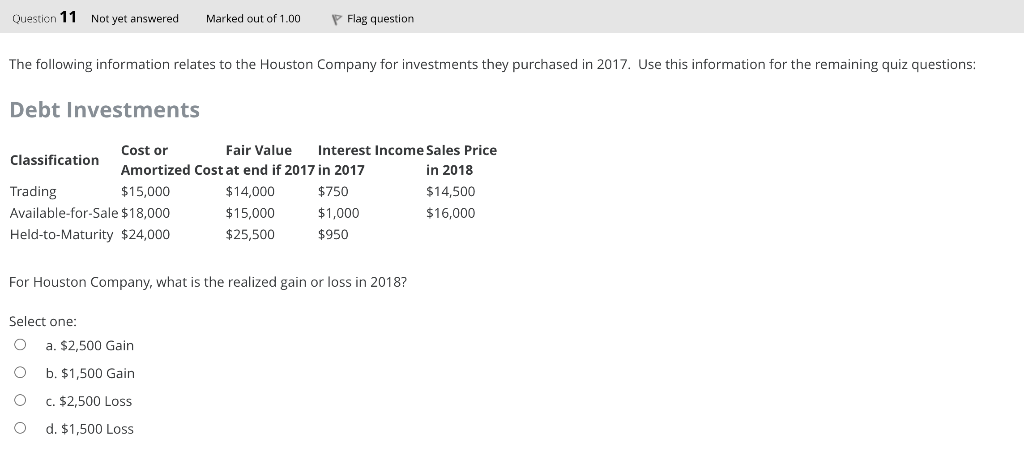

Question 8 Not yet answered Marked out of 1.00 Flag question The following information relates to the Houston Company for investments they purchased in 2017. Use this information for the remaining quiz questions: Debt Investments Cost or Fair Value Interest Income Sales Price Classification Amortized Cost at end if 2017 in 2017 in 2018 Trading $15,000 $14,000 $750 $14,500 Available-for-Sale $18,000 $15,000 $1,000 $16,000 Held-to-Maturity $24,000 $25,500 $950 What is the $ amount that Houston will show on the balance sheet at the end of 2017? Select one: a. $57,000 b. $53,000 C. $58,500 d. $54,500 Question 9 Not yet answered Marked out of 1.00 Flag question The following information relates to the Houston Company for investments they purchased in 2017. Use this information for the remaining quiz questions: Debt Investments Cost or Fair Value Interest Income Sales Price Classification Amortized Cost at end if 2017 in 2017 in 2018 Trading $15,000 $14,000 $750 $14.500 Available-for-Sale $18,000 $15,000 $1,000 $16,000 Held-to-Maturity $24,000 $25,500 $950 For the Houston Company, what amount will appear on the income statement in 2017? Select one: O a. ($2,500) b. $1,700 O C. $2,700 d. ($300) O e. $3,000 Question 10 Not yet answered Marked out of 1.00 P Flag question The following information relates to the Houston Company for investments they purchased in 2017. Use this information for the remaining quiz questions: Debt Investments Cost or Fair Value Interest Income Sales Price Classification Amortized Cost at end if 2017 in 2017 in 2018 Trading $15,000 $14,000 $750 $14,500 Available for Sale $18,000 $15,000 $1,000 $16,000 Held-to-Maturity $24,000 $25,500 $950 For the Houston Company, what is the unrealized gain or loss that will appear in the Accumulated Other Comprehensive Account in 2017? Select one: O a. $4,000 LOSS O b. $1,000 Loss O c. $1,500 gain O d. $3,000 Loss O e. $2,500 Loss Question 11 Not yet answered Marked out of 1.00 P Flag question The following information relates to the Houston Company for investments they purchased in 2017. Use this information for the remaining quiz questions: Debt Investments Cost or Fair Value Interest Income Sales Price Classification Amortized Cost at end if 2017 in 2017 in 2018 Trading $15,000 $14,000 $750 $14,500 Available-for-Sale $18,000 $15,000 $1,000 $ 16,000 Held-to-Maturity $24,000 $25,500 $950 For Houston Company, what is the realized gain or loss in 2018? Select one: O a. $2,500 Gain O b. $1,500 Gain C. $2,500 Loss O d. $1,500 Loss