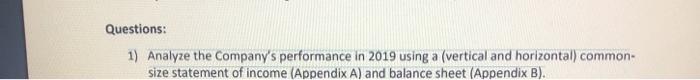

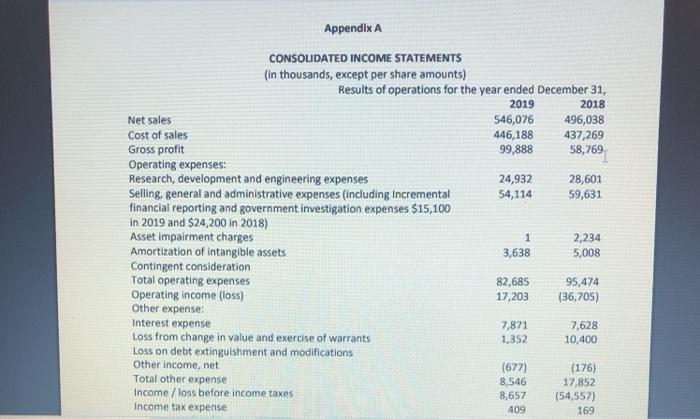

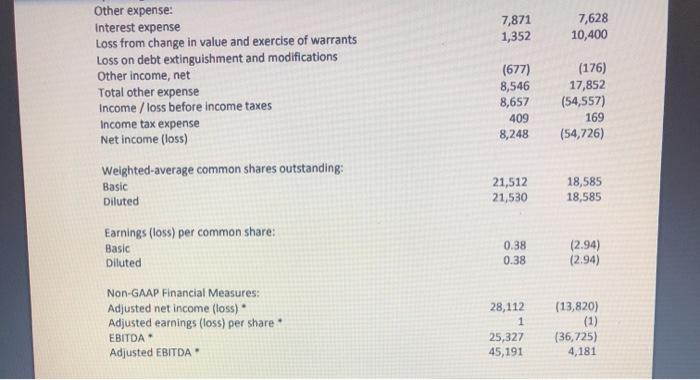

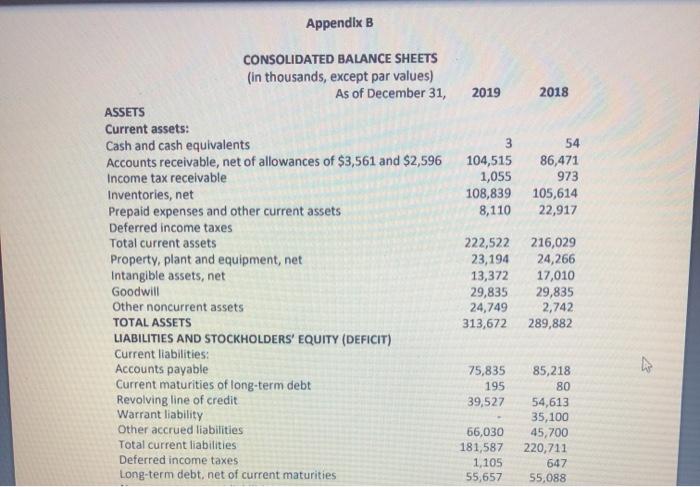

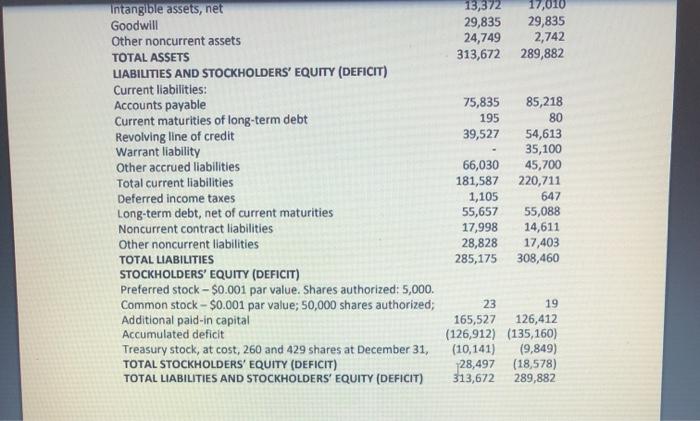

Questions: 1) Analyze the Company's performance in 2019 using a (vertical and horizontal) common size statement of income (Appendix A) and balance sheet (Appendix B). Appendix A 58,769 CONSOUDATED INCOME STATEMENTS (in thousands, except per share amounts) Results of operations for the year ended December 31, 2019 2018 Net sales 546,076 496,038 Cost of sales 446,188 437,269 Gross profit 99,888 Operating expenses: Research, development and engineering expenses 24,932 28,601 Selling, general and administrative expenses (including Incremental 54,114 59,631 financial reporting and government investigation expenses $15,100 in 2019 and $24,200 in 2018) Asset impairment charges 1 2,234 Amortization of intangible assets 3,638 5,008 Contingent consideration Total operating expenses 82,685 95,474 Operating income (los) 17,203 (36,705) Other expense: Interest expense 7,871 7,628 Loss from change in value and exercise of warrants 1,352 10,400 Loss on debt extinguishment and modifications Other income, net (677) (176) Total other expense 8,546 17,852 Income / loss before income taxes 8,657 (54,557) Income tax expense 409 169 7,871 1,352 7,628 10,400 Other expense: Interest expense Loss from change in value and exercise of warrants Loss on debt extinguishment and modifications Other income, net Total other expense Income / loss before income taxes Income tax expense Net income (loss) Weighted-average common shares outstanding: Basic Diluted (677) 8,546 8,657 409 8,248 (176) 17,852 (54,557) 169 (54,726) 21,512 21,530 18,585 18,585 Earnings (loss) per common share: Basic Diluted 0.38 0.38 (2.94) (2.94) Non-GAAP Financial Measures: Adjusted net income (loss) Adjusted earnings (loss) per share EBITDA Adjusted EBITDA 28,112 1 25,327 45,191 (13,820) (1) (36,725) 4,181 Appendix B 2019 2018 3 104,515 1,055 108,839 8,110 54 86,471 973 105,614 22,917 CONSOLIDATED BALANCE SHEETS (in thousands, except par values) As of December 31, ASSETS Current assets: Cash and cash equivalents Accounts receivable, net of allowances of $3,561 and $2,596 Income tax receivable Inventories, net Prepaid expenses and other current assets Deferred income taxes Total current assets Property, plant and equipment, net Intangible assets, net Goodwill Other noncurrent assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) Current liabilities: Accounts payable Current maturities of long-term debt Revolving line of credit Warrant liability Other accrued liabilities Total current liabilities Deferred income taxes Long-term debt, net of current maturities 222,522 216,029 23,194 24,266 13,372 17,010 29,835 29,835 24,749 2,742 313,672 289,882 v 75,835 195 39,527 85,218 80 54,613 35,100 45,700 220,711 647 55,088 66,030 181,587 1,105 55,657 13,372 17,010 29,835 29,835 24,749 2,742 313,672 289,882 75,835 195 39,527 Intangible assets, net Goodwill Other noncurrent assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) Current liabilities: Accounts payable Current maturities of long-term debt Revolving line of credit Warrant liability Other accrued liabilities Total current liabilities Deferred income taxes Long-term debt, net of current maturities Noncurrent contract liabilities Other noncurrent liabilities TOTAL LIABILITIES STOCKHOLDERS' EQUITY (DEFICIT) Preferred stock - $0.001 par value. Shares authorized: 5,000. Common stock - $0.001 par value; 50,000 shares authorized; Additional paid in capital Accumulated deficit Treasury stock, at cost, 260 and 429 shares at December 31, TOTAL STOCKHOLDERS' EQUITY (DEFICIT) TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) 66,030 181,587 1,105 55,657 17,998 28,828 285,175 85,218 80 54,613 35,100 45,700 220,711 647 55,088 14,611 17,403 308,460 23 19 165,527 126,412 (126,912) (135,160) (10,141) (9,849) 28,497 (18,578) 313,672 289,882