Answered step by step

Verified Expert Solution

Question

1 Approved Answer

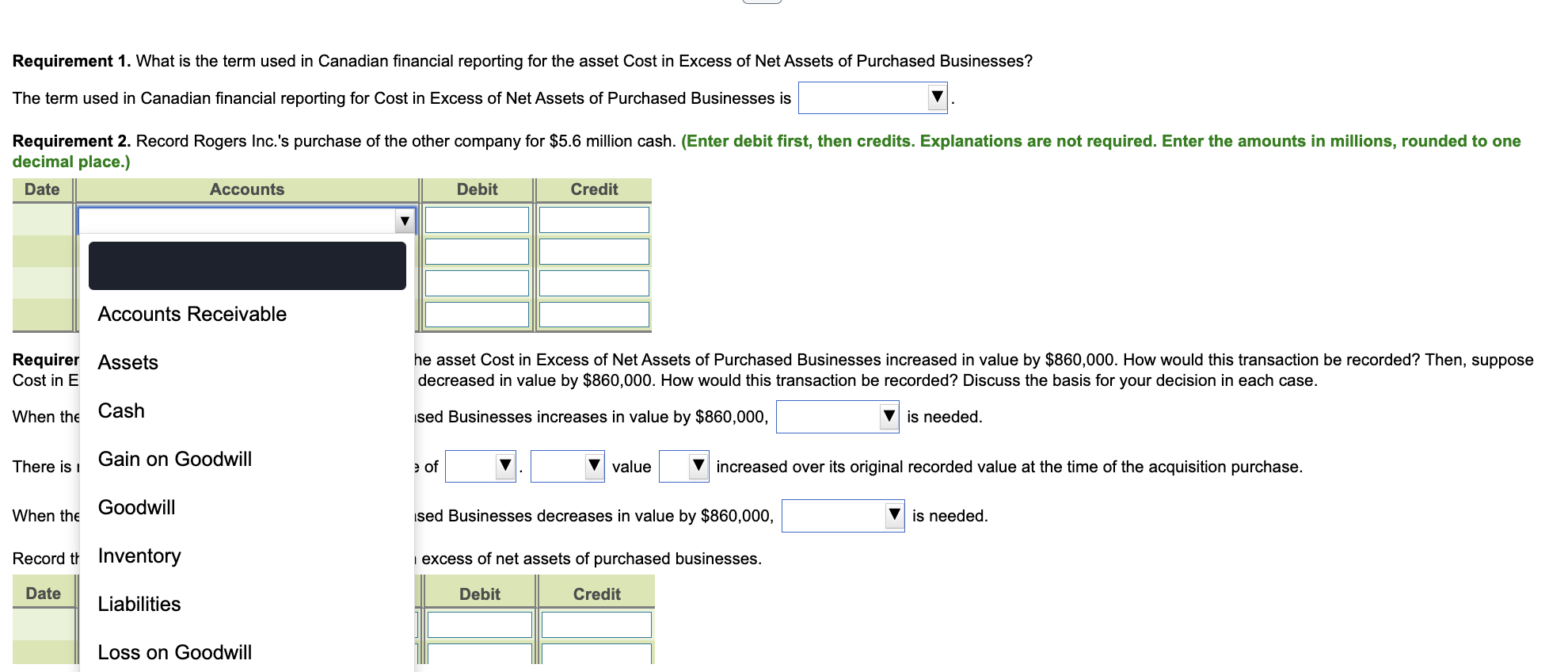

Requirement two Requirement one Requirement three fill in the blanks First blank:A journal entry, no journal entry. Second Blank: A decrease, an increase Third Blank:

Requirement two

Requirement one

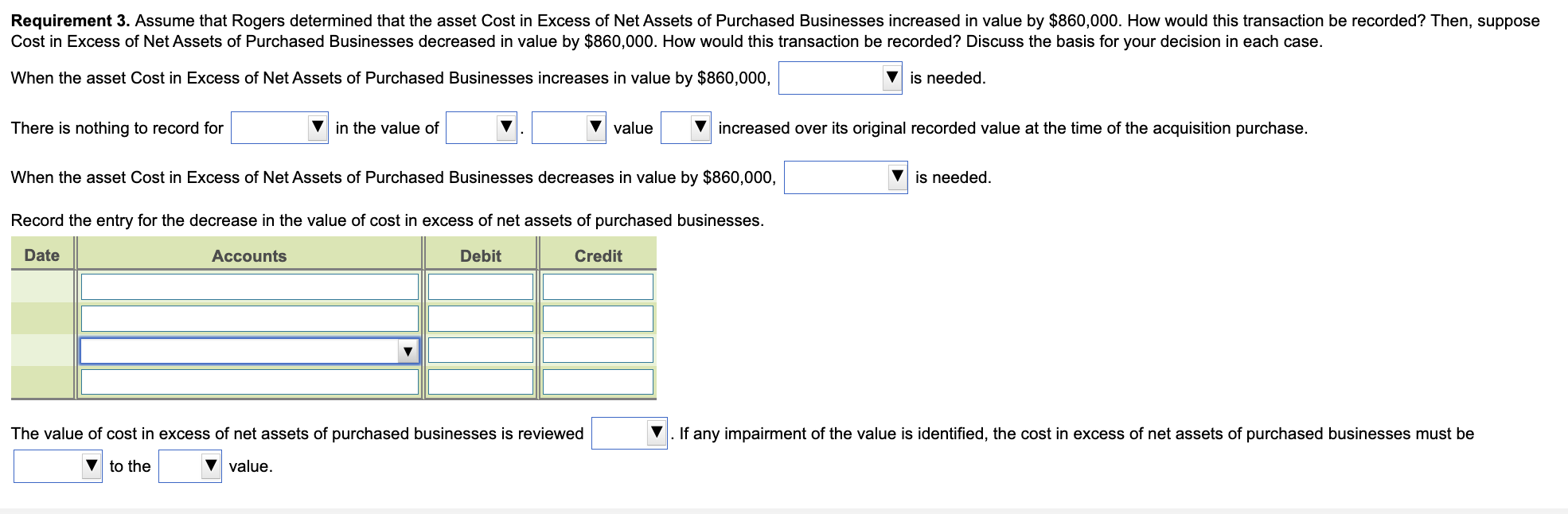

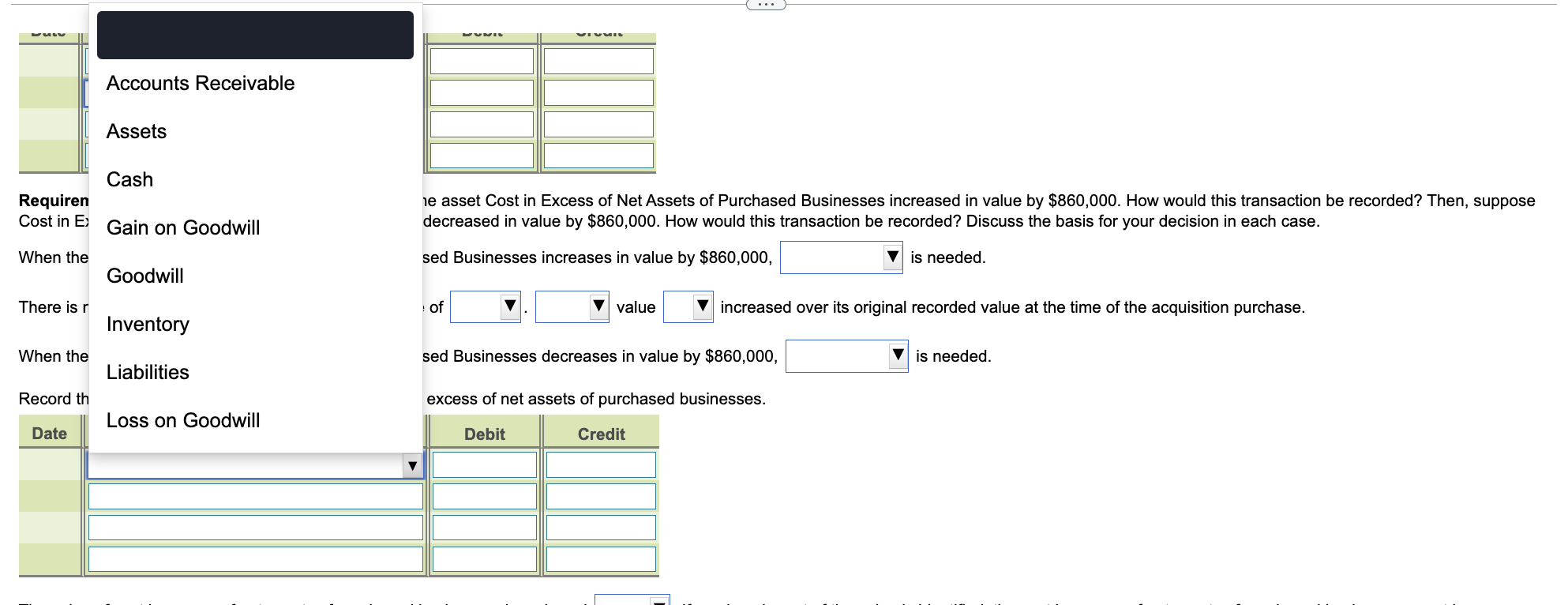

Requirement three fill in the blanks

First blank:A journal entry, no journal entry.

Second Blank: A decrease, an increase

Third Blank: assets, cash, goodwill

Fourth Blank: assets, cash, goodwill

5th Blank: is, is not

6th blank: A journal entry, no journal entry

All the blanks has the same options

7th blank: Annually, quarterly

8th blank: Decreased, increased

9th blank: book, current

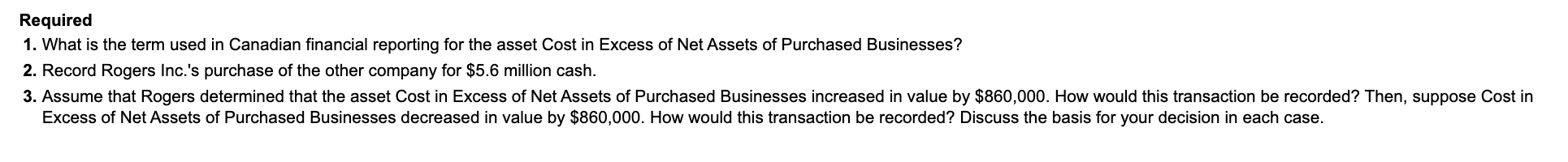

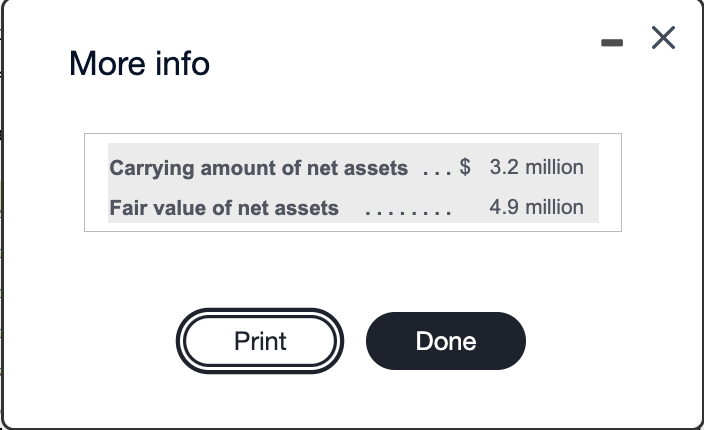

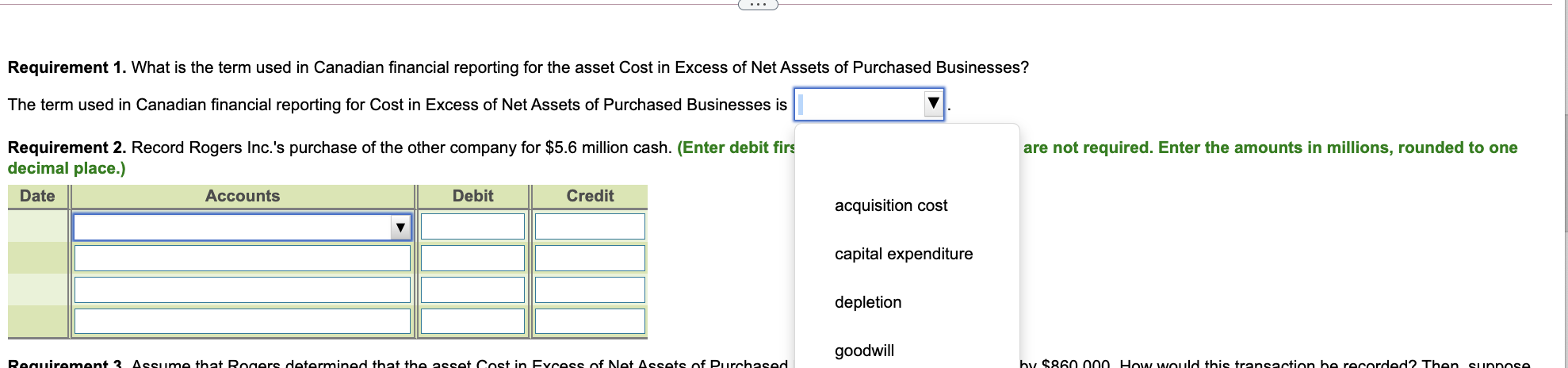

Required 1. What is the term used in Canadian financial reporting for the asset Cost in Excess of Net Assets of Purchased Businesses? 2. Record Rogers Inc.'s purchase of the other company for $5.6 million cash. 3. Assume that Rogers determined that the asset Cost in Excess of Net Assets of Purchased Businesses increased in value by $860,000. How would this transaction be recorded? Then, suppose Cost in Excess of Net Assets of Purchased Businesses decreased in value by $860,000. How would this transaction be recorded? Discuss the basis for your decision in each case. More info Carrying amount of net assets ... $ 3.2 million Fair value of net assets 4.9 million Print Done Requirement 1. What is the term used in Canadian financial reporting for the asset Cost in Excess of Net Assets of Purchased Businesses? The term used in Canadian financial reporting for Cost in Excess of Net Assets of Purchased Businesses is Requirement 2. Record Rogers Inc.'s purchase of the other company for $5.6 million cash. (Enter debit first, then credits. Explanations are not required. Enter the amounts in millions, rounded to one decimal place.) Date Accounts Debit Credit Accounts Receivable Requirer Assets Cost in E he asset Cost in Excess of Net Assets of Purchased Businesses increased in value by $860,000. How would this transaction be recorded? Then, suppose decreased in value by $860,000. How would this transaction be recorded? Discuss the basis for your decision in each case. When the Cash ised Businesses increases in value by $860,000, is needed. Gain on Goodwill There is of value increased over its original recorded value at the time of the acquisition purchase. Goodwill When the ised Businesses decreases in value by $860,000, is needed. Record th Inventory excess of net assets of purchased businesses. Date Debit Credit Liabilities Loss on Goodwill Requirement 1. What is the term used in Canadian financial reporting for the asset Cost in Excess of Net Assets of Purchased Businesses? The term used in Canadian financial reporting for Cost in Excess of Net Assets of Purchased Businesses is are not required. Enter the amounts in millions, rounded to one Requirement 2. Record Rogers Inc.'s purchase of the other company for $5.6 million cash. (Enter debit firs decimal place.) Date Accounts Debit Credit acquisition cost capital expenditure depletion goodwill Requirement 3 Assume that Rogers determined that the asset cost in Eycess of Net Assets of Purchased by $860000 How would this transaction be recorded2 Then sunnose Requirement 3. Assume that Rogers determined that the asset Cost in Excess of Net Assets of Purchased Businesses increased in value by $60,000. How would this transaction be recorded? Then, suppose Cost in Excess of Net Assets of Purchased Businesses decreased in value by $860,000. How would this transaction be recorded? Discuss the basis for your decision in each case. When the asset Cost in Excess of Net Assets of Purchased Businesses increases in value by $860,000, is needed. There is nothing to record for in the value of value increased over its original recorded value at the time of the acquisition purchase. When the asset Cost in Excess of Net Assets of Purchased Businesses decreases in value by $860,000, is needed Record the entry for the decrease in the value of cost in excess of net assets of purchased businesses. Date Accounts Debit Credit The value of cost in excess of net assets of purchased businesses is reviewed If any impairment of the value is identified, the cost in excess of net assets of purchased businesses must be V to the value. Accounts Receivable Assets Cash Requiren Cost in E Gain on Goodwill he asset Cost in Excess of Net Assets of Purchased Businesses increased in value by $860,000. How would this transaction be recorded? Then, suppose decreased in value by $860,000. How would this transaction be recorded? Discuss the basis for your decision in each case. When the sed Businesses increases in value by $860,000, is needed. Goodwill There is r of value increased over its original recorded value at the time of the acquisition purchase. Inventory When the sed Businesses decreases in value by $860,000, is needed. Liabilities Record th excess of net assets of purchased businesses. Loss on Goodwill Date Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started