Question: Task and Mark distribution: Scenario You are a commodity manager hedging British Airways price exposure to jet fuel oil for the next 2 years. The

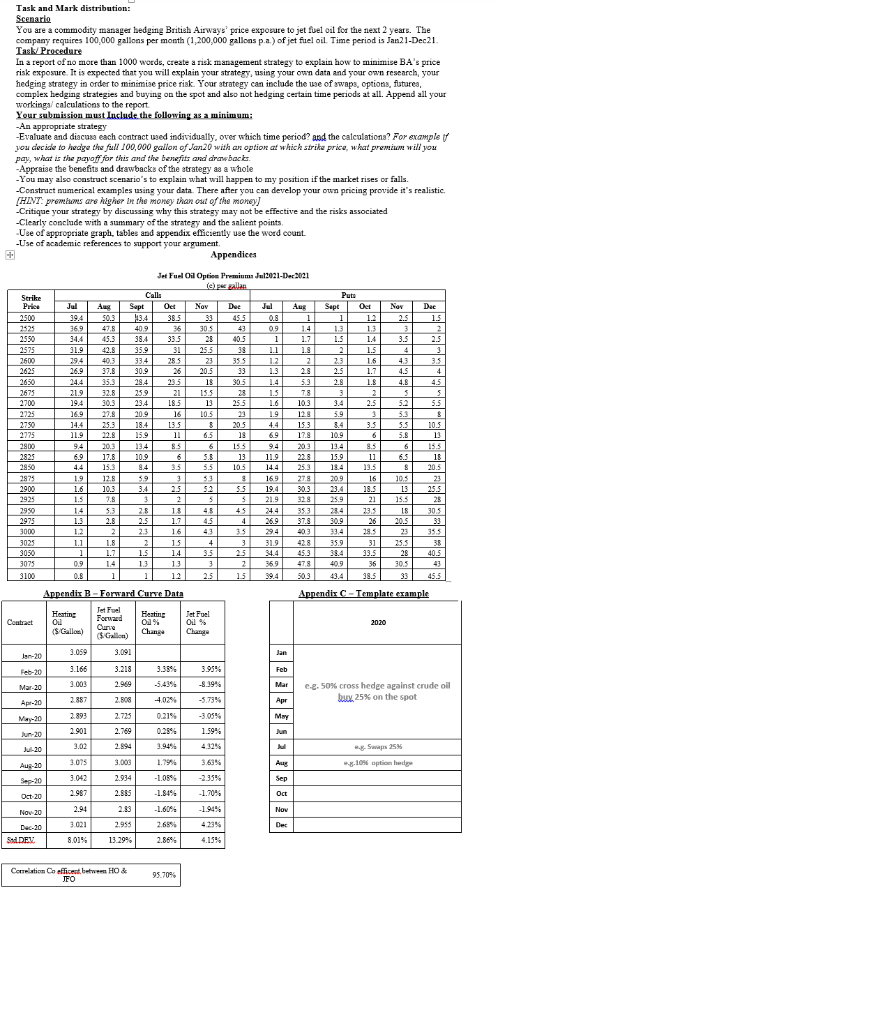

Task and Mark distribution: Scenario You are a commodity manager hedging British Airways price exposure to jet fuel oil for the next 2 years. The company requires 100,000 gallons per month (1,200,000 gallons p.a.) of jet fuel oil. Time period is Jan21-Dec21. Task/Procedure In a report of no more than 1000 words, create a risk management strategy to explain how to minimise BA's price risk exposure. It is expected that you will explain your strategy, using your own data and your own research, your hedging strategy in order to minimise price risk. Your strategy can include the use of swaps, options, futures, complex hedging strategies and buyang on the spot and also not hedging certain time periods at all. Append all your workings/ calculations to the report Your submission must include the following as a minimum: -An appropriate strategy -Evaluate and discuss each contract used individually, over which time period and the calculationa? For example it you decide to hedge the full 100,000 gallon of Jan20 with an option at whick strike price, what premium will you pay, what is the payoff for this and the benefits and drawbacks. -Appraise the benefits and drawbacks of the strategy as a whole -You may also construct scenario's to explain what will happen to my position if the market rises or falls. -Construct numerical examples using your data. There after you can develop your own pricing provide it's realistic (HINT. promiums are higher in the money than out of the money) -Critique your strategy by discussing why this strategy may not be effective and the risks associated -Clearly conclude with a summary of the strategy and the salient points, Use of appropriate graph, tables and appendix efficiently use the word count. Use of academic references to support your argument. Appendices Jet Fuel On Option Premium Ju12021-Dec-2021 Dec 455 Nov 2.5 Dec 1.5 40.5 1 3.5 2.5 355 30.5 23 253 105 205 Puts Jul Aug Sepe Oet 0.8 1 12 09 1.2 1.3 1 1.7 1.5 1.4 1.1 1.8 2 1.5 1.2 2 1.6 1.3 2.8 2.5 1.7 5.3 1.8 1.5 7.8 3 1.6 10.3 3.4 2.5 1.9 12.8 5.9 4.4 15.3 3.5 6.9 17.8 10.9 20.3 13.4 9.5 11.9 22.8 15.9 11 14.4 25.3 13.5 169 27.9 20.9 16 19.4 30.3 18.5 21.9 32.9 25.9 21 353 23.5 26.9 37.8 26 29.4 403 28.5 31.9 42.8 35.9 31 34.4 45.3 33.5 478 40.9 36 38.5 153 13 105 8 55 Strike Calls Pree Jul Aus Sept Oct Nov 2500 50.3 113.4 38.5 2525 47,8 40.9 305 2550 45.3 38.4 33.5 2575 31.9 35.9 31 25.5 2600 40.3 33.4 23 2625 26.9 37.8 30.9 20.5 2650 35.3 28.4 23.5 18 2673 21.9 32.8 25.9 21 15.5 2700 19.4 30.3 23.4 18.5 1 2725 16.9 20.9 16 2750 14.4 18.4 13.5 2725 11.9 22.8 15.9 11 6.5 2900 94 20.3 13.4 8.5 6 2825 6.9 17.8 10.9 6 2950 4.4 15.3 9.4 5.5 2875 1.9 12.8 591 3 53 2900 1.6 10.3 3.4 52 2925 1.5 7.8 2 5 2990 14 53 28 13 2975 1.3 2.8 2.5 1.7 4.5 3000 1.2 23 16 43 3025 1. 1.8 1.5 4 4 3050 1 1.7 1.5 1.4 3.5 3073 0.9 1.3 13 3 3100 0.8 1 1.2 2.5 Appendix B-Forward Curve Data Heating Jet Fuel Forward Hosting Jet Fuel Contract Oil O % Oil % ($Gallon) ($ Change 3.059 3.09 3. Isr-20 Feb-20 3.166 3.218 3.35% 3.95% Mar-20 3.003 2.969 -8.39% 2.887 Apr-20 2.808 4.025 -5.73% 2.893 May-20 2.725 0.21% % -3.05% 2.901 Jun-20 2.769 1.59% % 3.02 Jul-20 2.9944 3.075 3.000 1.7994 3.63% Aug-20 3.042 -1.059 Sep-20 2.934 % 2.987 Oct 20 2.885 -1.84% -1.70% 2.94 Nov-20 -1.60% -1.94% 3.021 Dec-20 2.955 2.6596 Sid DEV 8.01% 13.29% 2.86% 4.15% 43 35 4.5 4 4.8 4.5 5 5.2 5.5 5.3 5.5 10.5 5.8 15.5 6.5 16 8 20.5 10.5 23 13 25.5 15.5 25 18 30.5 20.5 33 23 35.5 25.5 28 40.5 30.5 33 45.5 3 45 4 35 3 2 15 994 Appendix C - Template example 2020 Jan Feb Mar e-e. 50% cross hedge against crude oil buy 25% on the spot Apr M May 4. Swaps 25 -3.10% option here Sep Oct Nov Dec Correlation Coefficent between HO & JFO 95.70% Task and Mark distribution: Scenario You are a commodity manager hedging British Airways price exposure to jet fuel oil for the next 2 years. The company requires 100,000 gallons per month (1,200,000 gallons p.a.) of jet fuel oil. Time period is Jan21-Dec21. Task/Procedure In a report of no more than 1000 words, create a risk management strategy to explain how to minimise BA's price risk exposure. It is expected that you will explain your strategy, using your own data and your own research, your hedging strategy in order to minimise price risk. Your strategy can include the use of swaps, options, futures, complex hedging strategies and buyang on the spot and also not hedging certain time periods at all. Append all your workings/ calculations to the report Your submission must include the following as a minimum: -An appropriate strategy -Evaluate and discuss each contract used individually, over which time period and the calculationa? For example it you decide to hedge the full 100,000 gallon of Jan20 with an option at whick strike price, what premium will you pay, what is the payoff for this and the benefits and drawbacks. -Appraise the benefits and drawbacks of the strategy as a whole -You may also construct scenario's to explain what will happen to my position if the market rises or falls. -Construct numerical examples using your data. There after you can develop your own pricing provide it's realistic (HINT. promiums are higher in the money than out of the money) -Critique your strategy by discussing why this strategy may not be effective and the risks associated -Clearly conclude with a summary of the strategy and the salient points, Use of appropriate graph, tables and appendix efficiently use the word count. Use of academic references to support your argument. Appendices Jet Fuel On Option Premium Ju12021-Dec-2021 Dec 455 Nov 2.5 Dec 1.5 40.5 1 3.5 2.5 355 30.5 23 253 105 205 Puts Jul Aug Sepe Oet 0.8 1 12 09 1.2 1.3 1 1.7 1.5 1.4 1.1 1.8 2 1.5 1.2 2 1.6 1.3 2.8 2.5 1.7 5.3 1.8 1.5 7.8 3 1.6 10.3 3.4 2.5 1.9 12.8 5.9 4.4 15.3 3.5 6.9 17.8 10.9 20.3 13.4 9.5 11.9 22.8 15.9 11 14.4 25.3 13.5 169 27.9 20.9 16 19.4 30.3 18.5 21.9 32.9 25.9 21 353 23.5 26.9 37.8 26 29.4 403 28.5 31.9 42.8 35.9 31 34.4 45.3 33.5 478 40.9 36 38.5 153 13 105 8 55 Strike Calls Pree Jul Aus Sept Oct Nov 2500 50.3 113.4 38.5 2525 47,8 40.9 305 2550 45.3 38.4 33.5 2575 31.9 35.9 31 25.5 2600 40.3 33.4 23 2625 26.9 37.8 30.9 20.5 2650 35.3 28.4 23.5 18 2673 21.9 32.8 25.9 21 15.5 2700 19.4 30.3 23.4 18.5 1 2725 16.9 20.9 16 2750 14.4 18.4 13.5 2725 11.9 22.8 15.9 11 6.5 2900 94 20.3 13.4 8.5 6 2825 6.9 17.8 10.9 6 2950 4.4 15.3 9.4 5.5 2875 1.9 12.8 591 3 53 2900 1.6 10.3 3.4 52 2925 1.5 7.8 2 5 2990 14 53 28 13 2975 1.3 2.8 2.5 1.7 4.5 3000 1.2 23 16 43 3025 1. 1.8 1.5 4 4 3050 1 1.7 1.5 1.4 3.5 3073 0.9 1.3 13 3 3100 0.8 1 1.2 2.5 Appendix B-Forward Curve Data Heating Jet Fuel Forward Hosting Jet Fuel Contract Oil O % Oil % ($Gallon) ($ Change 3.059 3.09 3. Isr-20 Feb-20 3.166 3.218 3.35% 3.95% Mar-20 3.003 2.969 -8.39% 2.887 Apr-20 2.808 4.025 -5.73% 2.893 May-20 2.725 0.21% % -3.05% 2.901 Jun-20 2.769 1.59% % 3.02 Jul-20 2.9944 3.075 3.000 1.7994 3.63% Aug-20 3.042 -1.059 Sep-20 2.934 % 2.987 Oct 20 2.885 -1.84% -1.70% 2.94 Nov-20 -1.60% -1.94% 3.021 Dec-20 2.955 2.6596 Sid DEV 8.01% 13.29% 2.86% 4.15% 43 35 4.5 4 4.8 4.5 5 5.2 5.5 5.3 5.5 10.5 5.8 15.5 6.5 16 8 20.5 10.5 23 13 25.5 15.5 25 18 30.5 20.5 33 23 35.5 25.5 28 40.5 30.5 33 45.5 3 45 4 35 3 2 15 994 Appendix C - Template example 2020 Jan Feb Mar e-e. 50% cross hedge against crude oil buy 25% on the spot Apr M May 4. Swaps 25 -3.10% option here Sep Oct Nov Dec Correlation Coefficent between HO & JFO 95.70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts