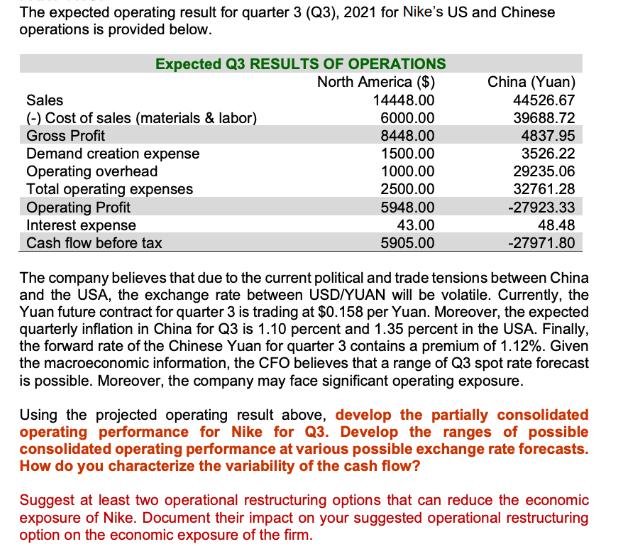

Question: The expected operating result for quarter 3 (Q3), 2021 for Nike's US and Chinese operations is provided below. Expected Q3 RESULTS OF OPERATIONS North

The expected operating result for quarter 3 (Q3), 2021 for Nike's US and Chinese operations is provided below. Expected Q3 RESULTS OF OPERATIONS North America ($) Sales (-) Cost of sales (materials & labor) Gross Profit Demand creation expense Operating overhead Total operating expenses Operating Profit Interest expense Cash flow before tax 14448.00 6000.00 8448.00 1500.00 1000.00 2500.00 5948.00 43.00 5905.00 China (Yuan) 44526.67 39688.72 4837.95 3526.22 29235.06 32761.28 -27923.33 48.48 -27971.80 The company believes that due to the current political and trade tensions between China and the USA, the exchange rate between USD/YUAN will be volatile. Currently, the Yuan future contract for quarter 3 is trading at $0.158 per Yuan. Moreover, the expected quarterly inflation in China for Q3 is 1.10 percent and 1.35 percent in the USA. Finally, the forward rate of the Chinese Yuan for quarter 3 contains a premium of 1.12%. Given the macroeconomic information, the CFO believes that a range of Q3 spot rate forecast is possible. Moreover, the company may face significant operating exposure. Using the projected operating result above, develop the partially consolidated operating performance for Nike for Q3. Develop the ranges of possible consolidated operating performance at various possible exchange rate forecasts. How do you characterize the variability of the cash flow? Suggest at least two operational restructuring options that can reduce the economic exposure of Nike. Document their impact on your suggested operational restructuring option on the economic exposure of the firm.

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

To develop the partially consolidated operating performance for Nike for Q3 we need to convert the Chinese Yuan amounts to US dollars using the spot rate forecast and consider the impact of inflation ... View full answer

Get step-by-step solutions from verified subject matter experts