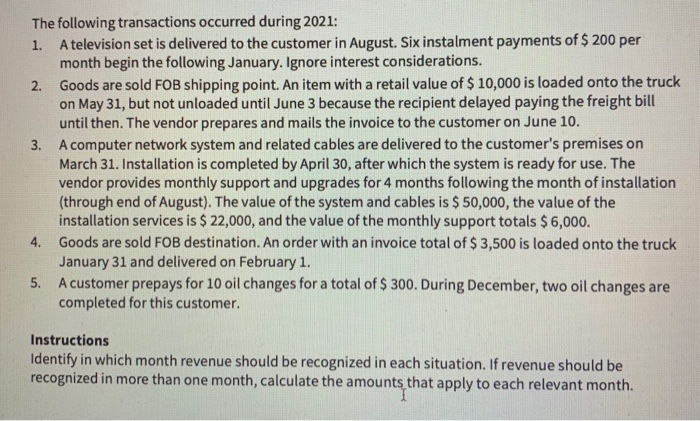

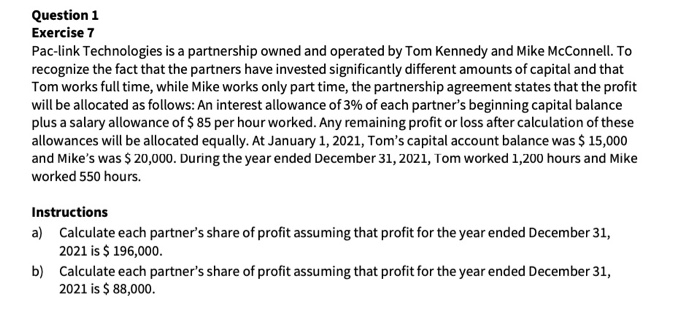

The following transactions occurred during 2021: 1. A television set is delivered to the customer in August. Six instalment payments of $ 200 per month begin the following January. Ignore interest considerations. 2. Goods are sold FOB shipping point. An item with a retail value of $ 10,000 is loaded onto the truck on May 31, but not unloaded until June 3 because the recipient delayed paying the freight bill until then. The vendor prepares and mails the invoice to the customer on June 10. 3. A computer network system and related cables are delivered to the customer's premises on March 31. Installation is completed by April 30, after which the system is ready for use. The vendor provides monthly support and upgrades for 4 months following the month of installation (through end of August). The value of the system and cables is $50,000, the value of the installation services is $ 22,000, and the value of the monthly support totals $6,000. 4. Goods are sold FOB destination. An order with an invoice total of $ 3,500 is loaded onto the truck January 31 and delivered on February 1. 5. A customer prepays for 10 oil changes for a total of $ 300. During December, two oil changes are completed for this customer. Instructions Identify in which month revenue should be recognized in each situation. If revenue should be recognized in more than one month, calculate the amounts that apply to each relevant month. Question 1 Exercise 7 Pac-link Technologies is a partnership owned and operated by Tom Kennedy and Mike McConnell. To recognize the fact that the partners have invested significantly different amounts of capital and that Tom works full time, while Mike works only part time, the partnership agreement states that the profit will be allocated as follows: An interest allowance of 3% of each partner's beginning capital balance plus a salary allowance of $ 85 per hour worked. Any remaining profit or loss after calculation of these allowances will be allocated equally. At January 1, 2021, Tom's capital account balance was $ 15,000 and Mike's was $ 20,000. During the year ended December 31, 2021, Tom worked 1,200 hours and Mike worked 550 hours. Instructions a) Calculate each partner's share of profit assuming that profit for the year ended December 31, 2021 is $ 196,000. b) Calculate each partner's share of profit assuming that profit for the year ended December 31, 2021 is $ 88,000. Question 1 Exercise 7 Pac-link Technologies is a partnership owned and operated by Tom Kennedy and Mike McConnell. To recognize the fact that the partners have invested significantly different amounts of capital and that Tom works full time, while Mike works only part time, the partnership agreement states that the profit will be allocated as follows: An interest allowance of 3% of each partner's beginning capital balance plus a salary allowance of $ 85 per hour worked. Any remaining profit or loss after calculation of these allowances will be allocated equally. At January 1, 2021, Tom's capital account balance was $ 15,000 and Mike's was $ 20,000. During the year ended December 31, 2021, Tom worked 1,200 hours and Mike worked 550 hours. Instructions a) Calculate each partner's share of profit assuming that profit for the year ended December 31, 2021 is $ 196,000. b) Calculate each partner's share of profit assuming that profit for the year ended December 31, 2021 is $ 88,000