Answered step by step

Verified Expert Solution

Question

1 Approved Answer

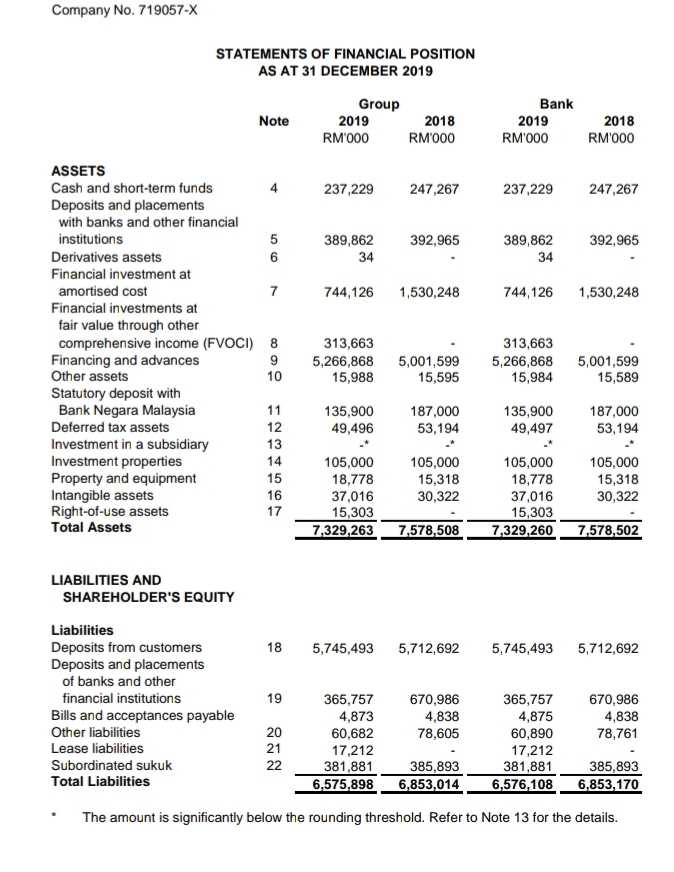

Prepare financial ratios in evaluating Islamic bank's performance by using Profitability Ratio only. Company No. 719057-X STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2019

Prepare financial ratios in evaluating Islamic bank's performance by using Profitability Ratio only.

Company No. 719057-X STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2019 ASSETS Group Bank Note 2019 RM'000 2018 RM'000 2019 2018 RM'000 RM'000 Cash and short-term funds 237,229 247,267 237,229 247,267 Deposits and placements with banks and other financial institutions 5 389,862 392,965 389,862 392,965 Derivatives assets 6 34 34 Financial investment at amortised cost 7 744,126 1,530,248 744,126 1,530,248 Financial investments at fair value through other comprehensive income (FVOCI) 8 Financing and advances Other assets 800 9 313,663 5,266,868 313,663 5,001,599 5,266,868 5,001,599 10 15,988 15,595 15,984 15,589 Statutory deposit with Bank Negara Malaysia 11 135,900 187,000 135,900 187,000 Deferred tax assets 12 49,496 53,194 49,497 53,194 Investment in a subsidiary 13 Investment properties 14 105,000 105,000 105,000 105,000 Property and equipment 15 18,778 15,318 18,778 15,318 Intangible assets 16 37,016 30,322 37,016 30,322 Right-of-use assets 17 15,303 15,303 Total Assets 7,329,263 7,578,508 7,329,260 7,578,502 LIABILITIES AND SHAREHOLDER'S EQUITY Liabilities Deposits from customers 18 5,745,493 5,712,692 5,745,493 5,712,692 Deposits and placements of banks and other financial institutions 19 365,757 670,986 365,757 670,986 Bills and acceptances payable 4,873 4,838 4,875 4,838 Other liabilities Lease liabilities Subordinated sukuk 222 20 60,682 78,605 60,890 78,761 21 17,212 17,212 381,881 385,893 381,881 385,893 Total Liabilities 6,575,898 6,853,014 6,576,108 6,853,170 The amount is significantly below the rounding threshold. Refer to Note 13 for the details.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the financial statements provided we can calculate the following profitability ratios for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started